AUSTRALIA'S LNG FOR CHINA DOWN

PLATTS - 20 Nov 2020 - Growing tensions between China and Australia, which have affected bilateral trade for commodities like coal and cotton, threaten to cloud the LNG sector with Chinese importers hesitant to enter new contracts with Australian LNG producers.

Several executives from Chinese energy companies, including the three main national oil companies, said they don't expect ongoing spot trade to be impacted, but new deals with Australian gas producers had become difficult.

Australian gas exporters argue that their projects are not contingent on Chinese buyers in a growing Asian market. They also expect the new trade agreement -- the Regional Comprehensive Economic Partnership, or RCEP -- which was signed by 15 countries on Nov. 15, including the 10 ASEAN states, China, Australia, Japan, South Korea and New Zealand, to open new channels for LNG trade.

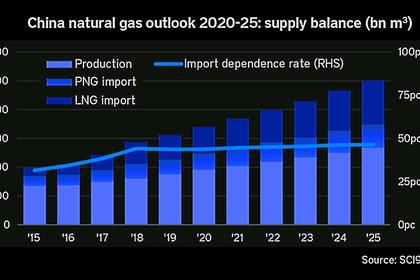

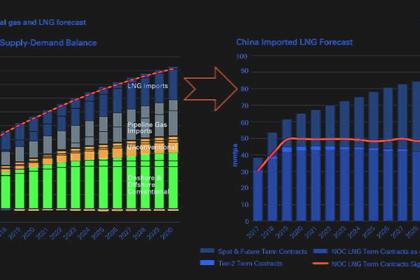

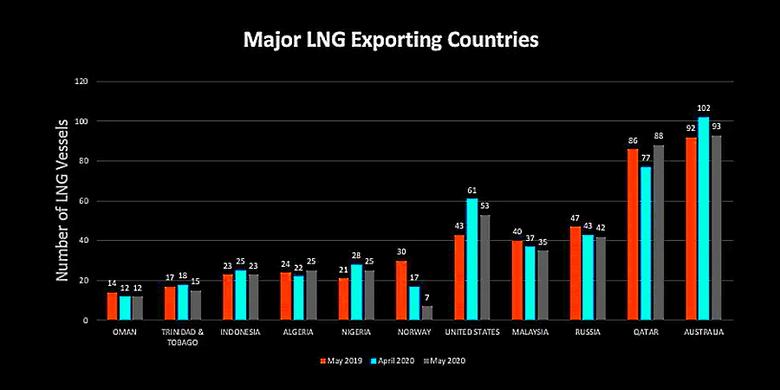

Still, low cost suppliers like Russia and Qatar are actively engaging Chinese buyers, and Beijing may seek long-term diversification that allows it to target Australian LNG without impacting its own gas supply should relations deteriorate.

Chinese gas importers make purchase decisions based on demand and prices, but "will have to obey if the government issues new guidelines on trading," a source with one of the state-owned oil and gas majors said.

"There could be some impact on China's investment in new LNG projects in Australia, which would need companies to seek government approval or at least require them to discuss with the government before investing," the person, who declined to be named, added.

At least five other oil and gas executives based in Beijing and Guangdong agreed new contracts with Australia had become difficult.

SCARBOROUGH EXPANSION

"The Chinese were potential purchasers of upstream equity in Scarborough, but unfortunately they've come back to us and said they are unable to participate in a sale process at the current time," Woodside Energy's CEO Peter Coleman said in an emailed statement Nov. 16.

He was "hopeful that we can get back to the negotiating table at a point in the future," and said the project was not as reliant on offtake agreements as before.

"[T]he reality is the LNG market has changed very dramatically from the last significant investment that Woodside made in Pluto," Woodside's executive vice president for development and marketing Meg O'Neill said Nov. 11 at an investor briefing.

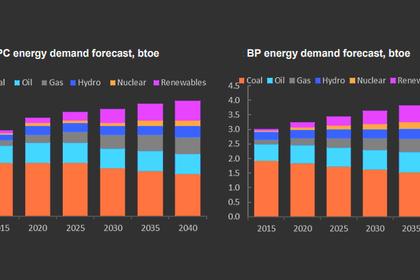

"There are more customers buying LNG today than ever before. We expect over the next years that numbers will increase," she said.

Woodside has a controlling interest in the Scarborough gas field, around 300 km offshore Western Australia, and plans to use the gas to add a second train to Pluto LNG, which currently has a 4.9 million mt/year capacity. It plans to expand processing capacity for Scarborough from a base case of 6.5 million mt/year to 8 million mt/year.

Woodside's CFO Sherry Duhe said in a briefing that Scarborough's viability had been stress-tested in the COVID environment at prices below $50/b and it was still "a very economic, attractive, project."

Coleman said the conversion of initial agreements to firm contracts had slowed because of the pandemic but the engineering ramp-up for Scarborough was on track for early 2021 and FID for Scarborough and Pluto Train 2 in the second half of 2021.

PROJECT COMPETITIVENESS

A Singapore-based LNG trader said the lack of Chinese interest in Scarborough may not be fully linked to geopolitical tensions.

"The project was a tough one to begin with, without a concrete timeline, and it was also costly. It's a buyer's market with lots of projects out there. We will focus on what is the most competitive," the trader said.

"If it's a good project for the Chinese to invest in, the buyers will try to convince the government for their support," the trader added.

Woodside has acknowledged that competitors like Qatar had introduced low contract prices but called the rival "one price point" that doesn't reflect the overall market.

"The benchmarks that people want to get out there, the Qatari volumes -- you've got to take all of that with a grain of salt," Coleman said at the briefing. "We know what the second-tier buyers are willing to pay, or need to pay, and we have a strategy around that," he said.

Qatar's LNG expansion will make all other pre-FID projects more challenging to proceed but some will still capture the market due to differentiation on supply diversity grounds and equity stakes offered alongside LNG sales contracts, Saul Kavonic, Australia energy analyst for Credit Suisse, said.

He said heightened geopolitical tensions alongside greater scrutiny by Australia's Foreign Investment Review Board are making asset sales, particularly to Chinese buyers, even more difficult. "Australian producers may need to find avenues to develop their projects without the degree of foreign capital hoped for last year," he added.

In the first nine months of 2020, Australia was the largest LNG supplier to China, followed by Qatar and Malaysia. For Australia, LNG is its second-largest resource export, and its largest LNG customer is Japan, followed by China.

-----

Earlier: