OIL PRICE: NOT BELOW $47 ANEW

REUTERS - NOVEMBER 30, 2020 - Crude oil prices fell on Monday, amid investor jitters ahead of a meeting of producer group OPEC+ to decide whether to extend large output cuts to balance global markets, but vaccine hopes helped keep them on track to rise more than a fifth in November.

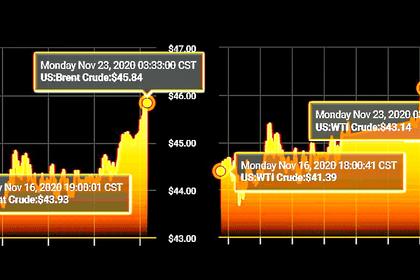

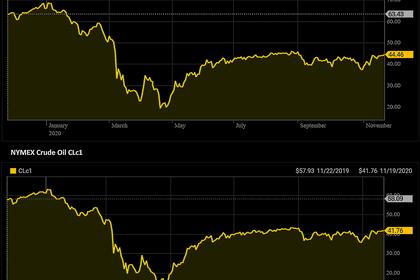

January Brent crude futures, which will expire later on Monday, dropped 46 cents, or 1%, to $47.72 a barrel by 0355 GMT. The more actively traded February Brent contract was at $47.83 a barrel, down 42 cents.

U.S. West Texas Intermediate crude futures for January fell 48 cents, or 1.1%, to $45.05 a barrel.

However, both benchmarks are still set for a rise of more than 20% in November, the strongest monthly gains since May, boosted by hopes for three promising coronavirus vaccines to limit spread of the disease and thus support fuel demand.

Analysts and traders also expect the Organization of the Petroleum Exporting Countries (OPEC) and allies including Russia - the OPEC+ grouping - to delay next year’s planned increase in oil output as a second COVID-19 wave has hit global fuel demand.

OPEC+ previously agreed to raise output by 2 million barrels per day (bpd) in January - or about 2% of global consumption - after record supply cuts this year.

The group held an initial round of talks on Sunday, but has yet to reach consensus on oil output policy for 2021 ahead of key meetings on Monday and Tuesday, four OPEC+ sources told Reuters. Monday's meeting begins at 1300 GMT.

"While we base-case a 3-month delay to prevent a return to a global oil surplus through 1Q21, not all producers appear onboard," Goldman Sachs analysts said.

A lack of extension, representing a downside of $5 a barrel from current spot levels in the analysts' modelling, would further contribute to short-term price gyrations, they added.

The winter wave of infections is expected to crimp global oil demand by 3 million bpd, they said, which would only partially be offset by heating and restocking demand in Asia.

ANZ estimated that the oil market surplus could run as high as 1.5 million to 3 million bpd in first half of 2021 if OPEC+ did not extend cuts.

Rising Middle East tension over the weekend, over events ranging from the assassination of Iran's top nuclear scientist to Islamic State's rocket attack on an oil refinery in northern Iraq propped up oil prices.

In the United States, the number of operating oil and natural gas rigs has risen for the fourth month in a row as producers return to the wellpad with crude prices mostly trading over $40 a barrel since mid-June.

China, the world's second-largest economy and top oil importer, expanded factory activity at its fastest in more than three years in November, keeping on track to be the first major economy to fully recover from the coronavirus crisis.

-----

Earlier: