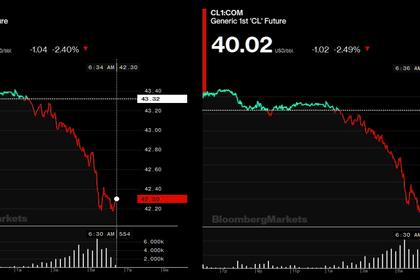

OIL PRICE: NOT ABOVE $43 ANEW

REUTERS - OCTOBER 19, 2020 - Oil prices fell on Monday as concerns over surging coronavirus cases globally dampened prospects for a demand recovery, while Libya planned to boost output further as the OPEC member tries to revive its energy industry after months of blockade.

Brent crude for December LCOc1 was down 30 cents, or 0.7%, to $42.63 a barrel at 1017 GMT. U.S. West Texas Intermediate crude for November CLc1 was down 28 cents, or 0.7%, at $40.60. The contract will expire on Tuesday.

Worldwide coronavirus cases crossed 40 million on Monday, according to a Reuters tally.

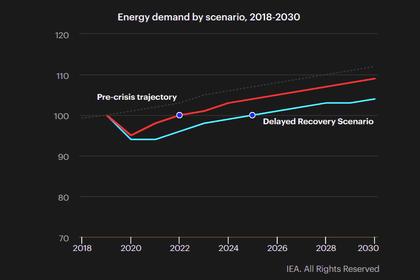

“Even if the recent record-high new cases of COVID-19 worldwide have not yet caused demand forecasts to be revised further downwards, there is no sign as yet of the hoped-for recovery,” said Commerzbank analyst Eugen Weinberg.

Many European governments are tightening lockdowns to curb the spread of virus.

“This latest swathe of stringent restrictions will inevitably impede economic growth and undermine the fuel demand recovery,” said Stephen Brennock of oil broker PVM.

Investors are also focusing on the OPEC+ oil producer group’s Joint Ministerial Monitoring Committee (JMMC) meeting later on Monday.

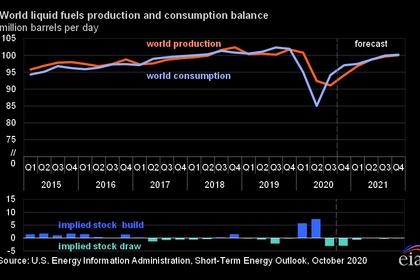

The committee is expected to discuss the weakening demand outlook as well as increased output from Libya, but is unlikely to recommend immediate action, sources told Reuters.

Libya has significantly boosted its production after the easing of a blockade by eastern forces in September. The 70,000-barrels-per-day Abu Attifel oilfield is expected to begin its restart on Oct. 24 after being shut down for months, two engineers said.

Energy companies in the United States, the world’s biggest oil producer, last week added the most oil and natural gas rigs since January, with crude prices having held around $40 a barrel in recent months.

Bank of America projected Brent and WTI would average $44 and $40 per barrel in 2020, respectively, and $50 and $47 per barrel in 2021.

Meanwhile, China’s oil-buying frenzy earlier this year is expected to slow in the fourth quarter. Chinese refiners slowed their processing rates in September.

China’s economy expanded by 4.9% in the third quarter from a year earlier, missing analyst expectations of 5.2%, government data showed.

-----

Earlier: