U.S. SHALE RECOVERY

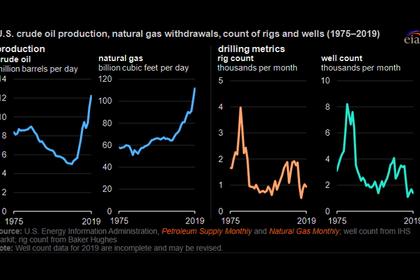

PLATTS - 15 Oct 2020 - The US shale sector could be on a path to recovery after a destructive boom-bust period, with plentiful opportunities still available, but a more disciplined approach is needed, executives from US upstream companies ConocoPhillips and Parsley Energy said Oct. 15.

Speaking at the Energy Intelligence Forum, ConocoPhillips chief technical officer Greg Leveille struck a contrite note on behalf of the shale sector, saying it had out-run demand levels ahead of this year's crisis, and had now to focus on low-cost, high quality prospects, coupled with technological improvement.

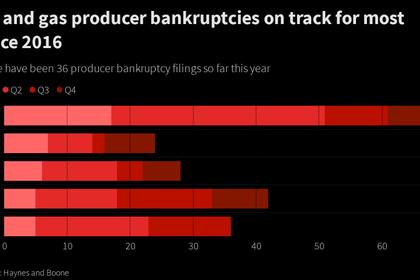

Parsley CEO Matt Gallagher said the industry had gone through a period of learning and infrastructure expansion in the last decade, which meant outspending its financial means.

But he said the industry was now ready for recovery, provided it took a more transparent approach, not focused exclusively on production growth, but addressing the concerns of investors and society on issues like pollution.

"The good news is there's still an enormous number of locations to be developed in the US. Our tally, the numbers we see, are north of 50,000 prime locations -- tier one acreage, the sweetest of the sweet spots," ConocoPhillips' Leveille said.

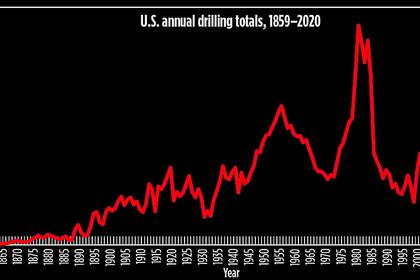

"There's a lot out there to be developed, it will be developed. The question is will the industry continue on a boom-bust cycle, which has been very destructive. US growth at times has been in excess of the total growth in global demand. That of course leads to downturns," he said.

"The key for the industry is to get some discipline, run a business like it really needs to be run, returning cash to investors, and end up with a much more profitable industry overall."

Reduced lineup

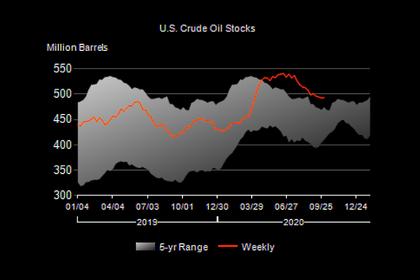

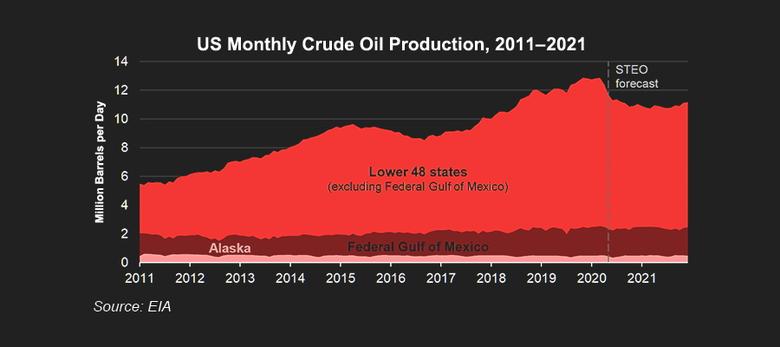

Gallagher echoed a growing view in the industry that US oil production is unlikely to return to a pre-pandemic peak of more than 13 million b/d, but said the trend of remunerating executives on the basis of production had been a bad idea, and a reduced line-up of companies was now on the path to success.

He estimated the likely number of leading players had been whittled down to 5-10, from 10-15 previously, and those top companies could deliver greater free cash flow this year than they had forecast at the start of the year.

"It was a futile effort to go for pure market share with a high-declining production base. The willingness to support that again is frankly just not there. We have to pivot as US companies into being US companies which are delivering a profit. We have base declines as producers anywhere from 25%-45% across the big players," Gallagher said.

However, following the learning and infrastructure development of the last decade, "Take COVID out of it, and even living with COVID and the reduced demand, we are finally set up to deliver some world-competitive barrels at a low cost across some of the top companies," he said. "The next few months you've got to put the proof in the pudding."

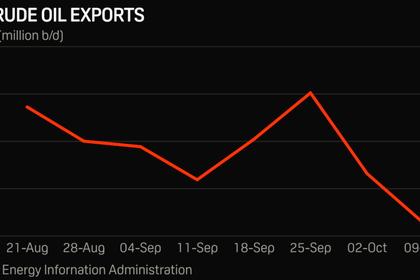

His cautious optimism echoed that of Occidental Petroleum CEO Vicki Hollub, speaking at the same event earlier, who also doubted US oil production would return to recent peaks, but said there was a demand for US oil, including in the export market, with global demand set to grow beyond 100 million b/d, led by China.

"By the end of 2021 we're going to see supply-demand back in balance and the US continuing to grow to help fill some of that supply. We're well positioned now to export to the rest of the world," Hollub said Oct. 14.

-----

Earlier: