U.S. LPG FOR ASIA IS STABLE

PLATTS - 10 Dec 2020 - US LPG shipments to Asia will remain strong in 2021, with about 2.9 million mt estimated to arrive in January 2021, more than 2.7 million mt for December arrivals, lending support to Very Large Gas Carrier rates, traders said.

US shipments are propane-heavy, with butane normally making up 20% of the volume, though some can comprise cargoes that are evenly split, or 33,000 mt of propane and 11,000 mt of butane, trade sources said.

The ample US shipments come as Chinese petrochemical sector demand for propane feedstock held firm amid high domestic prices of propylene, which are in short supply, sources said.

Propane demand for winter heating in north Asia is steady. However, with the January-February CP propane swap valued Dec. 9 at plus $18/mt from $9/mt the day before and indicated early Dec 10 at plus $15/mt, the wide backwardation could prompt Japanese importers to stagger imports, traders said.

South Korea's domestic sales are projected to be positive this year on healthy petrochemicals feedstock demand to produce medical supplies and higher heating fuel usage, supporting imports of US LPG, major S Korean distributors said.

Steady shipments of US LPG to Asia in recent months have been supported by attractive regional prices.

CFR North Asia propane touched a one-week high at $525/mt Dec. 8, after hitting 10-month peaks at $536/mt Nov. 27, S&P Global Platts data showed. On Dec. 9, it was assessed at $515.50/mt. US Gulf Coast normal butane rebounded Dec. 9, up 2 cents/gal to 75 cents/gal and from its lowest in almost three weeks. Non-LST normal butane reached a 21-week high at 84.50 cents/gal Nov. 25, with sources attributing the strength of November barrels to strong exports, tight supply, and lower fractionation and refinery runs.

Normal butane built its premium to non-LST propane to 29.125 cents Nov. 24, the largest margin since Platts assessed normal butane at 29.25 cents above propane Feb. 19.

When December normal butane barrels weakened, the premium to propane dwindled to 13.5 cents/gal before the Dec. 9 rebound.

Butane widening against propane signaled butane receiving buying support as winter gasoline season ramped up, although there was the expectation that the same seasonal premium to propane would not hold to traditional levels.

As the coronavirus pandemic continues and countries impose new restrictions, weaker demand and exports of butane could pressure the spread to propane.

Platts assessed propane flat for a fourth consecutive day at 59.50 cents/gal Dec. 9, maintaining a year-to-date high. Propane recorded nine straight day-on-day gains before reaching its current level Dec. 4.

RETURN TO PREPANDEMIC EXPORTS

Despite healthy flows of US propane to Asia, the propane-butane CP swap spread was valued at parity Dec. 9, before propane flipped to a premium of $3/mt in early indications on Dec. 10. This is the first time propane is above butane since Sept. 2, Platts data showed.

Strengthening propane prices is stoked by north Asian appetite for the product and the pause in Indian spot demand for mixed propane-butane cargoes, while Middle East supply is expected to be steady, trade sources said. Qatar Petroleum has also issued a tender in the week started Dec. 6 offering 45,000 mt of evenly-split LPG for Jan. 11-14, after announcing acceptances the week prior of January-loading term cargoes without cuts or delays.

Yet, some sources said in the medium term, butane could persist at $5-$10/mt above propane, as Indian term imports next year are projected higher at about 1.1 million mt versus 1 million mt in 2020.

VLGC rates out of the US Gulf Coast to Chiba, Japan, climbed to $147/mt Dec. 4, the highest since Jan. 4, 2016, when they were at $159/mt. Platts assessed freight to Northwest Europe at $77/mt Dec. 4, matching the assessment from Nov. 15, 2019, while Persian Gulf-Japan rates rose to $107/mt Dec. 10, the highest since Aug. 3, 2015, when it hit $107.50/mt, Platts data showed.

Other than steady shipments out of the US, sources identified VLGCs dry docking -- with nine currently in shipyards -- and delays via the Panama Canal as causing the freight spike.

Panama Canal congestion has persisted for more than two months, with some delays extending to nine days, said a source.

Some of those delays aligned with container traffic while other backlogs were linked to low water levels and reduced staffing due to COVID-19 protocols, a source said.

US propane exports are projected to fall 8% from the 2020 estimate and average 1.1 million b/d in 2021, the latest North American NGLs Five-Year Forecast showed.

Tightening forecast production suggests a slight contraction in average annual production to 1.8 million b/d in 2021 before a recovery to prepandemic levels by mid-2022.

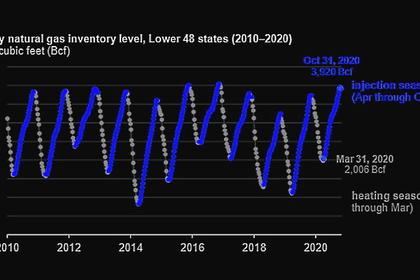

US propane stocks briefly surpassed a record 100 million barrels early October, but have since retreated. Exports are expected to average 1.5 million b/d by 2025. Rising exports across the forecast may pressure propane stocks in coming years.

US normal butane exports are forecast to fall 44% from 2020 estimates and average 183,000 b/d in 2021.

With global demand for propane growing much faster than butane, exports are forecast to return to prepandemic levels by 2023 and average 316,000 b/d by 2025.

-----

Earlier: