OPEC+ STABILIZE OIL MARKET

PLATTS - 19 Oct 2020 - Ministers on a key OPEC+ monitoring committee acknowledged a slowdown in the oil market's recovery and vowed to be proactive in preventing a slide in prices, with the scheduled tapering of the coalition's output cuts looming at year-end.

With six weeks to go before the full 23-member OPEC+ alliance meets to consider its 2021 production plans, the Joint Ministerial Monitoring Committee said Oct. 19 it was closely following market trends and would not hesitate to call for further supply restraint if needed.

"We will do what is necessary in the interest of all," said Saudi energy minister Prince Abdulaziz bin Salman said in his opening remarks to the JMMC meeting.

The oil market was sending "a lot of mixed messages in the last month," he said, but "nobody in the market should be in any doubt as to our resolve and our intent."

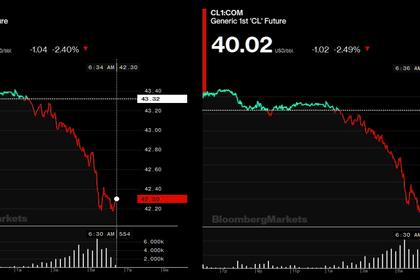

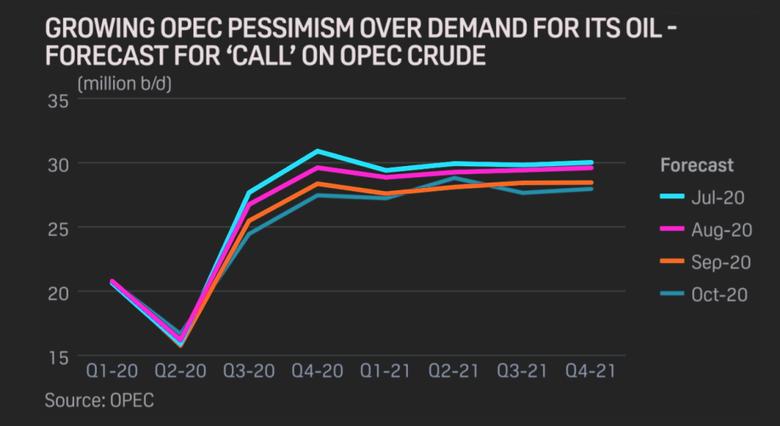

OPEC and 10 partners are set to ease their 7.7 million b/d collective production cuts by about a quarter to 5.8 million b/d at the start of 2021, but fading demand growth and the resurgence of Libyan supplies have muddled the path to stable, higher oil prices. Dated Brent has been stuck in the low $40s/b for several weeks.

Delegates have told S&P Global Platts that the bloc may consider extending the cuts, but any new deal would require delicate political negotiations and potentially some concessions to countries weary of reining in production.

The JMMC, co-chaired by Prince Abdulaziz and Russian energy minister Alexander Novak, advises the full OPEC+ coalition, which must approve any changes and is next scheduled to convene Nov. 30-Dec. 1.

The JMMC will meet online again about two weeks before then, on Nov. 17.

In its meeting, the JMMC studied various market outlooks for 2021, including a scenario in which demand is weaker than consensus forecasts and Libya achieves a more aggressive ramp-up in production, according to an internal report seen by Platts. That would lead to a further bloating of already swelling oil inventories that the OPEC+ alliance is trying to whittle down.

Novak said in his opening remarks that the oil market was seeing "a material slowing of demand recovery," with many countries reimposing lockdown measures to contain the coronavirus pandemic.

But he said that any second wave of the virus likely will not be as acutely damaging to the global economy as the initial crisis this spring, which prompted the OPEC+ alliance to end a brief price war and enact record production cuts.

He also noted some estimates that upstream investment in 2020 would be down by some 18-20% from 2019 levels, "which is significantly higher than the demand destruction we are observing."

"It's clear that the market is much more volatile than it may seem," Novak said. "We're seeing how difficult it is for the market to continue on its recovery path, facing lots of uncertainties in return to pre-crisis levels."

COMMITTED TO THE CAUSE

OPEC+ members could help their own cause by implementing so-called compensation cuts for previous quota violations.

Under the agreement, countries that produced in excess of their quotas must make extra cuts of equivalent volume in subsequent months. An internal document prepared for the JMMC outlined a cumulative 2.33 million b/d in compensation cuts owed by 13 members.

Prince Abdulaziz, who has made compliance enforcement a top priority, said he hoped those countries would implement their compensation cuts by the end of the year.

Novak and Prince Abdulaziz both said their countries, the two largest members of the alliance, were committed to maintaining oil market cooperation through the OPEC+ platform.

The two countries have not always been on the same page on OPEC+ policy, most notably when talks over a coronavirus response broke down in March, leading to the brief price war. Russia, whose partnership with OPEC is critical to the agreement's credibility, has at times been more reluctant to impose tighter quotas and its compliance with its cuts has not been as rigorous as Saudi Arabia's.

But Russian President Vladimir Putin and Saudi Crown Prince Mohammed bin Salman held phone consultations twice in the past week leading up to the JMMC meeting to discuss the oil market, and their respective energy ministers said they were united in their cause.

"Russia is committed and intent to further enhance and strengthen OPEC+ cooperation, in the interests of producers and consumers of crude oil," Novak said.

Prince Abdulaziz said the market should be reassured that the two major producers were in frequent contact.

"Both countries enjoy modern technologies and good rapport at the leadership level, sufficient to allow everybody to talk to each other as regularly as possible," he said.

TAKING AIM AT SPECULATORS

Prince Abdulaziz, who is the half-brother of the crown prince, also used his opening remarks to once again take aim at market speculators and paper traders that he said were distorting fundamentals.

Repeating his warning to traders betting against the OPEC+ coalition's determination to rebalance the market, he said: "Please, make my day."

"I recognize the need for modern risk management and the useful role of derivative markets play in enabling market participants to manage risk, [but] destabilizing speculation and manipulation have no place in a responsible and efficient market."

-----

Earlier: