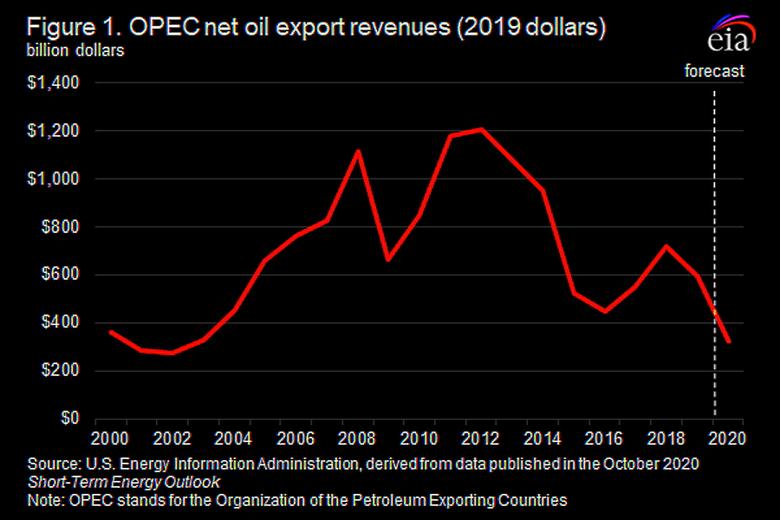

OPEC OIL REVENUES WILL DOWN

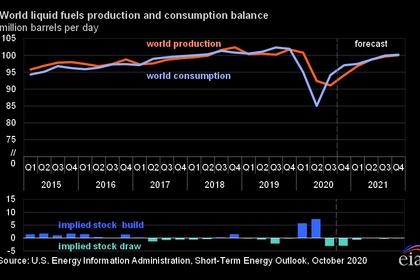

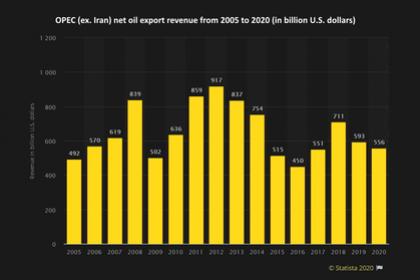

U.S. EIA - October 28, 2020 - The U.S. Energy Information Administration (EIA) expects that members of the Organization of the Petroleum Exporting Countries (OPEC) will earn about $323 billion in net oil export revenues in 2020, the lowest level since 2002 (Figure 1). EIA based this revenues estimate on forecast total petroleum liquids production—including crude oil, condensate, and natural gas plant liquids— forecast total petroleum consumption, and the crude oil price forecasts in the October 2020 Short-Term Energy Outlook (STEO). The expected decrease in export revenues compared with last year is driven by lower crude oil prices and lower export volumes. Crude oil prices have fallen as a result of lower global demand for petroleum products because of COVID-19 and associated mitigation efforts. Export volumes have also decreased as a result of high production disruptions in Libya, Iran, and, to a lesser extent, Venezuela and OPEC agreements to limit crude oil output in response to low crude oil prices.

EIA’s estimate of OPEC net oil export revenues assumes that exports are sold at prevailing spot crude oil prices. Projected revenues are estimated using EIA’s forecast for oil prices from STEO. These forecasts incorporate historical price differentials between spot prices for the different OPEC crude oil types and the benchmark crude oil prices forecasted in STEO (Brent and West Texas Intermediate). For countries that export several different crude oils, EIA assumes that the proportion of total net oil exports represented by each type of crude oil is the same as the proportion of the total domestic production represented by that variety. For example, if Arab Heavy represents 12% of total oil production in Saudi Arabia, EIA assumes that Arab Heavy also represents 12% of total net oil exports from Saudi Arabia.

Although OPEC net oil export revenues include estimated revenues for Iran and Venezuela, EIA does not adjust OPEC net oil export revenues for possible price discounts that importers of Iranian and Venezuelan oil may be receiving. Similarly, EIA does not adjust the net revenue estimate for crude oil imported by China, Russia, and India as debt repayment from Venezuela and Iran.

OPEC earned an estimated $595 billion in net oil export revenues in 2019, a decrease of 17% compared with the estimated 2018 net export revenue and less than half the estimated record high of almost $1.2 trillion earned in 2012. Similar to the factors driving the decrease in net oil revenues in 2020, the estimated 2019 revenues fell as a result of lower crude oil prices, higher crude oil production disruptions, and voluntary curtailment of crude oil output among OPEC members. Per capita net oil export revenues across OPEC averaged $1,201 in 2019, down 19% from 2018 (Figure 2). EIA forecasts that 2020 per capita net oil export revenues will fall to $638. The decrease in revenues could be detrimental to member countries’ fiscal budgets, which rely heavily on oil sales to import goods, fund social programs, and support public services. The decline in expected net oil export revenue in 2020 is driven by continued voluntary curtailments and low crude oil prices.

The Brent spot price fell from an annual average of $71 per barrel (b) in 2018 to $64/b in 2019, and EIA expects it to average $41/b in 2020. Heavier crude oils are typically priced lower than lighter crude oils. As the global slate of crude oil changed with increased light crude oil production, some OPEC members benefited from a narrowing price discount for their heavier crude oils. In 2019, smaller discounts for OPEC members’ heavier crude oil streams contributed to higher spot prices for the OPEC crude oil basket price, which incorporates spot prices for the major crude oil streams from all OPEC members (Figure 3).

Sanctions targeting Iranian and Venezuela crude oil sales as well as a combination of mismanagement and general deterioration of the oil sector in Venezuela affected total OPEC revenues in 2019 and 2020 (Figure 4). Combined crude oil production in Iran and Venezuela fell by 1.9 million barrels per day (b/d), or 37%, in 2019 and then by more than 600,000 b/d between January and September 2020. Iran’s and Venezuela’s net oil export revenues halved from 2018 to 2019 (Figure 4).

Venezuela’s net oil revenues continued to fall in the first half of 2020 as a result of falling oil prices and U.S. sanctions that affected Venezuela’s ability to sell its oil. EIA estimates that from January to July 2020, Venezuela received an estimated $3 billion in net export revenues, down from an estimated $8 billion during the same period in 2019. Iran exports were also limited by sanctions and COVID-19 and its mitigation efforts. Export revenues fell to a low of $50 million in April 2020. EIA estimates that Iran received a total of $9 billion in export revenues from January to July 2020, compared with $20 billion during the same period in 2019.

EIA’s net oil revenue estimates are subject to uncertainty. Any changes in forecast OPEC crude oil production, either higher or lower, would result in a change in EIA’s OPEC net oil export revenue estimates for 2020 and 2021.

-----

Earlier: