U.S. OIL COMPANIES BANKRUPTCIES

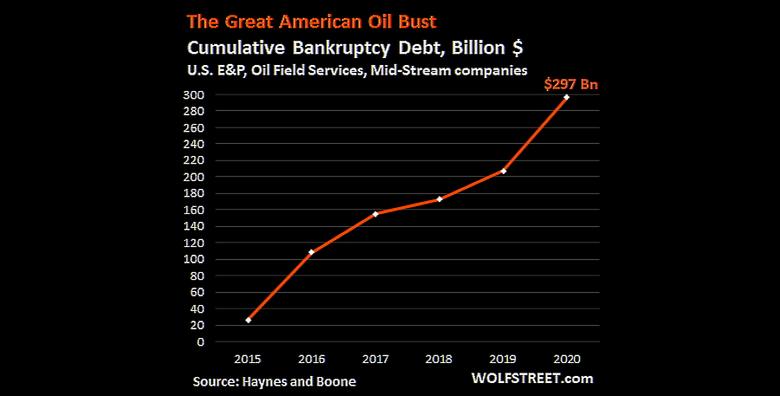

PLATTS - 17 Dec 2020 - A total 45 bankruptcies in the North American E&P patch were filed in 2020, the second-highest number since oil prices abruptly plummeted to the $50/b level six years ago, Haynes & Boone said in a Dec. 17 report.

The international law firm, which has tracked energy bankruptcies since since early-2015, said this year's number was only exceeded by 2016 with 70.

Companies that filed in fourth-quarter 2020 included MD America Energy, Finger Oil & Gas, Onpoint Oil & Gas, Gulfport Energy Corp and Canaan Resources.

While most of those were privately held operators, 2020 saw some of industry's biggest producers file for bankruptcy including Whiting Petroleum in April, Unit Corp in May, Chesapeake Energy in June and Oasis Petroleum in September.

Trailing this year very narrowly in terms of bankruptcies was 2015 with 44. Years 2017 and 2018 were fairly placid, with 24 and 28 respectively. Last year, 42 bankruptcies were filed. Some companies, such as Fieldwood Energy and Chaparral Resources, have filed more than once.

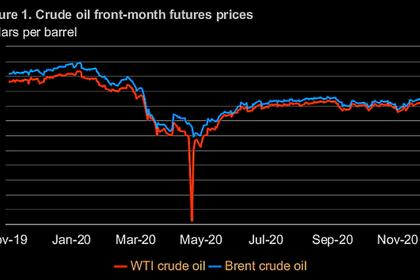

In late 2014, oil prices had been on their way down from levels over $100/b earlier in that year. That November, OPEC refused to restrict oil production which would likely have lifted the price. Instead, the cartel's move left the world awash in excess oil, forcing down crude prices by half and eventually even still lower.

Many oil companies that were hit hard in 2015 from the sudden drop in oil prices to levels not seen in years at the time, were able to hold on initially. But eventually a cash crunch forced them to legally file for protection while restructuring debt, selling assets or offering themselves for sale.

During 2016, WTI oil prices began the year in the $30s/b and even dipped briefly in the $20s/b twice, putting an even larger number of upstream companies which were already coping with a year's worth of relatively low oil prices in a financially precarious position.

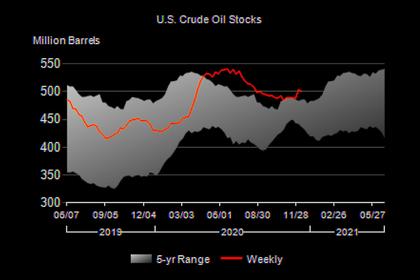

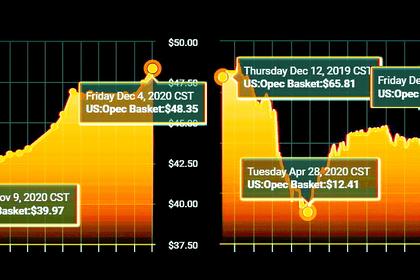

Prices stabilized around the $50/b level in 2017, rose into the $70s/b in 2018, and stayed in the $50/b to $60/b in 2019. As a result, there were a lesser number of bankruptcies. But the coronavirus pandemic earlier this year caused prices to plunge to the $30s/b, then $20s/b, and then the teens.

Since late June they have been around $40/b, and in the last few weeks as a vaccine for the virus began to be distributed, WTI prices have been above $45/b.

NYMEX WTI settled Dec. 17 at $48.44/b, up 62 cents.

----

Earlier: