U.S. OIL EXPORTS DOWN

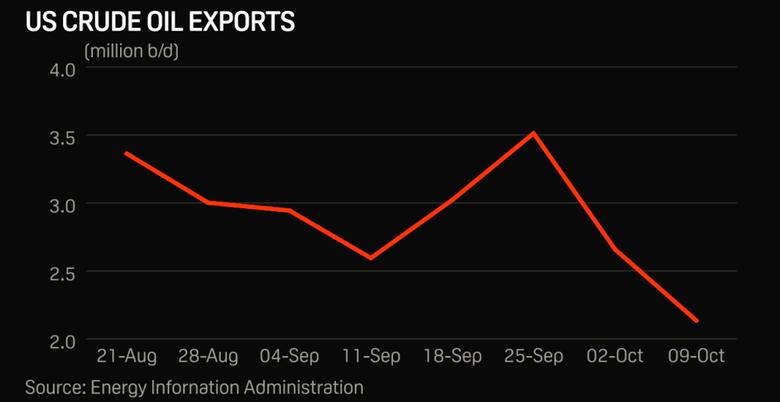

PLATTS - 15 Oct 2020 - US exports fell to a 14-month-low over the week ended Oct. 9, and are expected to remain weak into 2021, as sources note poor demand in the export market.

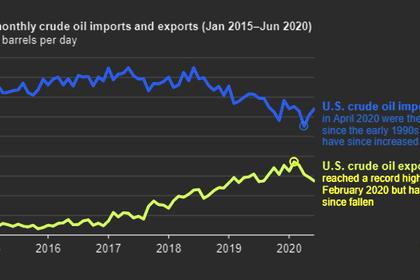

The US exported an average of 2.135 million b/d of crude over the weekend ended on Oct. 9, the lowest level since the week ended on August 2, 2019, when exports were reported at just 1.865 million b/d, according to weekly data from the US Energy Information Administration.

Lack of demand was evident in the shipping markets where dirty tankers rates out of the Americas have floundered.

"[There are] lots of boats hanging around with few takers was what ship brokers were saying [the] past three weeks now," one source said.

Freight has been depressed since the end of May and remains so 15 days into Q4, when freight typically sees seasonal highs, but due to the pandemic and unwinding of floating storage barrels booked in Q2 2020, rates have not picked up.

The cost of taking an Aframax on the benchmark 70,000 mt USGC-UK Continent route was assessed at w40, or $8.15/mt October 15. Rates for the trans-Atlantic voyage first reached this level on Oct.5, the lowest level since Platts began assessing the route in March 2018. The monthly average for freight for the trip was $10.36/mt in Sept. 2020, compared to a monthly average of $22.72/mt in Sept. 2019, and $17.11/mt in the same month of 2018.

There have been 12 fixtures booked to make USGC-UK Continent/Mediterranean routes so far in October, compared to 14 in the same period of 2019, S&P Global Platts fixture data shows.

Freight for VLCCs, which account for the lion's share of export business out of the USGC destined to Asia, has also been at low levels, with the 270,000 mt USGC-China run assessed Oct. 15 at lump sum $4.75 million. Rates for the long-haul voyage have fallen 76% since Apr. 1, 2020, when freight spiked on the back of a massive drop in global crude prices that prompted an uptick in floating storage and tanker demand.

"Most ships [are] facing long idle [times]," a VLCC shipowner said. "[The] end result is very poor, way below what the routes are showing, [we] need an increase on cargo volumes, which won't happen soon."

There have been two VLCCs fixed out of the USGC since the beginning of October, compared to eight booked in the same period of 2019.

At least one trading source expected the lower export levels to continue past the prompt market, which is currently trading November cargoes. "Exports are tough in November, demand is weak and [arbitrage] isn't there," the trader said, "I expect it to be weak [in December and January] as well."

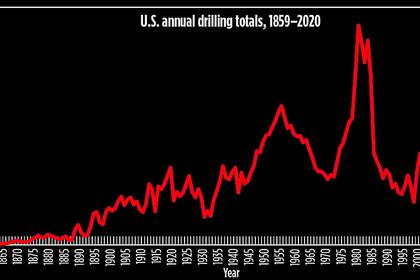

Indeed, Platts Analytics expects exports to remain near the current levels in October and November before trending downwards towards the end of the year. As US shale crude production is slated to decline in 2021, the lowered production will result in fewer barrels available for the export market. Platts Analytics forecasts total US production to be 1.2 million b/d lower in 2021 versus 2020, and 2 million b/d lower than the 2019 average. With this decline in production, Platts Analytics expects total US exports to average just 2.1 million b/d in 2021. By comparison, through the first eight months of 2020, US crude exports have averaged 3.22 million b/d, according to data from the US Census Bureau.

-----

Earlier: