OIL PRICE: NOT BELOW $39

REUTERS - OCTOBER 2, 2020 - Oil prices extended losses to about 3% on Friday after U.S. President Donald Trump said he has tested positive for COVID-19, while agrrement on a U.S. stimulus package eluded negotiators amid ongoing worries about demand.

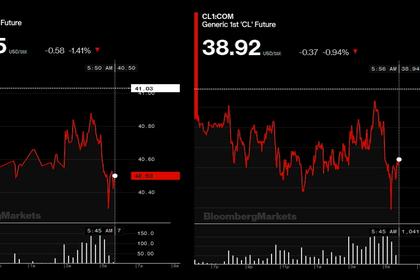

Brent crude LCOc1 slipped on the Trump news and was down $1.12, or 2.7%, at $39.81 a barrel by 0710 GMT. U.S. oil CLc1 was also down $1.12, or 2.9%, at $37.60.

U.S. and Brent cruse are heading for drops of around 5% and 6% respectively this week for a second consecutive week of declines.

In a tweet, Trump said that he and First Lady Melania Trump tested positive for COVID-19.

Oil was already in negative territory after a bipartisan deal for more economic relief in response to the pandemic continued to elude House Speaker Nancy Pelosi and the White House, adding to fears about worsening demand without more support for the economy.

“It was a weak market already and this event has come along and added uncertainty, giving pause for people to say, ‘you know what, I’m taking some risk off the table’,” said Lachlan Shaw, head of commodity research at National Australia Bank in Melbourne.

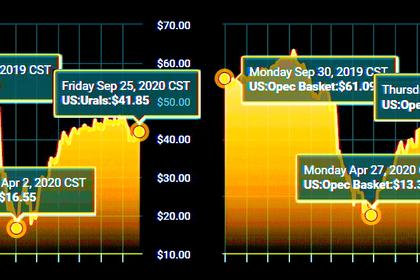

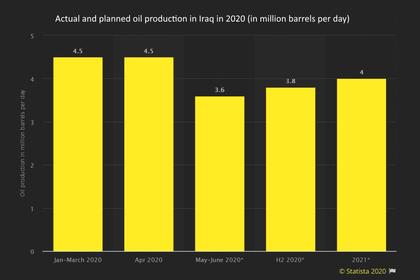

Crude supplies from the Organization of the Petroleum Exporting Countries (OPEC) rose in September by 160,000 barrels per day (bpd) from a month earlier, a Reuters survey showed.

The increase was mainly the result of increased supplies from Libya and Iran, OPEC members that are exempt from a supply pact between OPEC and allies led by Russia - a group known as OPEC+.

Libya’s production has risen faster than analysts expected after the relaxation of a blockade by the Libyan National Army. Its crude output has risen to 270,000 bpd as the country ramps up export activity, a Libyan oil source told Reuters on Thursday.

New COVID-19 cases worldwide have rise to more than 34 million, nearly 2 million more than at the end of last week, based on Reuters tallies.

This week marked the grim milestone of 1 million deaths and several countries are tightening restrictions and contemplating lockdowns as infections accelerate, prompting concerns about the impact on fuel demand.

“Oil’s upside was always likely to be limited as fears rise about the global consumption picture and rising OPEC+ production,” said Jeffrey Halley, senior market analyst at OANDA.

-----

Earlier: