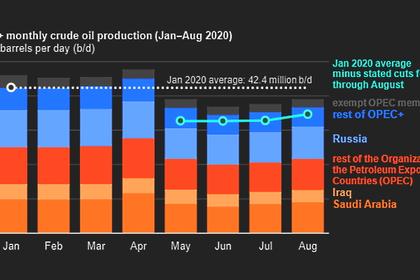

OPEC+ PRODUCTION: 99%

PLATTS - 09 Oct 2020 - OPEC and its allies sharpened their output quota compliance to 99% in September, led by the Gulf states, but discipline from Russia and some African producers continued to slip, the latest S&P Global Platts survey found.

Compensation cuts by 13 producers that had previously violated their quota levels remain scant, putting pressure on the alliance to do more to prop up an oil market still reeling from the impact of the coronavirus.

OPEC's 13 members produced 24.34 million b/d in September, a fall of 30,000 b/d from August, while its nine partners, including Russia, produced 12.72 million b/d, an addition of 50,000 b/d.

Sliding compliance by Russia, which is now the largest producer of crude in the coalition, could emerge as a growing concern.

Russia produced 9.10 million b/d last month, 110,000 b/d above its quota. Seaborne exports from the country saw a steady rise and production has also recently increased due to more domestic demand, panellists noted.

In early-March, Russia and OPEC clashed over production cuts leading to a dramatic oil price war. But the former's influence in the deal remains vital.

OPEC production fell only marginally as a large cut by the UAE was almost offset as six of its members increased supply.

OPEC kingpin Saudi Arabia pumped 8.99 million b/d in September, in line with its quota, the survey found, with both exports and inventories rising slightly.

The UAE, which is now OPEC's third-largest oil producer, implemented strident cuts in September after having pumped well above its quota the previous month.

The key Saudi ally produced 2.54 million b/d last month, a fall of 200,000 b/d from August, as exports dived.

The UAE energy minister has admitted that it produced more oil and gas this summer to meet rising domestic energy needs.

Lack of compensation

The dodging of so-called compensation cuts could pose another conundrum for OPEC+ as it gets closer to its next scheduled meeting on Nov. 30-Dec. 1.

OPEC+ recently extended 2.375 million b/d of catch-up cuts for the rest of the year but not all members have disclosed their plans, according to an internal document seen Platts.

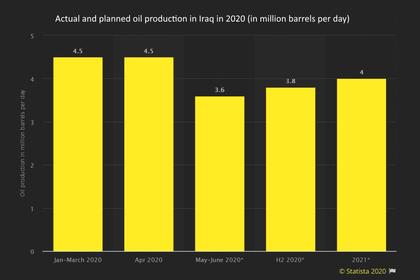

Iraq, which has a lot of catching up to do in these cuts, kept its output stable at 3.74 million b/d in September, remaining below its quota of 3.80 million b/d.

But Iraq is supposed to make 698,000 b/d of catch-up cuts from September through to December, divided into 203,000 b/d in September and 165,000 b/d in October, November and December.

Nigeria pumped 1.53 million b/d in September, its lowest since December 2016, when Niger Delta militants attacked some of its key oil infrastructure.

But Africa's largest oil producer remained around 30,000 b/d above its cap of 1.50 million b/d, though output was down 40,000 b/d from August.

The OPEC+ alliance had asked Nigeria to commit to compensation cuts of 283,000 b/d from August through to December.

Platts estimates Nigeria produced 150,000 b/d of the Agbami grade in September. Nigeria says Agbami should be categorized as condensate, which is not subject to OPEC+ quotas.

Exempt members

Production recoveries in Iran, Libya and Venezuela -- all three of which are exempt from the cuts -- could also prove tricky for the coalition as it strives to keep its non-compliant members in check.

These three producers added a cumulative 150,000 b/d to the oil market in September, with some more expected in the coming months.

Libya increased output by 50,000 b/d to 170,000 b/d as the UN-backed Government of National Accord and the self-styled Libyan National Army agreed a fragile truce to restart its oil fields and terminals.

Production in the conflict-torn country has already doubled in the past few weeks, reaching 300,000 b/d, with more barrels likely to come online in October, according to industry sources.

But the return of Libyan oil is likely to be gradual and prone to delays due to the shakiness of the production restart deal and presence of armed groups at some oil infrastructure.

Venezuela's crude production rebounded in September to average 390,000 b/d, a 50,000 b/d increase from August, as exports were up steadily, the survey found.

The Latin American producer recently imported Iran's South Pars condensate, which is likely to be used by as a diluent for its extra-heavy crude from the Orinoco Belt, as its oil sector remains crippled by US sanctions.

The Platts figures are compiled by surveying oil industry officials, traders, and analysts, as well as reviewing proprietary shipping, satellite and inventory data.

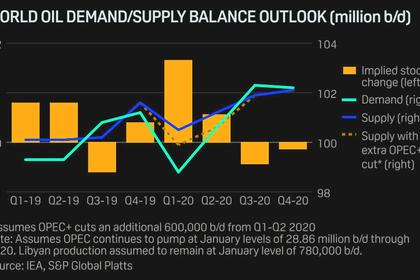

Notes: OPEC and its allies in May implemented a 9.7 million b/d production cut accord. The cuts taper to 7.7 million b/d from August to December, and then down to 5.8 million b/d from 2021 through April 2022.

The cuts are determined from an October 2018 baseline production level, except for Saudi Arabia and Russia, which were given baselines of 11 million b/d.

Mexico exited the deal at the end of June. OPEC members Iran, Libya and Venezuela are exempt from the deal.

The OPEC+ coalition's next formal meeting is Nov. 30-Dec. 1 in Vienna. A nine-country Joint Ministerial Monitoring Committee will meet online Oct. 19 and monthly thereafter to assess compliance and decide whether to change the level of cuts.

The S&P Global Platts OPEC survey, which has been published since 1988, measures wellhead crude oil production in each member country. In 2020, Platts began estimating production from the non-OPEC members of the OPEC+ alliance.

-----

Earlier: