TOTAL NET INCOME $202 MLN

TOTAL - October 30, 2020 — Total SE's Board of Directors met on October 29, 2020, under the chairmanship of CEO Patrick Pouyanne to approve the Group's third quarter 2020 financial statements. On this occasion, Patrick Pouyanne said:

"After a second quarter in which the Group faced exceptional circumstances with oil prices falling below $20/b and a very strong slowdown of global activity linked to the health crisis, the Group benefited during the third quarter from a more favorable environment, with oil prices above $40/b thanks to strong OPEC+ discipline as well as the demand recovery for petroleum products for road transportation. However, the environment was mixed with low natural gas prices and severely depressed refining margins due to excess production capacity relative to demand and high inventories.

In this context, the Group is once again demonstrating its resilience thanks to its integrated model, by generating cash flow (DACF) of more than $4 billion, conforming to forecasts with a $40/b crude price, and reducing gearing to 22% given its investment and cost discipline. Adjusted net income was close to $850 million, and the organic cash breakeven remained below $25/b.

Upstream carries the Group's results with adjusted net operating income of $1.1 billion, notably thanks to low production costs of $5/boe, despite lower LNG prices and lower production. Given the strict discipline with which OPEC+ has implemented quotas and the lack of production in Libya until October 2020, the Group now anticipates full-year 2020 production below 2.9 Mboe/d.

In Downstream, Refining faced losses while Petrochemicals resisted, and Marketing & Services generated net operating income of more than $400 million, better than in the third quarter 2019. Following the announcement of the sale of the Lindsey refinery in the United Kingdom in July, the Group continued to adapt its European refining with the conversion of Grandpuits in France to a zero-oil platform that will produce biofuels and bioplastics.

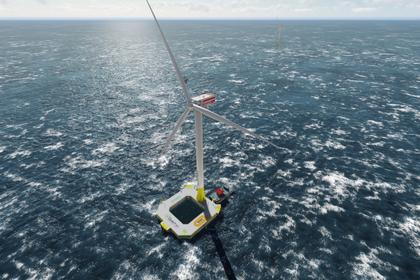

During the quarter, the Group accelerated the implementation of its renewable energy strategy, notably by acquiring a 3.3 GW solar portfolio in Spain and taking positions in floating offshore wind in South Korea and France. In addition to the gross renewable installed capacity of 5.1 GW at the end of the third quarter, the Group is developing a portfolio of 19 GW of projects, of which 9 GW already benefit from long-term power purchase agreements.

Confident in the fundamentals of the Group, the Board of Directors confirmed the third interim dividend payment maintained at €0.66 per share and reaffirmed that the dividend is supported in a context of $40/b, particularly in view of the results this quarter."

-----

Earlier: