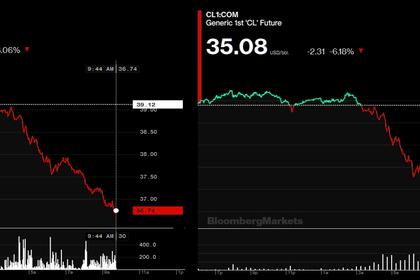

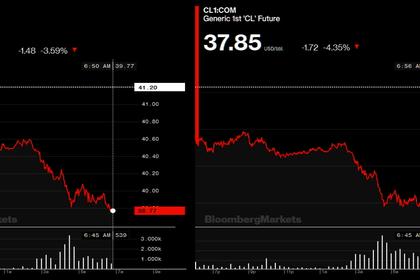

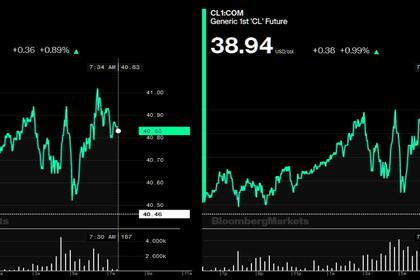

OIL PRICE: ABOVE $37 AGAIN

REUTERS - NOVEMBER 2, 2020 - Oil prices fell on Monday on worries that widening coronavirus lockdowns in Europe would weaken fuel demand while concerns remain over potential turbulence resulting from this week's U.S. presidential election.

Brent crude was down 80 cents, or 2.1%, at $37.14 a barrel by 1140 GMT. U.S. West Texas Intermediate fell 93 cents, or 2.6%, to $34.86. Both contracts fell more than $2 earlier in the session.

Countries across Europe have reimposed lockdown measures to try to slow COVID-19 infection rates that have accelerated over the past month.

“The number of lockdowns - and the oil demand the countries that imposed them account for - will lead to some demand destruction, depressing balances and putting further strain on the already fragile market,” said Rystad Energy analyst Paola Rodriguez-Masiu.

Global oil trading companies expect further demand destruction, though estimates differ. Vitol sees winter demand at 96 million barrels per day (bpd) while Trafigura expects demand to drop to 92 million bpd or lower.

A tight race in the lead up to the U.S. election on Tuesday and accompanying uncertainty also prompted investor caution in global markets.

“The concerns over oil supply and demand fundamentals ... are going to play second fiddle to the U.S. presidential election and to how risk markets will react to the outcome,” said BNP Paribas analyst Harry Tchilinguirian.

Oil pared some losses after Japan’s export orders grew for the first time in two years and China’s factory activity rose to its highest in nearly a decade in October. More manufacturing surveys are expected from the euro zone and the United States later in the day.

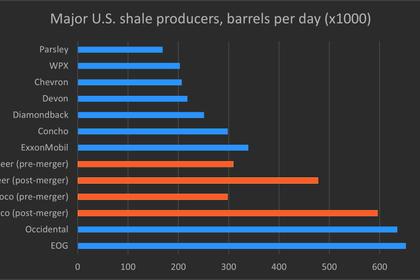

Sharply rising Libyan oil production also added to price pressures. Libya’s output stands at about 800,000 barrels per day (bpd), up more than 100,000 bpd from a few days ago, a Libyan source told Reuters on Saturday.

Meanwhile, output from the Organization of the Petroleum Exporting Countries (OPEC) rose for a fourth month in October, a Reuters survey found.

OPEC and allies including Russia are cutting output by about 7.7 million bpd to support prices. This OPEC+ group is scheduled to hold a policy meeting on Nov. 30 and Dec. 1, with some analysts expecting a postponement of plans to ramp up output by 2 million bpd from January.

“A resolute and coordinated announcement and action by OPEC+ are what is really needed to prevent any further price slide,” said Commerzbank analyst Eugen Weinberg.

-----

Earlier: