CHINA'S OIL IMPORTS 10 MBD

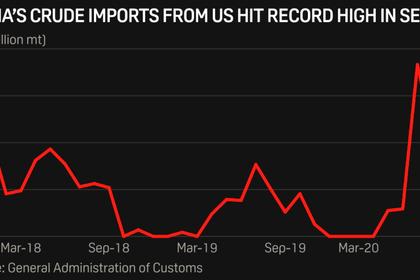

PLATTS - 09 Nov 2020 - China's crude oil imports in October registered the first year-on-year decline since April, with a 6.5% drop to 10.06 million b/d or 42.56 million mt, as refiners slowed down on their purchases amid a drop in throughput and less import quotas.

The fall in imports, which was within market expectations, is also likely to continue for the rest of 2020 due to the lower throughout and exhausted import quotas among private sector refiners.

The October imports were at a six-month low since April, when the volume was 9.88 million b/d, preliminary data released Nov. 7 by the General Administration of Customs showed.

On a barrels-per-day basis, the imports dropped 15.1% from the 11.85 million b/d in September, according to GAC data, with a conversion factor of 7.33 barrels per metric ton used for crude.

Chinese refiners had slowed in their buying since June-July when crude prices recovered to over $40/b, and also after storage tanks as well as floating storage along the country's coast hit historical highs. The port congestion experienced at that time has now eased, market sources said.

With less arrivals in October and a drop in discharged volumes from floating storage since late September, the import volume in the month was set to fall, analysts said.

S&P Global Platts data showed that imports by the independent sector, which has faced difficulties due to its limited import quota availability, fell 4.5% to 4.09 million b/d in October from 4.43 million b/d in September. This suggests that the state-owned oil sector slashed their imports more than their private sector peers.

The leading state-owned refiners had cut their average run rates to 78.9% in October -- the fourth consecutive monthly drop from a six-month high of 83.1% in July. The reduction was due to scheduled maintenance at a few Sinopec and PetroChina refineries, while others were reluctant to boost run rates to make up for the drop amid gloomy domestic demand, Platts earlier reported.

This trend will extend to the end of the year as state-run refiners prefer to run at their current utilization rates to limit their refining losses, rather than ramp up to meet their annual operation targets of the previous year, refining sources said.

OIL PRODUCT EXPORTS

Oil product exports, on the other hand, rebounded 46.6% in October to 5.79 million mt from the lower-than-expected 3.95 million mt in September, the GAC data showed.

Platts previously reported that Chinese oil companies had planned to export 1.43 million mt of gasoline, 1.76 million mt of gasoil and 407,000 mt of jet fuel in October.

The plan was similar to September's but up from the August volumes, in order to offset domestic inventory pressure, market sources said. GAC data showed a significant month-on-month jump in October exports, following an unexpected month-on-month drop in September.

A Beijing-based analyst said it may be due to customs delaying the registering of some the September exports to October, as the data typically shows a lag in oil company plans and shipping data.

In Q4, China's oil product exports are unlikely to jump as refiners aim to limit run rates in order to control stock levels, refiners told Platts.

This includes outflows from potential exporters Norinco and Zhejiang Petroleum & Chemical, which are expected to receive their first oil product export quotas soon.

"Only one month left for them to find outlets and go through the export process, while prices overseas are not attractive at all, it is very unlikely for Norinco and ZPC to throw massive barrels to international market," a Beijing-based oil trader said.

OIL PRODUCT IMPORTS

Meanwhile, China's oil product imports dropped to a multiyear low at 1.5 million mt in October, GAC data showed. This was the lowest level since January 2005, when Platts started to collect China's oil import and export data.

The previous low was 1.63 million mt in July 2019, GAC data showed.

China's oil imports have been at low levels as Chinese refineries have been allowed to supply their fuel oil barrels to the bonded zone for bunkering. China used to rely on fuel oil imports for bonded bunkering.

In addition, imports declined further in October due to high domestic product inventory, analysts said.

As a result, China's net oil product exports more than doubled month on month to 4.28 million mt in October, GAC data showed.

GAC's oil product import and export data is believed to include a basket of oil products, with gasoline, gasoil, jet fuel and fuel oil as the key products.

-----

Earlier: