OIL PRICE: NEAR $50

REUTERS - DECEMBER 23, 2020 - Oil prices dropped on Wednesday after an industry report showed an unexpected rise in U.S. crude oil inventories, and as President Donald Trump rattled markets by threatening not to sign a long-awaited U.S. COVID-19 relief bill.

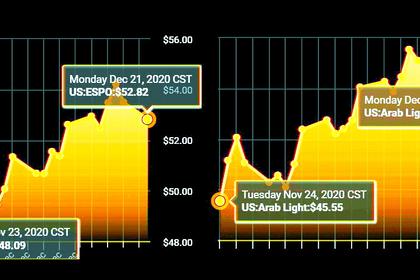

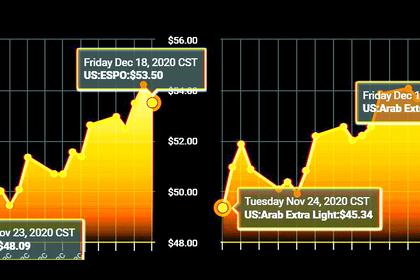

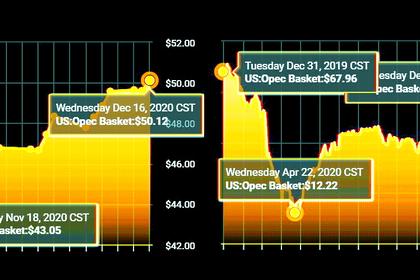

Brent crude futures were down 38 cents, or 0.8%, to $49.70 a barrel at 0814 GMT, while U.S. West Texas Intermediate (WTI) crude futures fell 40 cents, or 0.9%, to $46.62 a barrel. Both contracts fell nearly 2% on Tuesday in a second straight session of declines.

Oil markets also remain jittery about the future recovery of demand as a new, highly infectious strain of the novel coronavirus has hit Britain, prompting much of the world to shut its borders to the country.

“This is the holiday period, when people go out and that prompts fuel demand. But now, a majority of flights have been cancelled to and from the UK, so this is going to impact oil demand (overall),” said Ravindra Rao, vice president of commodities at Kotak Securities.

“Sometime earlier, the expectation was that the virus threat was subsiding, and demand was slowly and slightly moving higher. But with this ... new coronavirus strain, the market is purely operating on sentiment right now that it is going to create more restrictions.”

The immediate support for Brent is near $49 per barrel, Kotak Securities said. A close below that level could lead to a fall to $46, it said.

The American Petroleum Institute (API) reported on Tuesday that U.S. crude inventories rose by 2.7 million barrels in the week to Dec. 18, compared with analyst expectations for a draw of 3.2 million barrels.

“The repricing of the COVID-19 reality in the world continued unabated in oil markets overnight, with U.S. API crude inventories showing a surprise climb, and adding to the gloom,” said Jeffrey Halley, senior market analyst at OANDA.

Oil also took a hit after Trump threatened not to sign an $892 billion coronavirus relief bill, saying he wants Congress to increase the amount in the stimulus checks that lawmakers approved on Monday.

COVID-19 cases continued to surge in the United States, with more than a million new cases in just six days, and Americans were warned again to avoid Christmas travel, further dampening fuel demand.

-----

Earlier: