GLOBAL OIL DEMAND UPDOWN

OPEC - 11 November 2020 - OPEC MONTHLY OIL MARKET REPORT

Oil Market Highlights

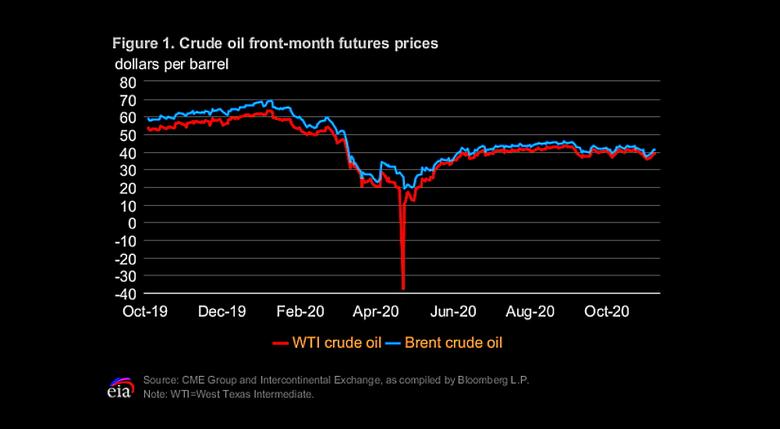

Crude Oil Price Movements

The OPEC Reference Basket (ORB) fell by $1.46, or 3.5%, month-on-month (m-o-m), to average $40.08/b in October. Year-to-date (y-t-d), the ORB averaged $40.57/b, or $23.34 lower than the same period last year. Crude oil futures prices extended losses, with oil market sentiment continuing to be dominated by concerns about the recovery in global oil demand, amid a sharp increase in the number of daily COVID-19 cases in several regions. Crude oil futures prices on both sides of the Atlantic settled lower in October. ICE Brent was down 35¢/b, m-o-m, to stand at $41.52/b, while NYMEX WTI edged 7¢ lower to settle at $39.55/b, keeping the Brent-WTI spread narrow at just below $2/b. In terms of market structure, NYMEX WTI, ICE Brent and DME Oman were in sustained contango during October. Hedge funds and money managers in WTI slightly reduced their net long positions during the month, while in ICE Brent there was a slight increase in net long positions, albeit remaining at low levels, given the high uncertainty surrounding market outlooks.

World Economy

The global economic growth forecast continues to show a contraction of 4.3% for 2020, while the 2021 forecast is revised down to growth of 4.4%, down from 4.5% forecast of last month, with all numbers now based on the newly-implemented 2017 purchasing power parity (PPP) levels. US economic forecast is revised up to show a contraction of 3.6% in 2020, while growth in 2021 is revised lower to 3.4%. The Euro-zone forecast is revised up to minus 7.2% from minus 7.7%, while the 2021 forecast is revised lower to 3.7%. Japan's economic growth forecast remains at minus 5.7% for 2020 and 2.8% for 2021. China's economic growth remains at 2.0% for 2020 and 6.9% in 2021. The forecast for India is revised down to minus 9.2%, while growth in 2021 remains at 6.8%. Brazil's forecasts is revised higher to minus 6.0% in 2020 and growth of 2.5% in 2021. Russia's economic growth forecast in 2020 remains unchanged, with a contraction of 4.9% this year and growth of 2.9% in 2021.

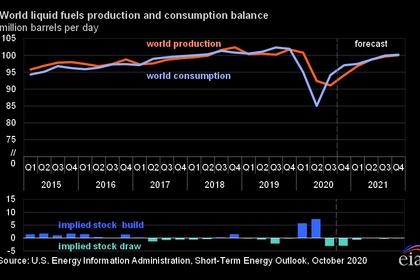

World Oil Demand

The global oil demand forecast for 2020 is revised down by 0.3 mb/d, given weaker-than-expected demand in OECD Americas in 3Q20 and the recently announced additional COVID-19 containment measures by various governments in OECD Europe. Transportation and industrial fuel are expected to remain adversely affected throughout 4Q20. As a result, world oil demand is now expected to contract by around 9.8 mb/d, y-o-y, in 2020. For 2021, oil demand growth is expected to grow by 6.2 mb/d, y-o-y, representing a downward revision of 0.3 mb/d compared to last month's assessment. These downward revisions mainly take into account downward adjustments to the economic outlook in OECD economies due to COVID-19 containment measures, with the accompanying adverse impacts on transportation and industrial fuel demand through mid-2021.

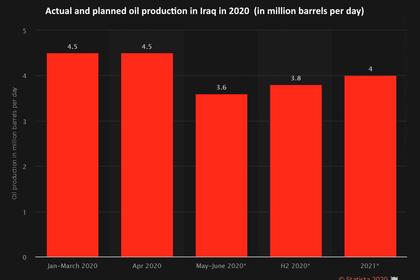

World Oil Supply

The non-OPEC liquids production forecast for 2020 is revised marginally lower by 0.06 mb/d from the last month's assessment, to now show a contraction of 2.4 mb/d. The marginal downward revision is due to production outages in the US Gulf of Mexico, as well as lower-than-expected output in Norway, the UK, and Mexico. Oil supply in 2020 is forecast to decline mainly in Russia, the US and Canada, partially offset by growth led by Norway, Brazil, China and Guyana. The 2021 supply forecast is revised higher by 0.06 mb/d, to average 0.95 mb/d, mainly due to a higher expectations for Oman production next year. Uncertainties regarding the ability to achieve sufficient well completions and spending levels remain. The main drivers for supply growth in 2021 are expected to be the US with 0.3 mb/d, followed by Canada, Brazil and Norway. OPEC NGLs are expected to decline by 0.1 mb/d in 2020 then grow by 0.1 mb/d, y-o-y, to average 5.2 mb/d in 2021. OPEC crude oil production in October increased by 0.32 mb/d, m-o-m, to average 24.39 mb/d, according to secondary sources.

Product Markets and Refining Operations

Globally, refining margins gained limited ground in October, with a positive performance seen at the middle and bottom of the barrel, impacted by lower processing rates, amid peak maintenance season and lower overall offline capacity, y-o-y. In addition, a decline in feedstock prices towards the end of the month lent further support to refining economics. In the US, margins remained almost flat, exhibiting only moderate gains, supported by a combination of product supply disruptions due to maintenance and a heavy hurricane season. The prompt start-up of refineries following weather-related disruptions, amid demand side pressure, prevented a steeper upturn. In Europe, margins showed the largest gains relative to other regions, with simple configurations benefiting the most. Meanwhile, margins in Asia saw support from economically driven run cuts in some countries within the region, the sharp fall in oil prices, and a robust product market performance, mainly in India.

Tanker Market

The weaker tanker market continued into October, with dirty tanker rates depressed by ample tonnage availability along with sluggish tanker demand as COVID-19 disruptions weighed on trade. High inventories and the unwinding of floating storage have also negatively impacted dirty tanker rates. After a brief pick-up in the Mediterranean last month, clean tanker rates in October turned lower West of Suez. East of Suez rates, however, managed an increase on gains on the Singapore-to-East route.

Crude and Refined Products Trade

Preliminary data shows US crude imports picked up, from an almost three-decade low, to average 5.4 mb/d in October. US crude exports fell further below 3 mb/d in October, impacted by lower demand amid renewed lockdown measures in Europe and as strong Chinese buying began to wind down. The latest data showed OECD Europe crude imports picked up in July to average 7.9 mb/d, after having declined for five-straight months to a 15-year low. China's crude imports rebounded in September, averaging 11.8 mb/d, the third-highest on record after the levels seen in June and July this year. China's crude imports are expected to be lower in 4Q20, as independent refiners have topped out import quotas for the year, with preliminarily data showing China's crude imports averaged 10.1 mb/d in October. India's crude imports fell back after improving the previous month, averaging 3.7 mb/d in September, but performed better y-o-y than in previous months, amid an easing of lockdown measures.

Commercial Stock Movements

Preliminary data showed total OECD commercial oil stocks down 15.3 mb, m-o-m, in September. At 3,179 mb, inventories were 237.1 mb higher, y-o-y, and 211.9 mb above the latest five-year average. Within this, crude and products stocks declined 13.0 mb and 2.2 mb, m-o-m, respectively. OECD crude stocks stood at 78.6 mb above the latest five-year average, while product stocks exhibited a surplus of 133.3 mb above the latest five-year average. In terms of days of forward cover, OECD commercial stocks fell, m-o-m, by 1.3 days in September to stand at 71.7 days. This is 10.3 days higher, y-o-y, and 9.4 days above the latest five-year average.

Balance of Supply and Demand

Demand for OPEC crude in 2020 is revised down by 0.2 mb/d from the previous month to stand at 22.1 mb/d, which is around 7.2 mb/d lower than in 2019. Demand for OPEC crude in 2021 is revised down by 0.6 mb/d from the previous month to stand at 27.4 mb/d, which is around 5.2 mb/d higher than in 2020.

Full PDF version

-----

Earlier: