ANGOLA NEED EXPLORATION

PLATTS - Angola's revamp of its oil and gas regulatory regime is raising hopes of arresting the country's oil output decline, but a return to former heights is likely to be several years away at best, Belarmino Chitangueleca, executive board member of the country's new regulator, the Agency for Oil, Gas and Biofuels, or ANPG, told S&P Global Platts.

In an interview in Florence, Italy, this week, Chitangueleca said the start of production from the Agogo deepwater oil field in January by Italy's Eni, nine months after its discovery, demonstrated the "quick-win opportunities" resulting from recent reforms.

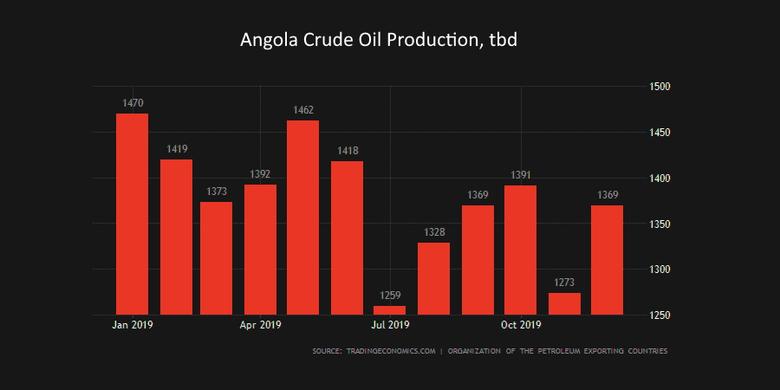

Angola's crude output has fallen from a peak of 1.9 million b/d in 2010 to 1.4 million b/d currently as production from flagship fields, such as Girassol and Pazflor, starts to flag. Currently, producing fields have an average annual decline rate of 10%-15%, Chitangueleca said.

However, the creation of the ANPG in February 2019 in a shake up by President Joao Lourenco, after the 38-year rule of Jose Eduardo dos Santos, removed a number of duties from state oil company Sonangol with the goal of speeding up decision-making in production operations, stimulating exploration, and enabling Sonangol to concentrate on its own operations.

"People were skeptical if this change would work, many [had] tried restructuring before. We think that it is working, and all the majors are happy with that," Chitangueleca said.

He highlighted a new, more flexible licensing system that allows companies to both produce and explore in the same offshore block simultaneously and tie new "marginal" discoveries to existing production facilities. This, he said, had led to Eni's recent run of discoveries.

He also noted a reform that enables international operators to monetize gas, rather than the state owning gas produced in the course of oil operations. Uniquely, Angola's LNG export facility relies on such associated gas rather than dedicated gas fields, but the government now wants to stimulate gas output, both to supply the LNG plant and help meet domestic power demand, he said.

However, a concerted exploration drive is needed if the country is to go beyond "fighting decline," Chitangueleca said. The government now aims to award 50 or more license blocks in successive licensing rounds from 2019 through 2025, while also trying to attract interest in onshore prospects, particularly from independent companies.

"Currently, we don't have big new oil fields to be developed, but we have marginal fields. With the new legislation that gives incentives to develop marginal fields, we should be able to bring new production that may help to arrest decline, but not to increase production immediately," he said.

"Currently, our objective is to maintain this 1.4 million-plus," he said, adding:

"Not only do you need to have good secondary recovery systems working, you also need to bring new production from developing new projects."

He estimated the time needed to get a major discovery into commercial production would typically be five-seven years, meaning that amount of time could be required to get oil output to levels "above 1.5 million or 1.6 million b/d."

Exploration prospects

In the early 2010s, a number of explorers entered Angola to try and make subsalt, or "pre-salt," discoveries analogous to Brazil's, with little success. However, the ANPG still sees promise in subsalt and other underexplored formations, Chitangueleca said.

"Many exploration wells didn't get drilled and our pre-salt was not successful, but we do have plans to go back and rework this geological horizon. Our pre-salt is in a very early stage of research," he said, adding:

"Pre-salt is [one] geological horizon, but to get there you have to pass through others -— you may also find oil before you get to the pre-salt."

On gas prospects, Chitangueleca added that a new international consortium had been formed to ensure gas for the LNG plant by 2022, when it will need new supply sources. The aim is for two new gas developments to be approved this year, he said.

-----

Earlier:

2019, June, 13, 15:45:00

IMF TO ANGOLA $1.24 BLN

Angola’s three-year extended arrangement was approved by the IMF Executive Board on December 7, 2018, in the amount of SDR 2.673 billion (about US$3.7 billion at the time of approval), the equivalent of 361 percent of Angola’s quota

|

2018, December, 29, 13:55:00

IMF FOR ANGOLA: $3.7 BLN

IMF - The oil endowment allowed Angola to rebuild critical infrastructure, and progress has also been achieved in reducing poverty. Still, much remains to be done to reduce the economy’s dependence on oil and its vulnerability to oil price fluctuations so that enough resources can be made available to improve living standards for all the Angolan people.

|

2018, November, 12, 12:00:00

TOTAL'S INVESTMENT TO ANGOLA: $16 BLN

THE LOCAL FRANCE - Angola and French oil giant Total formally launched a major new offshore oil project Saturday to aid the country's economy that plunged into crisis following oil price dips in 2014.

|