ASIA'S COAL PRICES UP

FT - DECEMBER 22 2020 - The world’s least-loved major commodity is burning brightly again.

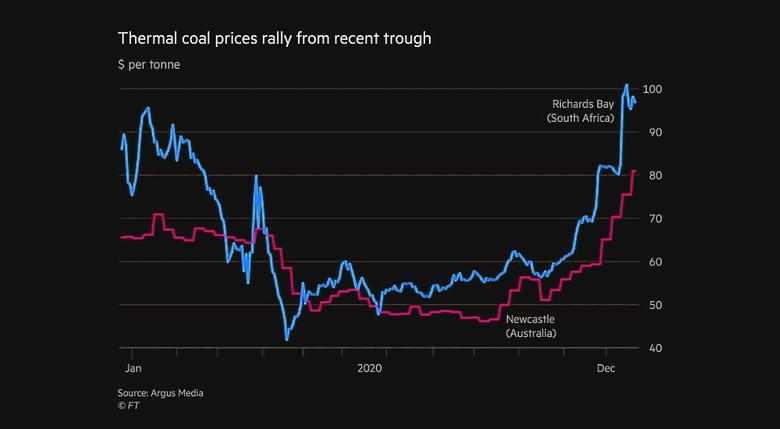

The price of thermal coal, used to generate electricity in power stations, has surged in the past two months as key consumers in China, India, South Korea and Japan rushed for supplies.

Since the start of November, high energy Australia coal — the benchmark for the vast Asian market — has climbed 45 per cent to $80 a tonne, according to a price assessment from Argus, while its South African equivalent is up 65 per cent to about $100 a tonne.

The rally will be a relief for big Australian producers of the fossil fuel such as Glencore after prices traded below $50 a tonne in the second and third quarters due to a drop in industrial activity caused by coronavirus lockdowns.

Traders say several factors are at play. First, the seaborne thermal coal market is tight. About 25m tonnes of Colombian production has been curtailed this year in response to weak prices and there is no fresh supply coming on stream as banks and investors refuse to finance new mines.

At the same time, demand in Asia has started to pick up owing to the region’s economic recovery and more recently a cold snap.

In China, where domestic production has not been able to match supply, that has led to soaring prices, a supply crunch and a search for imported coal. However, that has been complicated by an unofficial ban on Australia coal due to a diplomatic spat.

As a result, Chinese buyers have turned to producers in Indonesia, Russia, and even South Africa, which they have not imported from since 2016 due to impurities in the coal. Traders reckon about 1m tonnes of South Africa coal is currently on its way to China, with possibly more to follow.

“Thermal coal prices have risen extremely fast over the past few weeks, primarily driven by the developments in China,” said analysts at CRU in a report. “Very high domestic prices and their large premium compared to import prices will incentivise more buying in the seaborne market.”

Despite the lack of Chinese buying, Australian thermal coal prices have also surged in recent weeks.

Higher China demand has pushed up the price of Indonesian, Russian and South African coal, allowing Australian producers to push material into less traditional markets of Bangladesh, Turkey and India.

“One of the latest casualties of heightened China-Australia geopolitical tensions is Australian coal exports,” said James O’Rourke of Capital Economics. “But we think that this will have limited implications for demand and prices as, for the most part, coal should be redirected to other countries.”

Looking ahead, traders reckon prices could hold at current levels. Last week, the International Energy Agency said a global economic recovery would drive a 2.6 per cent increase in coal demand next year.

“There is little sign that the world’s coal consumption is set to decline substantially in the coming years, with rising demand in some Asian economies offsetting declines elsewhere,” the IEA said.

Separately, the price of iron ore pulled back from Monday’s nine-year high, falling 5.6 per cent to $167 a tonne after the Dalian Commodity Exchange in China brought in trading limits for investors who are not formally a futures member.

The steel-making ingredient is this year’s hottest commodity, rising almost 90 per cent since the end of 2019. China’s steel producers have called on regulators to investigate a recent rise in prices, which traders have blamed on speculators.

-----

Earlier: