GLOBAL ELECTRICITY DEMAND UPDOWN

IEA - Electricity Market Report - December 2020

Executive summary

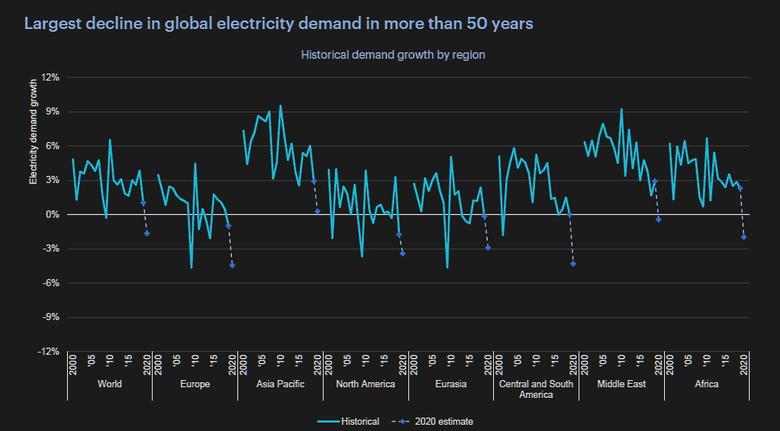

Global electricity demand in 2020 is projected to fall by around 2%. This is the biggest annual decline since the mid-20th century and far larger than what followed the global financial crisis, which resulted in a drop in electricity demand of 0.6% in 2009. The contraction this year is a result of the Covid-19 pandemic and its impact on economic activity – the assumed 4.4% decline in global GDP in 2020 is significantly larger than the 0.1% reduction in 2009 – and the measures taken to prevent the further spread of the virus.

China will be the only major economy to see higher electricity demand in 2020. However, projected demand growth of around 2% in the People’s Republic of China (hereafter, “China”), which represents about 28% of global electricity consumption, is still significantly below its average since 2015 of 6.5%. After implementing strict health measures

early in the year and experiencing subsequent drops in electricity demand in the first quarter, China has seen year-on-year demand growth every month since then. Although demand recovered in many economies during the Northern Hemisphere’s summer and autumn, major consumers including the United States, India, Europe, Japan, Korea and Southeast Asia are all set to experience declines for the year as a whole.

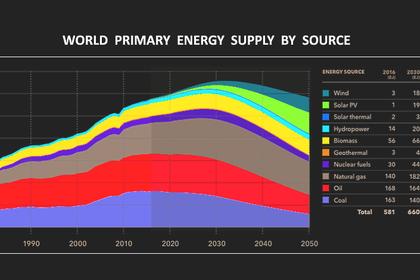

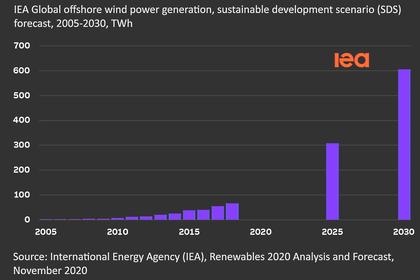

Renewable electricity generation is projected to grow by almost 7% in 2020, squeezing conventional generation. Long-term contracts, priority access to the grid and sustained installation of new plants are all underpinning strong growth in renewable electricity production. The decline in electricity demand combined with a rise in renewable supply has accelerated the squeeze on coal, gas and nuclear power. Coal-fired generation is estimated to fall by around 5% in 2020, the largest decrease on record, bringing it back to levels last seen in 2012. Nuclear power generation is set to decline by around 4% in 2020, affected both by the pandemic and lower capacity availability, especially in the first half of the year. China was the main exception to this: its nuclear output increased by about 6% thanks to new capacity coming into service. Gas-fired electricity generation is projected to fall by 2%, its decline cushioned by lower natural gas prices enabling it to take market share away from coal, particularly in the United States and Europe. Overall, electricity generation-related CO2 emissions are expected to fall by 5% in 2020, a much bigger decline than the forecast decline in global electricity demand.

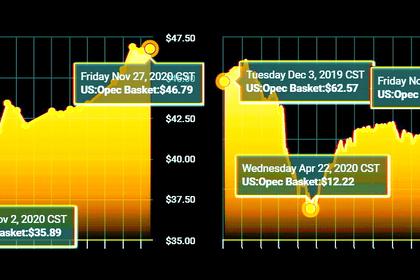

Wholesale electricity prices have plummeted in 2020. Falling demand, lower fuel prices and the increase in renewable generation units with zero marginal costs have dragged down prices. The IEA’s wholesale electricity market price index, which tracks price movements in major advanced economies, shows an average price decline of 28% in 2020, after having already fallen by 12% in 2019.

Following the shock of 2020, we expect a modest rebound in 2021. With the recovery of the global economy in 2021, global electricity demand is expected to grow by around 3%. This rebound is rather low compared with 2010, the year following the global financial crisis, when electricity demand grew by 7.2%. The increase in demand is expected to be driven by emerging and developing economies, particularly China and India.

The growth of renewables should remain the lead story in 2021, but coal is expected to bounce back. Electricity output from renewables, particularly wind and solar PV, is expected to continue to set new records in 2021, expanding their market share to 29% from 28% in 2020. Nuclear power is also set for growth of 2.5% owing to a rebound in France and Japan and new plants coming online in China and the United Arab Emirates. In advanced economies, the growth of renewables and nuclear will continue to shrink the space remaining for fossil fuel generation. Natural gas is likely to be impacted more than coal as a result of an assumed rise in natural gas prices. In emerging and developing economies, demand growth is projected to outpace increases in renewables and nuclear, leaving some room for coal and gas generation to expand. The expected net result globally is that coal-fired generation increases by around 3%, while gas-fired plants increase output by roughly 1%. This would lead to a rise in CO2 emissions from the power sector of around 2% in 2021.

-----

Earlier: