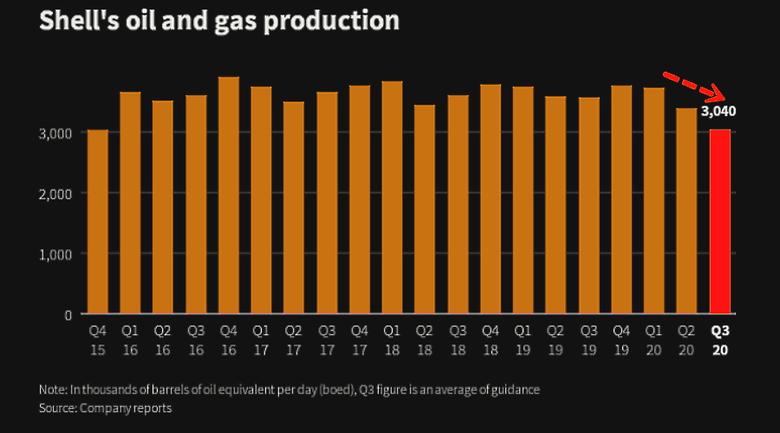

SHELL OIL PRODUCTION 2.3 MBD

SHELL - Dec 21, 2020 - This is an update to the fourth quarter 2020 outlook provided in the third quarter results announcement on October 29, 2020. The impacts presented here may vary from the actual results and are subject to finalisation of the fourth quarter 2020 results.

This update note is presented based on prevailing commodity prices and forward curves, further movements and volatility till the end of the year are likely to impact earnings and CFFO.

Unless otherwise indicated, presented impacts relate to Adjusted Earnings on a post-tax basis.

Integrated Gas

Production is expected to be between 900 and 940 thousand barrels of oil equivalent per day. Despite increased production compared with the third quarter 2020, earnings impact is limited due to PSC effects.

LNG liquefaction volumes are expected to be between 8.0 and 8.6 million tonnes.

Trading and optimisation results are expected to be below average.

Approximately 80% of our term sales of LNG in 2020 have been oil price linked with a price-lag of up to 6 months.

Significant margining outflows have impacted CFFO in the fourth quarter so far, compared with margining related inflows at the end of the third quarter 2020. The full quarter impact is subject to movements in commodity prices and forward curves up until the last day of the quarter.

Upstream

Adjusted Earnings are expected to show a loss in the current price environment.

Production is expected to be between 2,275 and 2,350 thousand barrels of oil equivalent per day, reflecting hurricane impacts in the US Gulf of Mexico (between 60 and 70 thousand barrels of oil equivalent per day) and the effect of mild weather in Northern Europe in the first half of the fourth quarter.

Realised Upstream gas prices are expected to trend in line with Henry Hub.

Depreciation is expected to be $100 to $200 million higher compared with the third quarter 2020.

Tax charge in the range of $600 million and $900 million is expected to negatively impact Adjusted Earnings in the fourth quarter. This includes unfavourable movements in deferred tax positions.

Despite the expected earnings loss, CFFO is not expected to reflect a comparable cash tax effect due to the build-up of deferred tax positions in a number of countries.

CFFO is expected to be negatively impacted by the settlement of previously booked provisions in the range of $400 to $500 million.

Oil Products

Refinery utilisation is expected to be between 72% and 76%.

Realised gross refining margins are expected to be slightly improved compared with the third quarter 2020.

Sales volumes are expected to be between 4,000 and 5,000 thousand barrels per day.

Marketing results are expected to be in line with the fourth quarter 2019 while significantly lower compared with the record third quarter 2020 due to lower volumes driven by seasonal trends.

Trading and optimisation results are expected to be significantly lower compared with the third quarter 2020.

Significant derivatives related outflows have impacted CFFO in the fourth quarter so far, compared with derivatives related inflows at the end of the third quarter 2020. The full quarter impact is subject to movements in commodity prices and forward curves up until the last day of the quarter.

Working capital movements are typically impacted by movements between the quarter opening and closing price of crude along with changes in inventory volume.

Chemicals

Chemicals manufacturing plant utilisation is expected to be between 77% and 81%.

Chemicals sales volumes are expected to between 3,600 and 3,900 thousand tonnes.

Chemicals base and intermediate margins are expected to improve compared with the third quarter 2020.

Corporate

Corporate segment Adjusted Earnings are expected to be a net expense of $900 to $975 million for the fourth quarter, impacted by unfavourable movements in deferred tax positions. This excludes the impact of currency exchange effects.

Other

Higher underlying operating expenses due to increased activity compared to the third quarter 2020 are expected to impact Adjusted Earnings across the businesses.

As per previous disclosures, CFFO price sensitivity at Shell Group level is estimated to be $6 billion per annum for each $10 per barrel Brent price movement.

Note that this price sensitivity is indicative and is most applicable to smaller price changes than those in the current environment and in relation to the full-year results. This excludes the short-term impacts from working capital movements and cost-of-sales adjustments.

Post-tax charges, in aggregate, between $3.5 to $4.5 billion in relation to impairments, asset restructuring and onerous contracts are expected in the fourth quarter. These expected charges, reported as identified items, relate to Upstream (including partial impairment of Appomattox asset in the US Gulf of Mexico due to subsurface updates), Oil Products (including charges related to announced transformation of the refinery portfolio) and Integrated Gas (onerous contracts). As per accounting standards, charges linked to Reshape organisational restructuring are expected to be recognised in 2021.

Shell will provide a strategy update on 11 February 2021.

Consensus

The consensus collection for quarterly Adjusted Earnings and CFFO excluding working capital movements, managed by VARA research, is scheduled to be opened for submission on 13 January 2021, closed on 27 January 2021, and made public on 28 January 2021.

-----

Earlier: