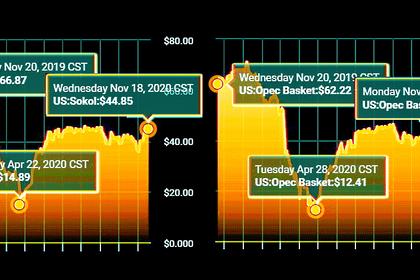

OIL PRICE: NOT BELOW $44

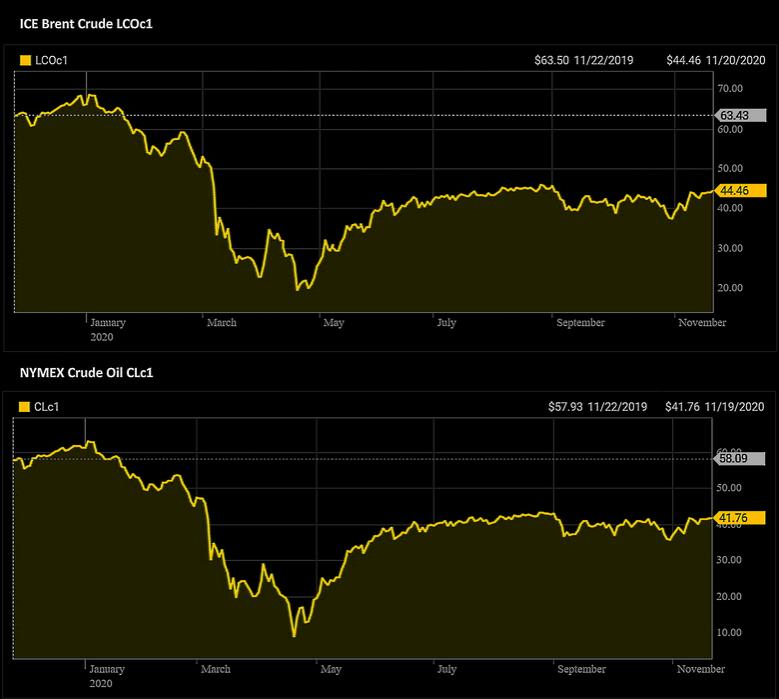

REUTERS - NOVEMBER 20, 2020 - Oil prices were little changed on Friday, on track for a third consecutive weekly rise, but demand concerns stemming from surging coronavirus cases and renewed lockdowns in several countries capped gains.

Prospects of an effective COVID-19 vaccine and hopes that OPEC and its allies will keep production in check have bolstered oil markets this week.

Brent crude LCOc1 futures were up 2 cents, or 0.05% at $44.22 a barrel by 0730 GMT.

The more active U.S. West Texas Intermediate (WTI) January crude contract CLc2 dipped 4 cents to $41.86 a barrel. The WTI contract for December CLc1, which expires on Friday, was down 3 cents at $41.71 per barrel.

“Both contracts continue to consolidate at the upper end of their November ranges. However, momentum has notably waned, and both are vulnerable to negative headline surprises now,” said Jeffrey Halley, senior market analyst at OANDA.

Both benchmarks are up more than 3% so far this week, the slimmest weekly gains in the last three weeks.

The oil markets have trimmed their weekly gains “as virus surge throws a wet blanket over vaccine optimism,” said Stephen Innes, chief global market strategist at Axi.

“But it is all down to OPEC,” he added.

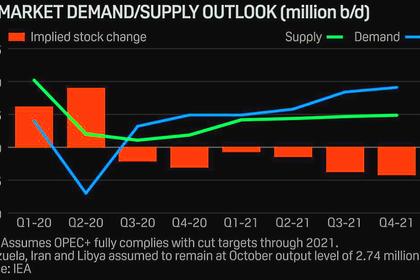

OPEC+, a grouping that includes the Organization of the Petroleum Exporting Countries (OPEC), Russia and other producers, will discuss its output policy at a meeting on Nov. 30 and Dec. 1.

“The next few sessions are going to be choppy. The good news is that there seems to be hope of containing the disease,” said Sukrit Vijayakar, director of energy consultancy Trifecta.

The market needs to see a slowdown in the increase of daily cases, a reduction in the number of active cases and growth in demand for oil products, he said.

Oil prices were getting some support from signs of movement on a stimulus deal in Washington after U.S. Senate Republican Majority Leader Mitch McConnell agreed to resume discussions on providing more COVID-19 relief as cases surge across the United States.

Oversupply concerns, however, continue to weigh as Libya has raised production to pre-blockade levels of 1.25 million bpd.

-----

Earlier: