CHINA'S CORONAVIRUS: NO AFFECT

REUTERS - FEBRUARY 13, 2020 - The coronavirus epidemic in China has had a marginal impact on energy markets and is unlikely to dramatically affect oil prices even if Chinese demand falls by 500,000 barrels per day, U.S. Energy Secretary Dan Brouillette told Reuters on Thursday.

Brouillette cautioned, however, that there had been some "slowing" of Chinese energy purchases. He said there could be a greater impact if the new virus continued to expand at a rapid pace, affecting flights in and out of the country and hitting China's economy.

"But at this point it's marginal," he said during a visit to Portugal. "If the Chinese market is off by half a million barrels, that is 0.5% of total market, we are not going to see that impact on pricing very dramatically."

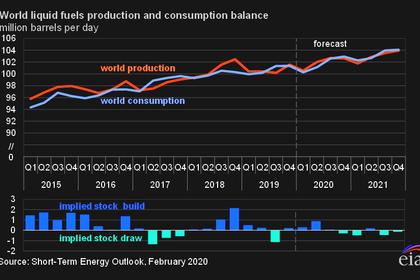

Oil demand is set to fall by 435,000 bpd this quarter, in its first decrease since the financial crisis in 2009 due to the coronavirus outbreak in China, the International Energy Agency (IEA) said on Thursday.

Analysts' estimates over the hit to global demand from the virus range from 0.2% to over 1%.

Asked about these estimates, Brouillette said "a 1% decrease in consumption worldwide is significant, but it is not material at this point of time".

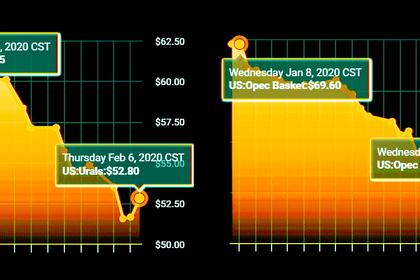

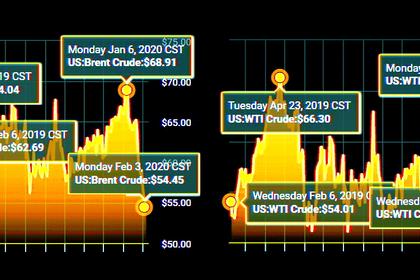

He cited relatively small price movements after recent events such as a drone attack on Saudi oil facilities last September.

"Had that happened 10 years ago, 12 years ago, we would have seen prices spike real high," he added.

Asked about U.S. policies regarding climate change, Brouillette said the administration wanted to develop technologies to allow large wind and solar plants to feed electricity non-stop into the power grid, which should also be equipped with "grid-scale" battery storage.

"If we can reach that, then I think we'll achieve, at an even faster pace, some of the climate goals we all seek to achieve," he said.

Brouillette added, though, that the United States would still seek to develop all energy resources, from zero-emission energy to nuclear power and fossil fuels.

"That diversity brings not only strength, but lower pricing to the market as well. If the consumers have those types of options they get better pricing and we get better result on the climate issues that we all care about as well."

He said his discussions with various European countries had focused on developing infrastructure for U.S. natural gas exports - such as a pipeline connecting Spain and France - and renewable technologies.

-----

Earlier: