ASIA SHARES DOWN

REUTERS - DECEMBER 18, 2020 - Asian shares slipped on Friday after Reuters reported that the United States is set to add dozens of Chinese companies, including the country’s top chipmaker SMIC, to a trade blacklist later in the day.

Still, the prevalent underlying mood on global equities remained upbeat, as the prospect of a major U.S. coronavirus relief package meant investors were keen on picking up stocks and other risk-exposed assets.

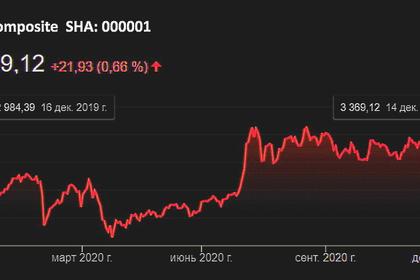

MSCI’s broadest index of Asia-Pacific shares outside Japan dropped 0.6% from Thursday’s record. Mainland Chinese shares fell 0.4% while Hong Kong’s Hang Seng lost 1%.

Washington is expected to name some Chinese companies that it says have ties to the Chinese military, sources said, adding in total around 80 additional companies and affiliates to the so-called entity list, nearly all of them Chinese.

Japan’s Nikkei dipped 0.2%, facing strong resistance around 27,000 while European shares are seen weaker, with Euro Stoxx 50 futures down 0.45% and FTSE futures falling 0.3%.

U.S. S&P 500 futures eased 0.24%, a day after their underlying index gained 0.58% to close at an all-time high of 3,722.48.

Global equities on the whole basked in optimism that a deal will be reached over a fresh U.S. economic stimulus package.

Lawmakers from both major U.S. political parties said failing to agree was not an option, and earlier Republican Senate Majority Leader Mitch McConnell said talks could spill into the weekend.

Many investors saw the passing of new measures to support the economy as imminent after data showed the number of Americans filing first-time claims for jobless benefits unexpectedly rose last week.

Markets were encouraged that the United States stood ready to ship 5.9 million doses of a new coronavirus vaccine developed by Moderna that is on the cusp on winning regulatory approval.

“Even though the current state of outbreak is so bleak, markets are assuming vaccines will help the U.S. achieve a herd immunity next year and that everybody will be dancing in spring, with pent-up demand for consumption exploding,” said Kozo Koide, chief economist at Asset Manegement One.

“Fund managers would be wise to ride on this bandwagon for now, but markets appear to be underestimating uncertainties. It’s not known exactly how long vaccines will protect you. There will be disappointment if markets learn they are not like measles vaccines, one shot of which will last for life,” he added.

The bullish mood supported many currencies against the safe-haven U.S. dollar, while other assets ranging from risky bitcoin to safe-haven gold also rose.

The dollar index stood at 89.977 , having slipped below 90 for the first time in two and a half years.

The euro changed hands at $1.2246 , having hit a two-and-a-half-year high of $1.2273 on Thursday. The dollar stood at 103.37 yen, after having slipped to a nine-month low of 102.88.

As expected, the Bank of Japan extended a package of steps aimed at easing corporate funding strains caused by the coronavirus pandemic.

The British pound slipped 0.40% to $1.3534 , off the two-and-a-half-year high it hit on Thursday, taking a minor hit after British Prime Minister Boris Johnson’s office said trade talks with the European Union were in a “serious situation”.

Bitcoin rose 1.5% to $23,128, extending its weekly gains to 21.3%, with a break of the $20,000 mark on Wednesday triggering a fresh wave of buying binge.

Spot gold eased slightly to $1,881.6 per ounce after having hit a one-month high of $1,896.2 in the previous session while copper hit its highest levels in almost eight years.

Likewise oil climbed to a nine-month high before easing slightly in Asia on Friday.

Brent crude futures traded at $51.34 a barrel, down 0.3% on day but not far from Thursday’s peak of $51.90, having gained 2.7% so far this week.

-----

Earlier: