OPEC+ CUTS PRODUCTION

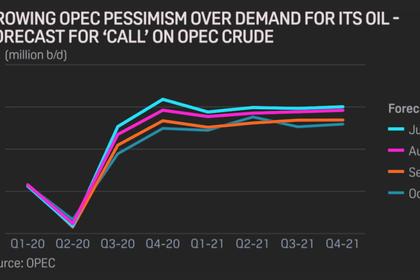

PLATTS - 16 Nov 2020 - Key oil ministers from OPEC and its allies will hold critical talks Nov. 17 on 2021 production quotas, steered towards an extension of current output cuts through March or June by an uncertain near-term market outlook.

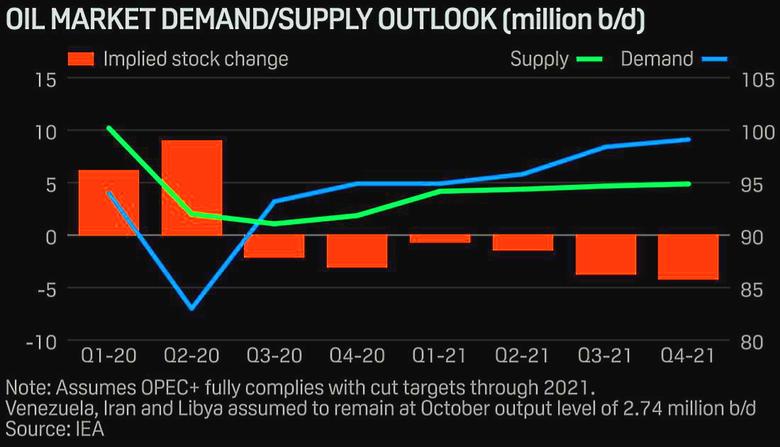

Recent promising results from coronavirus vaccine tests have provided some optimism that the global economy could return to normal by perhaps the back half of 2021, but the OPEC+ alliance must first tackle a likely challenging winter and possibly spring.

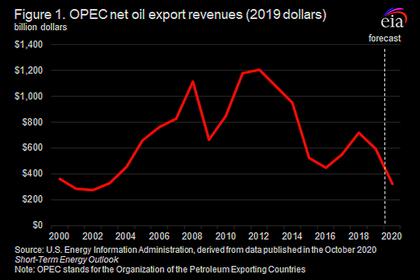

Renewed lockdown measures to contain the spread of COVID-19 in Europe continue to weigh on oil demand, even as economic activity in Asia appears robust. Meanwhile Libya's surprise oil industry revival following months of political and military turmoil is another damper on prices.

OPEC+ ministers are weighing whether to relax their current 7.7 million b/d in collective production cuts to 5.8 million b/d as originally scheduled, maintain them at the same level for a few months, or even deepen them.

The coalition will convene online Nov. 30-Dec. 1 to hammer out an agreement, but the Joint Ministerial Monitoring Committee, a nine-country panel co-chaired by Saudi Arabia and Russia, could provide the first signals of a decision when it meets Nov. 17.

Saudi energy minister Prince Abdulaziz bin Salman has previously said the deal could be "tweaked" as market conditions warrant. An advisory delegate-level technical committee met Nov. 16, reviewing scenarios in which the current cuts were extended for three months or six months, sources told S&P Global Platts.

Such an extension would help bolster the market as it awaits the mass availability of a COVID-19 vaccine, but many members are weary of having sacrificed so much production for so long already.

Traders appear to have already baked in a cut extension through at least the first quarter of 2021. Front-month Brent futures have risen above $44/b, after having hit a five-month low of $37.86/b on Oct. 30.

"The odds are overwhelming that there will be a postponement on putting oil back on the market," one top oil trader said at an industry conference, asking not to be named, while another said expectations are that the "market will not be burdened with 2 million b/d from January in one go."

The costs of noncompliance

Beyond the decision on cuts, compliance remains a sore spot among many members, OPEC+ sources said. Thirteen out of the 19 OPEC+ members with quotas have breached their caps since May and only the UAE has made significant progress in implementing its "compensation cuts" owed for overproduction, according to internal documents seen by Platts.

Full conformity would have helped speed the market's rebalancing from the pandemic, and OPEC+ delegates said they expect more contentious discussions around the issue, given Prince Abdulaziz's avowed drive for compliance.

Platts calculates OPEC+ quota compliance at a perfect 100% for October, but that was juiced by the UAE's catch-up volumes and traditionally strong performance from Saudi Arabia.

Market watchers will be monitoring how closely OPEC+ adheres with its quotas – as well as Saudi Arabia's patience with a lack of follow-through on compensation cuts – as the alliance manages supply in 2021.

Analysts with the Oxford Institute of Energy Studies calculate that oil prices could slide as much as $7/b for the year if OPEC+ discipline deteriorates.

"A shift in expectations of improved fundamentals in the second half of 2021 following the positive news on the vaccine may render the option of withholding barrels today and releasing them when the better times arrive attractive," the analysts said in a note. "Whatever decision OPEC+ takes, maintaining high compliance is key."

-----

Earlier: