OPEC+ RUSSIA EXTENSION

PLATTS - 27 Nov 2020 - Russia is expected to agree to a short-term extension of OPEC+ production cuts when the group meets next week, according to analysts, helped by the fact that Moscow is less dependent on higher oil prices than other OPEC+ countries.

Ongoing demand uncertainty coupled with its strong financials may lead Russia to push for a short duration to any new agreements on production cuts.

"I do believe that they will extend the cuts, but I think the cuts will be for up to three months, maybe one or two ... I don't think that the Russians will agree to more," one Moscow-based analyst said.

Russian President Vladimir Putin has frequently supported the deal and recently indicated that Russia is willing to amend the current terms of the deal if necessary.

"We are not ruling out that we can either keep the current restrictions on production or remove them less quickly than we initially envisaged," Putin said in mid-October, according to a transcript posted on the Kremlin website.

The fact that US shale is not recovering strongly is further cause for Russia to continue to support ongoing cooperation within OPEC+. The risk of losing market share to US producers has long been raised by Russian oil companies in discussions over their participation in the deal.

Russia's current quota for crude production is 8.99 million b/d. Under the current agreement, this is due to increase to 9.495 million b/d for January 2021-April 2022.

The Joint Ministerial Monitoring Committee heads of delegation are due to hold informal talks Nov. 28, before the OPEC ministerial meeting on Nov. 30 and the OPEC+ ministerial meeting on Dec. 1.

Lower breakeven

Russia said in July its budget deficit may rise to 5% of gross domestic product this year and that the OPEC+ agreement will cost Russia about 1.2% of GDP in 2020 and in 2021.

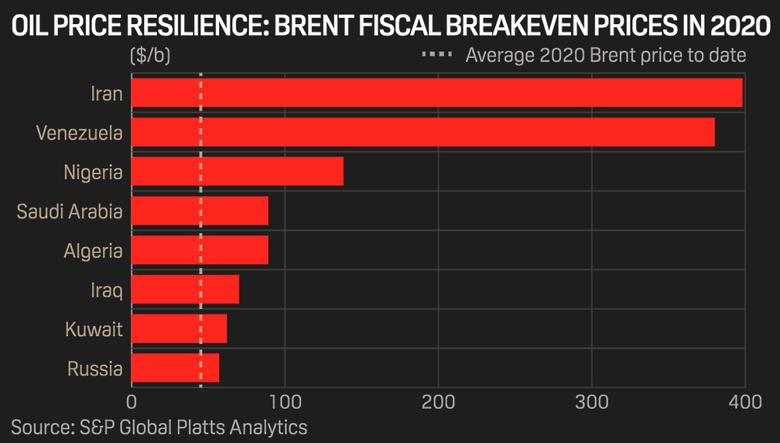

Despite the negative impact of the coronavirus pandemic on the Russian economy and oil prices in 2020, analysts see its financial position as stronger than other OPEC+ countries.

"Russia is in a much more comfortable financial position than are the other OPEC countries and the key reason is because of currency devaluation. In that sense, Russia will not be under any financial pressure to get a deal, but the other OPEC countries are," Chris Weafer, founding partner of consultancy Macro-Advisory said.

The free-floating currency is a major stabilizing factor for both the Russian state budget and oil producers during periods of oil price volatility. With costs primarily in rubles and export revenues in US dollars, Russian producers can minimize the impact of low oil prices on their operations.

In contrast, countries with currencies pegged to the dollar, such as Saudi Arabia and the UAE, see costs remain similar when oil prices and export revenues fall.

On March 6, when Russia temporarily walked away from the OPEC+ agreement, one dollar was worth 66.2 rubles. On Nov. 27 the ruble had weakened to 75.5 against the dollar, according to data from Russia's Central Bank.

Furthermore, Platts Analytics 2020 estimates for fiscal breakeven Brent prices are considerably lower for Russia at $57/b, than for other OPEC+ producers, including Saudi Arabia, which is estimated at $89/b.

Russia's comparatively strong financial position is largely due to the fiscal rule introduced in 2017, which reduces revenue volatility and softens the impact of oil price fluctuations.

"The fiscal rule is a good macroeconomic stabilizer and has, indeed, contributed to keeping this year's oil revenue and exchange rate volatility under control," George Voloshin, head of the Paris branch of Aperio Intelligence, said.

Voloshin said that in March, Russia's macroeconomic statistics looked better than in December 2016 when Russia first entered the OPEC+ agreement.

"Despite the fact that in December 2016 Russia also had around $30 billion in the Reserve Fund (fully exhausted by 2018), its NWF assets in both March and November 2020 were still considerably higher than the combined RF & NWF assets at the end of 2016," Voloshin said.

Analysts see the fiscal rule as continuing to support Russia's resilience to low oil prices in future.

-----

Earlier: