GCC RENEWABLE INVESTMENT $10 TLN

PLATTS - The power companies from the Gulf Cooperation Council nations are planning to further invest in the global $10 trillion renewables market, expanding outside their region as demand for cleaner energy gathers pace around the world.

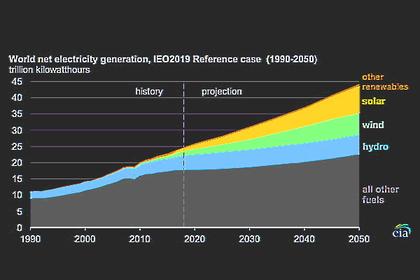

The renewables space, where the International Energy Agency projects investments to reach around $10 trillion by 2040, is attracting GCC power companies which were until recently focused on a region just waking up to the potential of clean energy.

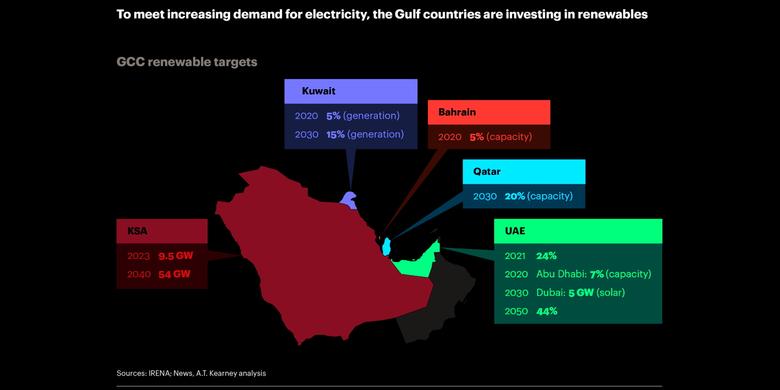

The GCC nations include Bahrain, Kuwait, Oman, Qatar, Saudi Arabia and the UAE.

The gulf countries, some of which burn crude for power generation, are focusing more on gas and renewable energy to free crude for export.

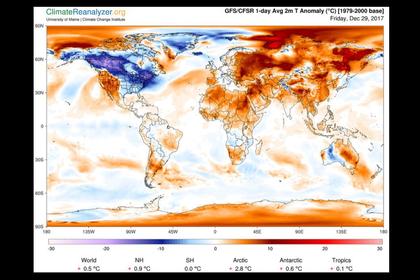

The gulf region could save 354 million barrels of oil equivalent from adopting renewable energy by 2030, according to a 2019 study from the Abu Dhabi-based International Renewable Energy Agency.

But now, greater investments globally in renewables is whetting the gulf power companies' appetite.

Quadrupling in size

ACWA Power, the company in which Saudi Arabia's sovereign wealth fund has a 25% stake, and Masdar, Abu Dhabi's clean energy firm that is a unit of Mubadala Investment Co, a fund managing about $230 billion in assets, are leading the regional foray into global renewable markets.

ACWA is aiming to more than quadruple its size in the next decade, with a greater focus on renewables. Currently, ACWA has 31 GW of installed power capacity, 4.6 GW of which is based on renewable energy in seven countries out of the 12 it operates in.

"By 2030 we are looking to be a company with about 150 GW of contracted capacity, 15 million cubic meters per day of desalinated water," Paddy Padmanathan, CEO of ACWA Power, told S&P Global Platts in an interview. "In terms of value of assets, we expect to be in excess of $200 billion, quadrupling our size in the next decade. Out of the 150 GW, I would be surprised if renewables is not at least 100 GW."

ACWA, whose portfolio is worth over $45 billion, is looking to invest $10 billion this year in new installed capacity, with about $7 billion in renewables. Just four years ago, renewables investments were about 50% of the total.

ACWA is developing renewable projects in Saudi Arabia, the UAE, Vietnam, South Africa, Morocco, Egypt, and Jordan and plans to expand fast in Africa and Asia.

It expects to enter into Azerbaijan, Uzbekistan and Indonesia this year and Cambodia, Philippines, and Myanmar in the next few years.

"We want to maintain a balanced overall business: 50 Saudi Arabia, 50 outside Saudi Arabia. In order to balance that we will continue to grow geographically elsewhere as part of our global portfolio," said Padmanathan.

Double-digit growth

In the UAE, Masdar is expanding fast and is counting on global demand for clean energy to help it continue its double-digit revenue growth. Currently the company has 5 GW of installed capacity of renewable power, representing $14 billion in gross investments.

"Our growth trajectory year-on-year has been double-digit growth in terms of capacity and revenues, they are aligned," Mohamed al-Ramahi, CEO of Masdar, told Platts.

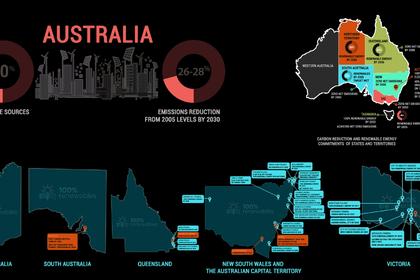

Its portfolio spans more than 25 countries, from Saudi Arabia, where it is developing the country's first wind project, to Australia, where it acquired a 40% stake in a waste-to-energy project for A$511 million.

"Current installed capacity is split between major primary markets, our region led by GCC and Northern Europe, which are the main markets we have invested in 10 years ago," said Ramahi.

"The largest growth in the future we are anticipating is from our region and North America because the US is the second largest renewable energy market tin the world and there is huge growth in the US and you have the GCC."

In the UK, Masdar has a 35% stake in Dudgeon wind farm, a 20% stake in the offshore London Array wind farm and a 25% interest in floating wind project Hywind Scotland.

"Northern Europe, particularly the UK will also be a primary region for us and we will continue growing there particularly in the offshore wind business," said Ramahi.

"Indonesia is a stepping stone into Southeast Asia, the opportunity is huge in Indonesia and Malaysia and hopefully we will see more projects spearheaded by Indonesia."

Regional growth

However, the power companies' global ambitions will not detract from their focus on the Gulf region, which is speeding up renewable projects.

Saudi Arabia launched the National Renewable Energy Program, which aims to boost the share of renewable energy in the total energy mix, targeting the generation of 27.3 GW of renewable energy by 2024 and 58.7 GW by 2030.

Meanwhile, the UAE, where currently power is mostly generated from gas, aims to produce 44% of its power from clean energy by 2050.

"There is no other country in the world that can give that much volume and opportunity that Saudi is giving in short to medium term, in terms for renewables and everything else," said Padmanathan.

-----

Earlier: