WORLD SHARES UP

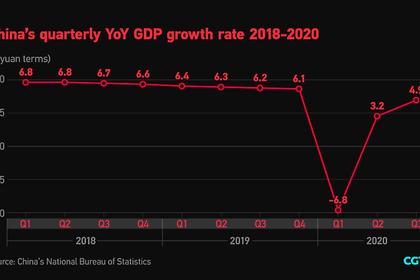

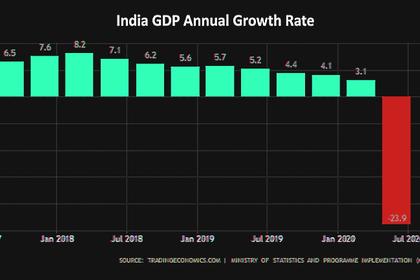

REUTERS - DECEMBER 1, 2020 - World shares edged up to just below record peaks on Tuesday after robust China data boosted expectations of a recovery from the COVID-19 downturn and as drugmakers seek fast approval for their vaccines and authorities look set to keep stimulus support.

Bets of more easing from the Fed in the United States to help the pandemic-hit economy through the winter weighed on the dollar, as riskier currencies rose, while crude prices missed out on the bounce after OPEC+ countries delayed a decision on output cuts.

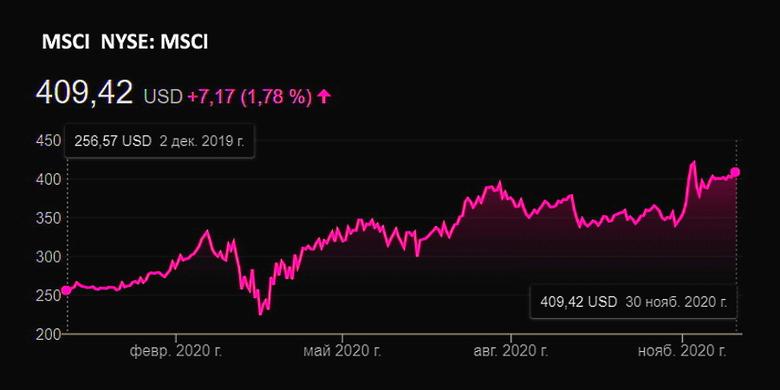

The MSCI world equity index, which tracks shares in 49 countries, was up 0.4% by 0849 GMT.

Breakthroughs in vaccine developments from top drugmakers Pfizer, Moderna and AstraZeneca last month along with a market-friendly outcome of the U.S. presidential election helped the index score its best month on record, up 12% to new all-time peaks.

"We believe the rally can continue, with the current pipeline of expected vaccine rollouts in line with our central scenario of widespread availability in the second quarter of 2021," said Mark Haefele, Chief Investment Officer at UBS Global Wealth Management in Zurich.

"We also believe that a divided U.S. government - which looks the most likely outcome - is no impediment to a rising market," he added.

In Europe the pan-regional STOXX 600 benchmark was up 0.7% in early deals, while U.S. stock index futures also pointed to a strong start on Wall Street with investors focusing on November manufacturing surveys from Europe and the United States.

Earlier the MSCI's broadest index of Asia-Pacific shares outside Japan added 1.3%, while China's blue-chip CSI300 index jumped 2.2% after a business survey showed on Tuesday activity in China's factory sector accelerated at the fastest pace in a decade in November.

Japan's Nikkei rose 1.3% while Australia's S&P/ASX 200 gained 1.1% after Australia's central bank said the country's economy would need fiscal and monetary support "for some time".

"What we are seeing today is that upward trend reasserting itself, given the positive news on the vaccine front, China's growth picking up, and the tremendous faith in the ability of central banks to keep the markets afloat," said Stephen Miller, market strategist for GSFM Funds Management.

Moderna Inc applied for U.S. emergency authorization for its COVID-19 vaccine after full results from a late-stage study showed it was 94.1% effective with no serious safety concerns.

In foreign exchange markets, the dollar was under pressure after closing out its worst month since July with a little bounce and as investors reckon on even more U.S. monetary easing.

The dollar index was last down 0.3% to 91.706.

In a speech released late on Monday, Fed chair Jerome Powell said a slowing recovery and a surging pandemic meant the U.S. was entering a "challenging" few months, with the potential deployment of a vaccine still facing hurdles.

Elsewhere sterling hit a three-month high as traders clung to hopes for a Brexit trade deal before the year's end, while risk-related currencies such as the Canadian and Aussie dollar rose against the greenback.

The U.S. bond market was steady, as the U.S. Congress began a two-week sprint to secure government funding and avoid a possible shutdown amid the coronavirus pandemic.

U.S. 10-year yields were up slightly at 0.8438%.

Germany's benchmark 10-year bond yield hovered near three-week lows, while southern European debt yields kept record lows in sight ahead of next week's European Central Bank meeting.

Germany's Bund yield was a touch lower in early trade at -0.574%, close to Monday's three-week low of -0.60%.

Reflecting the upbeat mood, copper prices rose with Shanghai prices hitting a more than eight-year high, helped by the robust Chinese data.

Oil prices however were slightly lower after leading producers delayed talks on 2021 output policy, while the coronavirus pandemic continued to sap fuel demand.

OPEC+ delayed talks on output policy for next year until Thursday, three sources told Reuters, as key players still disagreed on how much oil they should pump amid weak demand/

Brent crude futures were 0.2% lower at $47.8 a barrel, while U.S. crude also eased back to $45.31.

-----

Earlier: