RENEWABLES FOR EUROPE

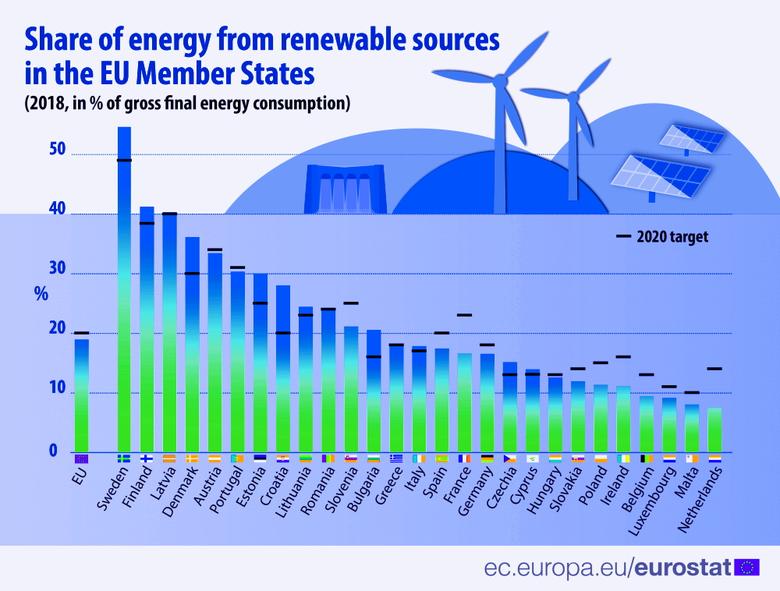

MEU - Oct 08, 2020 - Demand for renewables documented with Guarantees of Origin in Europe has steadily increased every year, and the annual growth (CAGR) is a robust 16% during the period from 2012 to 2020.

A continued growth of 15% in 2020, is especially impressive given the presence of the COVID-19 pandemic.

"The demand for renewable energy documented with Guarantees of Origin shows record growth during the first half of 2020, despite the negative effect COVID-19 is having on global and local economies. The fact that especially corporate demand for renewables seems unaffected is truly inspiring during these unusual and trying times," says Tom Lindberg, Managing Director in ECOHZ, commenting on new statistics from the Association of Issuing Bodies (AIB).

"The demand for renewables reached 530 TWh at the close of Q2 2020. This is the highest figure recorded, even compared to previous full years – with the year 2019 being the only exception," says Lindberg.

Much of the continued growth is still likely coming from strong ambitions among a growing group of corporates with extensive energy use across international markets.

Also seen are the effects of numerous market and policy changes deployed the last few years.

Among these are EU's new Renewable Directive strengthening and clarifying the use of Guarantees of Origin.

We also see a stronger emphasis to report and document sustainability results on global and local levels. In Europe specifically we see countries implementing various forms of Full Disclosure (FD) policy, with Holland deploying FD at the energy consumer level.

This policy change creates increased transparency and will again result in increased demand. New platforms for allowing access to renewables have also appeared in 2019 and 2020, including various auction concepts in a select group of countries.

Lastly, a nascent development to purchase and report renewables on a monthly basis, and in some cases on shorter time intervals (e.g. day, hour) also contributes to a more robust market. There are very few reasons these developments will not continue.

"Also, on a positive note is the inclusion of four new AIB countries in 2020 - Serbia, Slovakia, Greece and Portugal. These countries have contributed little to the volume growth so far in 2020 but will likely have a positive effect moving forward," says Lindberg.

The supply side also continues to grow during 2020, across most national markets and all renewable technologies. Wind and solar has doubled, hydro has also grown and still dominates the market supply.

Revisiting market developments in 2019 – demand outpacing supply

"Even with a strong growth in the supply, market demand easily outpaced supply in 2019. Demand volumes was up by 18.5%, ending at 621 TWh and breaking the "600-barrier" for the first time", remarks Lindberg. The 2019 growth is even more impressive given the historical annual growth (CAGR) is 15.6% in the period from 2010 to 2019.

With a total supply of 667 TWh and demand at 621 TWh in 2019, the market surplus shrunk to 46 TWh - the lowest since 2015. This may indicate a development where the market will enjoy a better balance, and where prices again could start to rise.

During earlier years one has often seen only a few countries contributing heavily to the growth. This has changed and we now see market growth across almost all national markets. This is very encouraging, and represents a robustness not experienced previously.

-----

Earlier: