U.S. ENERGY UPDOWN

By Kent Knutson Energy Market Content Specialist

Hitachi ABB Power Grids

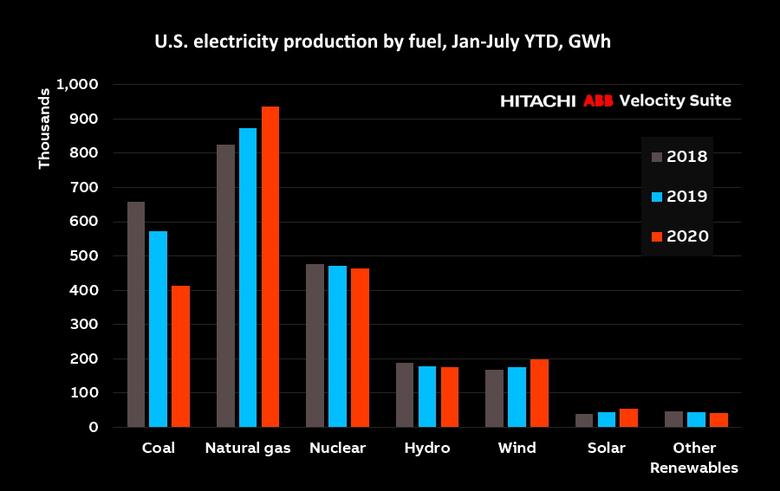

ENERGYCENTRAL - Despite the 2020 economic slowdown, electricity sales across the United States, through the first seven months were down a modest 2.6% (55.3 million MWh) from the same period in 2019, with all of the decline occurring in the industrial (-4.4%) and commercial (-6.1%) sectors. Possibly driven by ‘stay at home’ orders, power sales to residential customers increased by 2.0% during the period. Arizona (up 3.8%) and New Mexico (up 2.5%) consumed significantly more electricity in 2020 than in 2019 through the first seven months. Other states showing notable increases in retail power purchases include Alaska (up 1.53%), Nevada (1.1%), Idaho (1.0%), and Colorado (up 1.0%). In contrast, through the first seven months, the District of Columbia (-11.5%) and the state of Wyoming (-8.2%) consumed significantly less electricity in 2020 compared to 2019. Other states reporting notable declines in retail power purchases include Maryland (-5.8%), Maine (-5.6%), Hawaii (-5.4%), Indiana (-5.3%), Alabama (-5.2%), and Pennsylvania (-5.1%).

Fossil fuel prices remain extremely low

Driven by unprecedented low fuel prices, gas power production increased by 7.1% during the first seven months from last year, while coal dipped dramatically by 27.5%. The increase in natural gas was a robust 61.8 million MWh during the period. Like natural gas, electricity production from wind (up 13%) and solar (up 23.9%) was up significantly this year over the same seven-month time period in 2019 – producing roughly 33 million MWh of electricity more in 2020. Despite the relatively large increases in natural gas, wind, and solar power during the seven-month period, overall power production from U.S. power plants was down 3.2% (75.2 million MWh) from 2019. Slight declines in nuclear (-8.0), conventional hydro (-0.9), and other renewables (-1.5) augmented the dramatic fall-off in coal power (-157.1 million MWh).

Natural gas dominates power generation

Natural gas accounted for a record 40.6% of all power generation during the first seven months of 2020 – up from 36.7% last year. Wind and solar combined accounted for 10.9% of all power generation, while coal contributed about 18% of total generation, the lowest first seven-month total in history – down from 24% during the first seven-months of 2019. Driven by the rapid growth in wind and solar combined with nuclear, hydro, and other renewable sourced energy, zero-carbon resources accounted for a robust 40.5%, roughly equal to the natural gas contribution during the period.

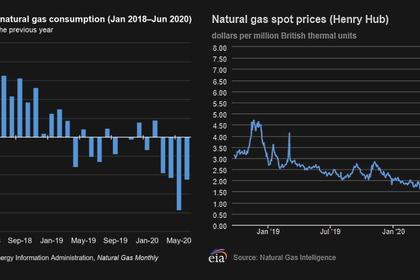

Natural gas, what a deal

The average delivered price of natural gas for electricity production through the first seven months of 2020 was only $2.20/mmBtu, down 28.6%, nearly 90 cents from 2019, when prices averaged $3.08/mmBtu. During the first seven months of 2020, the average delivered price of gas to independent power producers (IPPs) was only $1.92/mmBtu – virtually the same average delivered fuel price as that for coal delivered to all U.S. power plants across the country. Coal deliveries to IPPs were considerably lower at an average delivered price of $1.75/mmBtu during the first seven months of 2020 – down from $1.83 during the same period in 2019. The low average delivered prices of coal and gas are unprecedented. Before this year, the lowest average annual delivered price of coal and gas was $2.54/mmBtu and $2.87/mmBtu, respectively, back in 2016.

The seven-month reporting highlights a significant shift in power generation resources during an unusual year of economic downturn and shifting power demand. The availability of unparalleled low-priced natural gas has driven gas power generation to record heights resulting in an equally unparalleled decline in coal generation, which has fallen by 27.5% in a single year. The continued expansion of wind and solar resources has resulted in record power generation from the two sources – up 15.2% from last year and combined with nuclear and other renewables has zero-carbon power generation now accounting for roughly 40.5% of total U.S. electricity production.

-----

This thought leadership article was originally shared with Energy Central's Generation Professionals Group. The communities are a place where professionals in the power industry can share, learn and connect in a collaborative environment. Join the Generation Professionals Community today and learn from others who work in the industry.

-----

Earlier: