2020-11-03 12:55:00

CHINA'S REFINERY INVESTMENT $20 BLN

ENERDATA - 3 Nov 2020 - The Chinese private aluminium smelter Shandong Nanshan Group has started building the 400,000 bbl/d Yulong refinery project in Yantai, Shandong (east of the country). The project will include a 3 Mt/year ethylene plant and will require a US$20bn investment.

China has a refining capacity of 13.1 mb/d, i.e. 2.5 times as high as in 2000 (5.4 mb/d). There are around 65 refineries with a capacity of over 100 000 bbl/d. The Zhenhai (Sinopec) and Dalian (CNPC) refineries are the biggest, with capacities of more than 400 000 bbl/d.

-----

Earlier:

2020, October, 27, 14:45:00

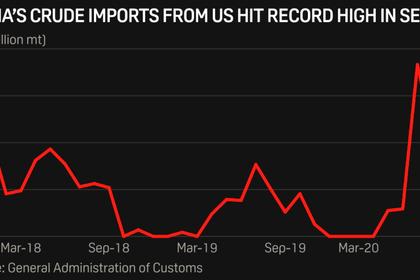

CHINA OIL IMPORTS UP

Crude oil is considered a key product to complete China's annual energy purchase commitments due to the commodity's typically higher value and volume compared with other energy products.

2020, October, 26, 13:50:00

CHINA NEED GAS

CNOOC’s hydrocarbon output increased from 475 mboe in 2018 to 506.5 mboe in 2019 (+6.6%).

2020, October, 21, 16:45:00

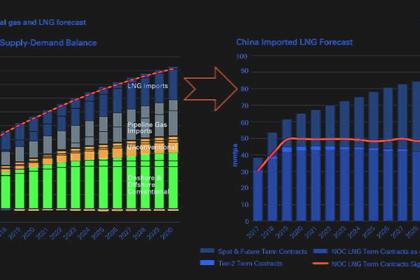

CHINA'S GAS DEMAND WILL TWICE

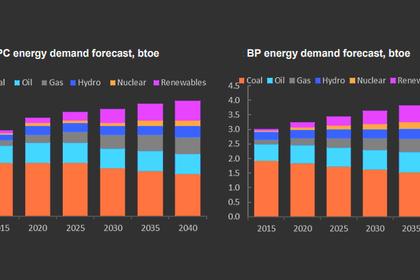

The goal of carbon-neutrality by 2060 will require China to kick its longstanding addiction to coal while building unprecedented amounts of intermittent wind and solar capacity.

2020, October, 19, 14:10:00

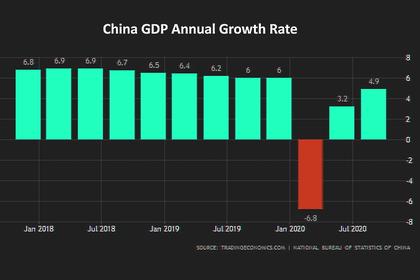

CHINA ECONOMY UP

On a quarter-on-quarter basis, China GDP rose 2.7% in the third quarter, the NBS said, compared with expectations for a 3.2% rise and an 11.5% rise in the previous quarter.

2020, October, 8, 12:35:00

CHINA MERGES COAL

In 2019, China was the largest coal producer in the world, with an output of 3,691 Mt, followed by India (769 Mt) and the United States (640 Mt).