QATAR LNG WILL UP

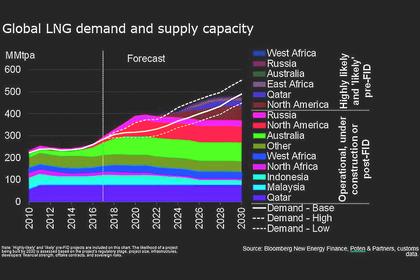

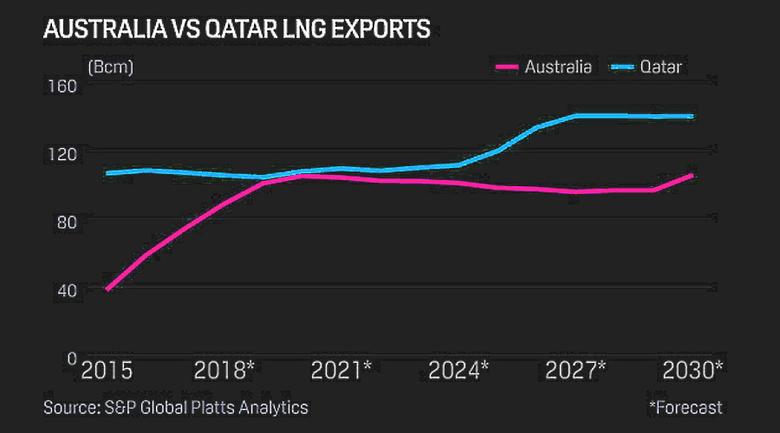

PLATTS - 13 Nov 2020 - With Qatar set to boost its LNG production capacity to 126 million mt/year before the end of the decade, Doha has been busy making sure it will be able to find homes for its huge volume of future supply.

Not only has Qatar Petroleum, or QP, been booking new significant long-term capacity at import terminals in northwest Europe over the past year, but it has now also launched an LNG trading arm that can target shorter-term volume placements globally.

It has been suggested that Qatar was caught slightly on the hop with the rapid growth in LNG liquefaction capacity first in Australia and then in the US, prompting Doha in 2017 to lift the moratorium on the further development of the massive North Field and then to target a significant LNG capacity expansion.

Qatar currently has an LNG production capacity of some 77 million mt/year, but has plans to boost it to 110 million mt/year by 2025 with the addition of four more trains and to 126 million mt/year by 2027 with the addition of two further trains.

Qatari energy minister Saad al-Kaabi also said in May that Qatar could even expand its production capacity further. "There is room to go above 126 [million mt/year]. You might hear us in a few years go higher, we have plenty of gas to do that," he said during a US-Qatar Business Council webinar.

In the meantime, QP has been active in booking new import capacity in Europe.

Most recently on Oct. 13, a QP affiliate signed a 25-year agreement for up to 7.2 million mt/year of import capacity at the UK's Isle of Grain terminal starting from mid-2025.

Qatari energy minister and QP CEO Saad al-Kaabi said that the agreement meant Doha was "reaffirming" its commitment to the UK's gas market.

Qatar already has the capacity at the 15.6 million mt/year South Hook LNG import terminal in Wales, which QP co-owns with US major ExxonMobil and France's Total.

France, Belgium capacity

The new Isle of Grain capacity booking was the third in succession in northwest Europe.

In February this year, a QP affiliate booked some 3 million mt/year of capacity at the Elengy-operated Montoir terminal in northwestern France for a term up to 2035.

"Montoir will thereby become a new LNG import terminal position for QP in Europe, facilitating the supply of Qatari and internationally sourced LNG to French and European customers," QP said at the time.

Kaabi also hinted at further cooperation with Elengy, saying QP looked forward to further strengthening the relationship in the future.

The Montoir booking followed an agreement in September 2019, when QP subsidiary Qatar Terminal Limited, or QTL, agreed to take the full capacity at Belgium's Zeebrugge terminal from the expiry of the existing long-term contracts until 2044.

QTL is already a party to an existing agreement under which about 50% of the terminal's capacity is utilized for delivery of Qatari LNG into Belgium under long-term LNG agreements.

Locking down Northwest European import capacity is clearly an important strategy for Qatar given the region's liquid trading hubs, ample gas storage capacity, and good interconnectivity.

"European regasification capacity will continue to be core part of QP's evolving commercial strategy, one that is part and parcel with a push into spot market trade," Samer Mosis from S&P Global Platts Analytics said.

Trading arm

QP on Nov. 9 launched a new trading arm, QP Trading, which is mandated with building a globally diversified portfolio and managing risk through physical and derivatives trading.

Mosis said it was a "tectonic shift" for Qatar whose exports traditionally either go to long-term customers, mainly in Asia, or get placed into Europe through Qatar's ever-expanding portfolio of regasification capacity.

"It ushers in a new era for the world's largest, lowest-cost, producer of LNG and represents a tacit recognition by the champion of oil-indexed, long-term deals that spot trade and commoditization are destined to dominate global LNG trade flows," he said.

QP Trading's first deal with Pavilion Energy also was accompanied by a pledge that each cargo delivered would come with a statement quantifying greenhouse gas emissions.

Mosis said that given Qatar's ultra-low development costs, the launch of QP Trading is particularly bearish for any prospective pre-FID LNG project, especially as it occurred simultaneously with the first instance of QP integrating carbon accounting into an LNG deal.

This, he said, removes two potential points of comparative advantage for any aspiring LNG producer.

"Successful operationalization of QP Trading, equipped with anywhere from 20 to 30 million mt/year of spot-destinated supply, holds the potential to increase Qatari spot market penetration and threatens to put the final nail in greenfield LNG's coffin this decade," Mosis said.

And with Qatar set to have more than 50 million mt/year of uncontracted capacity through 2026, it will require all possible outlets to maintain its traditional 100% utilization levels, he said.

-----

Earlier: