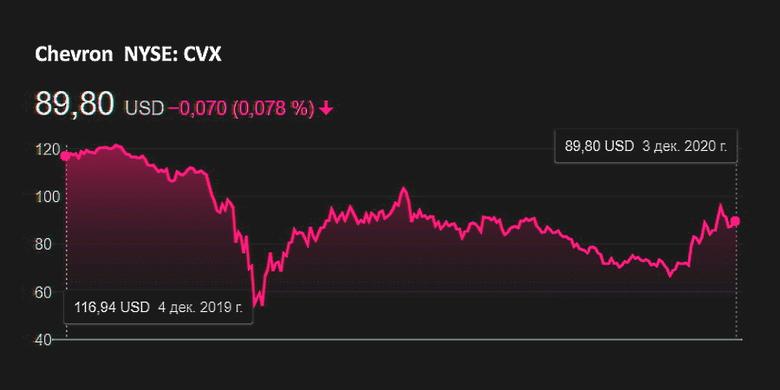

CHEVRON INVESTMENT $14 BLN

CHEVRON - Dec. 3, 2020 – Chevron Corporation today announced a 2021 organic capital and exploratory spending program of $14 billion and lowered its longer-term guidance to $14 to $16 billion annually through 2025. This capital outlook will continue to prioritize investments that are expected to grow long-term value and deliver higher returns and lower carbon, including over $300 million in 2021 for investments to advance the energy transition.

“Chevron remains committed to capital discipline with a 2021 capital budget and longer-term capital outlook that are well below our prior guidance,” said Chevron Chairman and CEO Michael Wirth. “With our major restructuring behind us and Noble Energy integration on track, we’re prepared to execute this program with discipline.”

Chevron’s capital guidance of $14 to $16 billion annually from 2022 to 2025 is significantly lower than its previous guidance of $19 to $22 billion, which excluded Noble Energy. During this time period, as capital is expected to decrease for a major expansion in Kazakhstan, the company expects to increase investments in a number of Chevron’s advantaged assets, including its world class position in the Permian, other unconventional basins, and the Gulf of Mexico.

“Chevron is in a different place than others in our industry,” Wirth said. “We’ve maintained consistent financial priorities starting with our firm commitment to the dividend. We took early and swift action at the beginning of the pandemic to prudently allocate capital, reduce costs and protect our industry-leading balance sheet. And we’ve completed a major acquisition and restructuring that positions our company to deliver higher returns and grow long-term value.”

Read the full press release with table.

-----

Earlier:

2020, October, 6, 15:15:00

NOBLE, CHEVRON DEAL $4.2 BLN

Noble Energy shareholders have approved a deal to sell the oil and gas producer to Chevron Corp, making Chevron the No. 2 U.S. shale oil producer and giving it international natural gas reserves close to growing markets.

|

2020, August, 3, 12:25:00

CHEVRON NET LOSS $ 8.3 BLN

Chevron Second quarter loss of $8.3 billion; adjusted loss of $3.0 billion

|

2020, August, 3, 12:00:00

CHEVRON, ALGONQUIN RENEWABLE ENERGY

Chevron U.S.A Inc. (CUSA), a wholly owned subsidiary of Chevron Corporation (NYSE: CVX), and Algonquin Power & Utilities Corp. ("Algonquin") (TSX: AQN) (NYSE: AQN) today announced an agreement seeking to co-develop renewable power projects

|