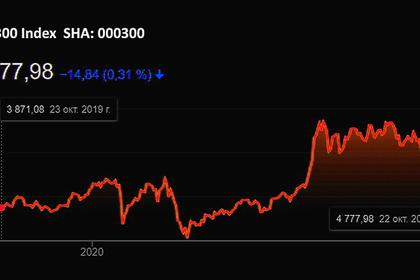

CHINA'S SHARES UP

REUTERS - NOVEMBER 5, 2020 - Asian shares scaled a near three-year peak on Thursday and bonds extended their blistering rally as investors wagered the prospect of U.S. policy gridlock would greatly favour some industries while also restraining government borrowing.

The risk of a prolonged contested election did remain, though the count was progressing in an orderly fashion with Democratic challenger Joe Biden narrowly ahead in key states.

“While the official outcome of the U.S. election remains unknown, the odds of a Biden win and Republicans maintaining control of the Senate are increasingly becoming the most likely outcome,” said Randal Jenneke, a portfolio manager at T. Rowe Price.

“This outcome is often seen as the ‘goldilocks scenario’ for financial markets -- no radical policy changes and the Fed providing ample liquidity to try to support the economy and financial markets when required.”

A divided government would constrain fiscal stimulus and any ‘radical policy changes’, which would boost growth stocks such as healthcare, IT and consumer discretionary, Jenneke added.

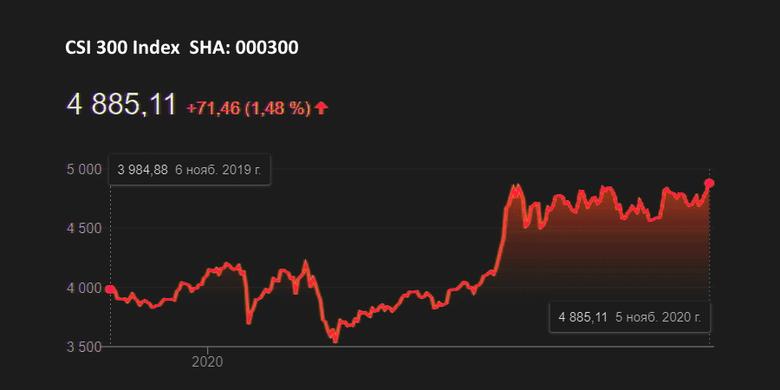

MSCI's broadest index of Asia-Pacific shares outside Japan climbed 2% to reach its highest since February 2018. Japan's Nikkei rose 1.7% to a more than nine-month top and South Korea put on 2.4%.

Chinese blue chips gained 1.3%, aided by talk a Biden White House might ease back on trade war tariffs.

E-Mini futures for the S&P 500 firmed 0.6% and NASDAQ futures 1.4%. EUROSTOXX 50 futures added 0.3% and FTSE futures 0.25%.

Both President Donald Trump and Biden have paths to 270 Electoral College votes as states tallied mail-in ballots. Biden remained optimistic on winning while the Republican incumbent filed lawsuits and demanded recounts.

Betting sites swung toward Biden as the results trickled in, having earlier heavily favoured Trump.

Yet the prospects of the Democrats taking the Senate also dimmed, pointing to deadlock should Biden take the White House.

“A Biden win without full Senate support means less risk of regulation and higher corporate/personal taxes,” wrote analysts at Nomura in a note.

“Asset market reaction over the past 24 hours confirms this view, with the US10-year yields declining sharply, and U.S. tech/WFH/structural growth stocks outperforming on prospects of less economic aid.”

BONDS WIN BIG

Bond markets assumed a divided government would greatly reduce the chance of debt-funded spending on stimulus and infrastructure next year, and thus less bond supply.

That saw 10-year Treasury yields tumble all the way back to 0.74%, having touched a five-month top of 0.93% at one stage on Wednesday.

The overnight drop of 11 basis points was the largest single-day move since the COVID-19 market panic of March.

The diminished chance of U.S. fiscal stimulus will pile pressure on central banks globally to inject liquidity, just as the Federal Reserve and Bank of England hold policy meetings.

"Both could be interesting given the need for central banks to do more," said Chris Beauchamp, chief market analyst at IG.

"The Fed in particular will have to take up its QE role again with a weary sigh, in order perhaps to provide yet another bridge to the future when, hopefully, a government stimulus package will have been agreed."

A renewed focus on Fed easing restrained the dollar, after a wild ride overnight. The dollar index was last at 93.362, a lot nearer Wednesday's low of 93.070 than the top of 94.308.

Likewise, the dollar settled back to 104.38 yen having briefly been as high as 105.32 overnight. The euro held at $1.1734, well away from a low of $1.1602.

Sterling had troubles of its own.

The Bank of England increased its already huge bond-buying stimulus on Thursday by a further 150 billion pounds ($194.61 billion) to a total target of 895 billion as it sought to cushion Britain's struggling economy against the hit from a second coronavirus lockdown.

The Telegraph newspaper had earlier reported the BoE was considering a move into negative interest rates.

The pound was down 0.3% at $1.2941, compared with an overnight peak of $1.3139.

All the talk of policy easing put a floor under gold prices, leaving the metal a shade firmer at $1,909.1 an ounce.

Oil prices ran into some profit-taking. They had jumped overnight on speculation a deadlocked U.S. government would be unable to pass major environmental legislation that favoured other forms of energy.

U.S. crude slipped 878 cents to $38.37 a barrel, though that followed a rise of 4% on Wednesday, while Brent crude futures fell 80 cents to $40.43.

-----

Earlier: