SAUDI ARAMCO NET INCOME $11.8 BLN

ARAMCO - Dhahran, Saudi Arabia, November 3, 2020 – The Saudi Arabian Oil Company ("Aramco" or "the Company") today announced its financial results for the third quarter of 2020. These results highlight the Company's financial and operational strength, despite market volatility and the impact of COVID-19 on the global economy.

Commenting on the results, Aramco President & CEO Amin H. Nasser, said:

"We saw early signs of a recovery in the third quarter due to improved economic activity, despite the headwinds facing global energy markets. Meanwhile, we maintained our commitment to shareholder value by declaring a dividend of $18.75 billion for the third quarter.

"Aramco's integration with SABIC is proceeding as planned. Our resilience is supported by our unique scale, low upstream carbon intensity and low production costs. As the global economic and social landscape evolves, these strengths and our continued drive to lower GHG emissions mean we are well positioned to support the energy needs of the global economic recovery.

"We continue to adopt a disciplined and flexible approach to capital allocation in the face of market volatility. We are confident in Aramco's ability to manage through these challenging times and deliver on our objectives.

"We are making progress on multiple fronts, including the world's first blue ammonia shipment for zero-carbon power generation in Japan – further strengthening our focus on new and innovative solutions that contribute to the global energy transition."

Financial Highlights

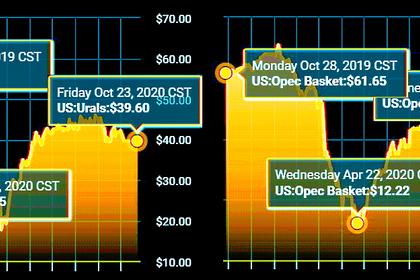

Aramco continues to demonstrate its strength and resilience across economic cycles, navigating challenging market conditions to record net income of $11.8 billion and free cash flow* of $12.4 billion in the third quarter of 2020.

Aramco declared a dividend of $18.75 billion for the quarter.

Q3 capital expenditure was $6.4 billion and Aramco continues to execute capital spending optimization and efficiency programs in response to the current business environment.

Operational Highlights

Total hydrocarbon production for the first nine months of 2020 was 12.4 million barrels per day of oil equivalent, of which 9.2 million barrels per day was crude oil.

The Company delivered crude and other products with 100% reliability in the third quarter of 2020, continuing its strong track record of supply reliability.

Aramco achieved a record historic single-day natural gas production of 10.7 bscfd on August 6, 2020 from both conventional and unconventional fields.

Successful exploration activities resulted in two successful unconventional field discoveries in the third quarter, both in the northern part of the Kingdom; one field with both oil and gas reservoirs and another field with a gas reservoir.

The Company's Khurais oil facility was recognized by the World Economic Forum as a leader in the adoption and integration of cutting-edge technologies of the Fourth Industrial Revolution (4IR), including artificial intelligence and industrial robotics. Khurais became Aramco's second facility to join WEF's Global Lighthouse Network – a select group of just 54 facilities worldwide that have shown leadership in 4IR technologies.

The Downstream business continues to focus on enhancing integration and creating growth opportunities across the hydrocarbon value chain. Following the successful close of the SABIC transaction, the third quarter of 2020 marks the first full quarter in which SABIC's financials are incorporated into Aramco's Downstream results. Integration with SABIC continues to progress and drives forward the Downstream strategy of creating value through integration across the hydrocarbon value chain.

Aramco continued to demonstrate its focus on sustainability with the world's first cargo of high-grade blue ammonia, which was shipped from Saudi Arabia to Japan for use in zero-carbon power generation. The process – a collaboration between Aramco, SABIC and the Institute of Energy Economics, Japan - involved the capturing of 50 tons of associated carbon dioxide (CO2) emissions for use in methanol production and enhanced oil recovery.

-----

Earlier: