OIL & GAS NEED INVESTMENT

PLATTS - 10 Dec 2020 - The oil and gas industry will have to overcome its pandemic-induced retrenchment and boost investment by at least 25% annually over the next three years to prevent a severe supply crunch that could send prices skyrocketing and tip the global economy back into crisis, according to an intergovernmental agency.

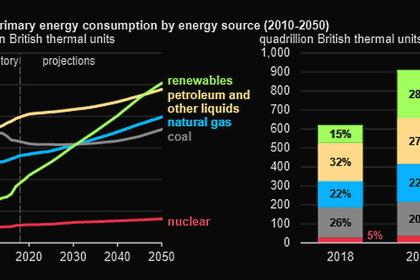

Even with the possibility of peak demand nearing, the world will lack enough production capacity to meet its projected needs if oil companies do not urgently replace depleted reserves and develop new fields, the International Energy Forum said in a Dec. 10 report.

"Without sufficient investment, a reduced supply of oil and gas could lead to greater market volatility and higher prices, slowing the global economic recovery and jeopardizing energy security and international goals," said the IEF, which collaborated with Boston Consulting Group on the study.

Warnings of a looming supply gap are not new, and indeed, both producing and consuming countries are largely united on the issue. Dating back to the oil price slump that began in 2014, the International Energy Agency and OPEC have both sounded the alarm that upstream capex in the industry was insufficient to meet future demand.

The Riyadh-based IEF, which was formed to foster dialog between producers and consumers, said conditions now are even more dire than they were six years ago, given the pandemic's gut-punch to the global community.

It estimates that reductions in capex spending today will have twice the effect of similar cuts made in 2014.

"Starting in 2014, oil and gas companies cut capex for two consecutive years. At the same time, service sector companies reduced their costs sharply, which helped to support industry activity," the report stated. "This time around, suppliers have less scope to do that. As a result, the recovery in investments is likely to take longer than it did in the wake of the 2014 price drop."

The IEF, which is composed of energy ministers from 70 countries, called on the industry and governments to seek more favorable investment conditions "by resisting the temptations of protectionism and uncoordinated solitary actions."

"A lack of incentives for producers to increase investment shortly after this low cycle will delay and weaken the restoration of market balances that are necessary to promote global economic recovery and support global sustainable development and greenhouse gas emissions reduction goals," the report said.

Boom and bust

With US shale production rising and OPEC unable to forge a deal on output quotas at a critical meeting in November 2014, the oil market began a three-year slump that saw prices dive below $30/b in early 2016.

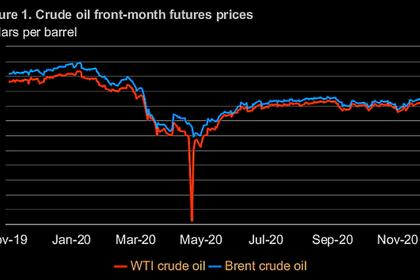

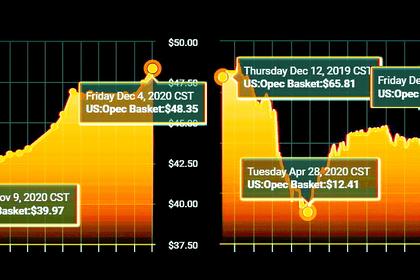

A sweeping accord between OPEC, Russia and several other key producers to begin a series of output cuts in 2017 is largely credited with rescuing prices, along with US President Donald Trump's decision to reimpose sanctions on Iran, which sent Dated Brent soaring above $85/b in October 2018.

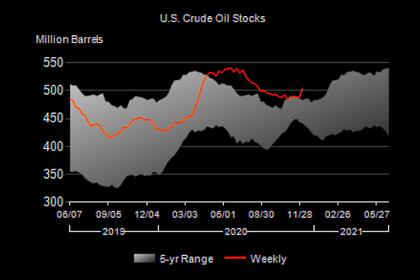

But weakening demand growth prospects for 2020 were already causing another slide in the oil market, before the coronavirus pandemic walloped the global economy and crashed Dated Brent prices to as low as $13.615/b in late April.

The IEF/BCG study found that the oil and gas industry has slashed its spending by 34% in 2020, with companies signaling continued belt tightening in 2021.

The IEA and OPEC have estimated that another 27 million to 30 million b/d of oil equivalent are needed by 2022 to replace naturally declining wells and meet projected demand. That will rise to 68 million to 70 million boe/d by 2030, necessitating upstream investment to roughly double from 2020 levels by then to be some $225 billion higher annually.

The expected deployment in COVID-19 vaccines will accelerate the global economic recovery, and potentially exacerbate the supply gap, the IEF said.

"Higher and more volatile prices would reduce the number of people who could afford the cooking, heating, and transportation fuels they require, and volatility would further increase uncertainty for companies and governments," the report said.

-----

Earlier: