OPEC+ RUSSIA CONSENSUS

PLATTS - 29 Nov 2020 - Key OPEC+ ministers ended preliminary consultations Nov. 29 with no firm consensus on future production levels, delegates told S&P Global Platts, as not all members were convinced of the need to roll over deep output cuts to shore up the oil market.

The dissent could make for difficult crunch-time talks when OPEC and its non-OPEC partners officially meet over the next two days to hammer out an accord that will set the tone for oil prices in 2021.

"We will have a very tough meeting, I think," said one OPEC source with knowledge of the deliberations.

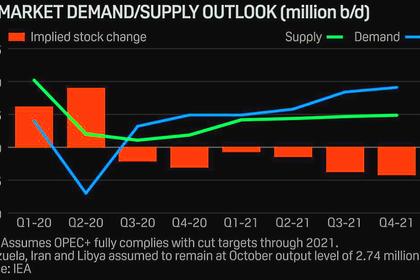

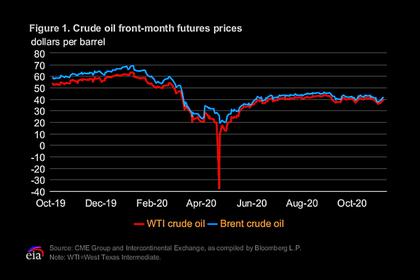

OPEC and nine allies led by Russia have implemented historic production cuts to combat the pandemic-fomented collapse in oil demand. The curbs began at 9.8 million b/d from May, and then were eased to 7.7 million b/d in August as the world economy, particularly in Asia, began to recover.

They are scheduled to taper again to 5.8 million b/d from January, but struggles to contain COVID-19 infection rates in western countries have stalled the global economic recovery, prompting some OPEC+ members to advocate an extension of the current cuts.

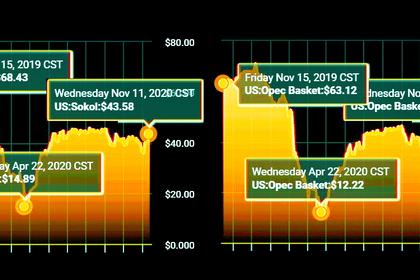

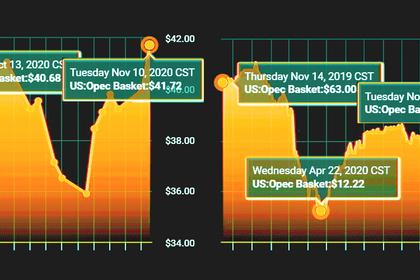

However, optimism over promising trial results for three coronavirus vaccines has buoyed oil prices in recent days to their highest since March, and fatigue among many members to reining in so much of their crude production has been growing. Platts assessed Dated Brent at $47.02/b on Nov. 27.

Talks in secrecy

Saudi Arabia and Russia had invited ministers on the nine-country monitoring committee that they co-chair to informal discussions to hash out positions ahead of the official meeting. OPEC members on the panel include Iraq, the UAE, Kuwait, Nigeria, Algeria and Venezuela. Non-OPEC Kazakhstan also serves on the committee.

The video conference session was restricted to ministers only -- without staffers present -- to maintain confidentiality, delegates said. No official statements were issued, and neither the Saudi nor Russian energy ministries responded to requests for comment.

Still, a few details emerged.

Ministers were considering a three-to-four-month continuation of the 7.7 million b/d cuts, that its supporters said would support oil prices while the development of vaccines progresses, sources told Platts.

However, Russia was seeking to allow a gradual increase of production quotas from January, while Kazakhstan wants the cuts to be scaled back as originally scheduled, one delegate said.

The UAE -- which Platts has previously reported may be considering an exit from OPEC -- is still considering its position, a source said.

Meanwhile Iraq, which has said it can not afford to maintain its quota, will go along with any OPEC+ decision and not seek an exemption from its production cuts because it does not want to see crude prices drop, oil minister Ihsan Ismaael told the official Alsabaah newspaper Nov. 29.

Leading the market ahead

The OPEC+ alliance will have to resolve the issues presented at the informal talks -- and perhaps more from the 13 countries who don't sit on the monitoring committee -- in just two days.

More long-term questions about the coalition's staying power may also have to be addressed, particularly with analysts anticipating a de-escalation of tensions between Washington and Tehran that could end sanctions on Iran's beleaguered oil sector and return some 2 million b/d of Iranian crude exports to the market.

Libya's faster-than-expected recovery in oil production following a ceasefire between rival groups must also be factored into the OPEC+ decision.

OPEC will meet first on Nov. 30, before Russia and the eight other non-OPEC partners join the talks on Dec. 1.

Traders have long priced in expectations of a cut extension through at least the first quarter.

Oil price volatility will depend on what OPEC+ decides, until oil demand recovers, said Igor Sechin, CEO of Russia's Rosneft.

"Everything here depends on the coordinated actions of market participants," he said Nov. 29 on state television. "We have to work in any conditions we have, that's all."

-----

Earlier: