OPEC+ PRODUCTION CUTS 100.2%

PLATTS - 08 Dec 2020 - OPEC and its allies in November pumped their most crude oil since implementing historic production cuts in May, the latest S&P Global Platts survey found, driven largely by Libya's brisk recovery and a rebound in the UAE's output.

OPEC's 13 members produced 25.21 million b/d in November, up by 670,000 b/d from October, while its nine partners, led by Russia, added 12.68 million b/d, a fall of 50,000 b/d, according to the survey.

With Libya exempt from quotas due to its years of civil war and the UAE remaining well below its cap as it makes up for previous overproduction, overall OPEC+ compliance with its production cuts stayed stable at 100.2%.

The output rise comes as the alliance on Dec. 4 agreed to slightly relax its quotas in January by 482,000 b/d and meet monthly to determine subsequent production levels, in an attempt to steer the unsteady oil market through the pandemic. The coalition will next convene on Jan. 4, delegates told Platts.

Preparing to ramp up

OPEC kingpin Saudi Arabia pumped 9.01 million b/d in November, 20,000 b/d above its quota, the survey found, with both exports and inventories rising slightly.

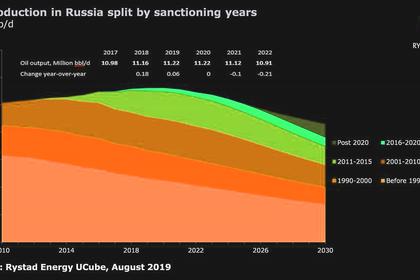

Russia, which is now the largest producer of crude in the coalition, saw its production fall 20,000 b/d in November to 9.09 million b/d, still 100,000 b/d above its quota, according to the survey.

Both Russia and Saudi Arabia will see their caps increase by 126,000 b/d in January.

Russia normally has difficulties increasing production in winter, but Deputy Prime Minister Alexander Novak, who handles the country's OPEC+ affairs, has said its domestic oil companies have been ordered to ready for a ramp-up.

Meanwhile, the UAE continued to observe strong compliance, but production in November saw a significant 90,000 b/d bump, as it closed the books on the additional so-called "compensation cuts" that it owed for violating its quota earlier this summer.

The Gulf producer pumped 2.51 million b/d last month, which is still 80,000 b/d below its current quota, the survey found.

UAE energy minister Suhail al-Mazrouei has been critical of other non-compliant countries for not following through on their compensation cuts, triggering tensions in the alliance and a rift with usual ally Saudi Arabia, which co-chairs the OPEC+ monitoring committee with Russia, sources have said.

Under the deal, all compensation cuts owed will carry over through March, when they are expected to be completed.

Exempt members pump more

Libya, Iran and Venezuela -- all of which are exempt from the cuts -- added more than 600,000 b/d to the oil market in November, with more increases expected in the coming months.

Libya's rise has been meteoric since the UN-backed Government of National Accord and the self-styled Libyan National Army agreed a permanent ceasefire in August. Libyan crude production has risen by 840,000 b/d in the past two months, jumping to an 11-month high in November to 1.03 million b/d, as all the country's oil fields and terminals are now open.

Venezuela's production continued to recover slightly as the sanctions-hit country scrambles to keep some of its key fields running, while Iran has also seen a gradual rebound as it prepares for what it hopes will be a lifting of US sanctions in 2021 after President-elect Joe Biden takes office in January.

Compensation missing

Compliance by other typically lax members improved, though some of the compensation cuts have still to be implemented.

Iraq's production in November was in line with its quota but without the 165,000 b/d in catch-up cuts it had committed to, the survey found.

Nigeria improved its compliance to 99%, pumping 1.50 million b/d, as output from key grades such as Forcados, Qua Iboe and Brass River dipped. Brass River exports have been on force majeure since late November due to a pipeline explosion, survey panelists noted.

Africa's largest oil producer entered recession after its GDP fell for two consecutive quarters as its oil revenues have shrunk due to hefty production cuts along with the fallout from the coronavirus pandemic.

Angola, which has also had to cut deeper due to previous violations, saw its output fall to 60,000 b/d below its quota.

The Platts figures are compiled by surveying oil industry officials, traders and analysts, as well as reviewing proprietary shipping, satellite and inventory data.

-----

Earlier: