OIL DEMAND GROWTH DOWN TO 825 KBD

IEA - Oil Market Report - February 2020

Highlights

- Global oil demand has been hit hard by the novel coronavirus (Covid-19) and the widespread shutdown of China’s economy. Demand is now expected to fall by 435 kb/d y-o-y in 1Q20, the first quarterly contraction in more than 10 years. We have cut our 2020 growth forecast by 365 kb/d to 825 kb/d, the lowest since 2011. Lower-than-expected consumption in the OECD trimmed 2019 growth to 885 kb/d.

- The coronavirus outbreak has also led us to revise down the outlook for global refinery runs. Chinese crude throughputs for 1Q20 have been cut by 1.1 mb/d and are now expected to contract by 0.5 mb/d year-on-year. As a result, global runs are forecast to expand by just 0.7 mb/d in 2020. The launch of IMO’s new bunker fuel regulations in January boosted simple refining margins based on sweet crudes.

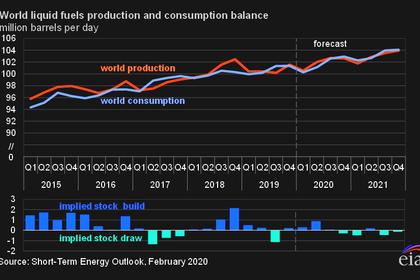

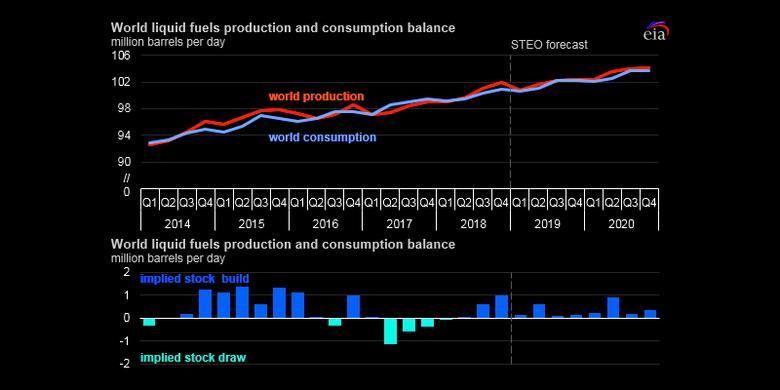

- Global oil supply slumped by 0.8 mb/d in January to 100.5 mb/d. A blockade in Libya slashed production and the UAE saw output fall by 0.3 mb/d. World oil output was largely unchanged on a year ago as lower supply from OPEC was offset by a 2.1 mb/d increase in non-OPEC production. The call on OPEC crude plunges to 27.2 mb/d in 1Q20, which is 1.7 mb/d below the group’s January production of 28.86 mb/d.

- OECD industry stocks held largely steady in December at 2 915 mb as a build in product inventories more than offset lower crude holdings. Total oil stocks stood 26.4 mb above the five-year average and covered 61 days of forward demand. Preliminary data for January show inventories building in the US and Japan while falling in Europe. Short-term floating storage of crude oil built 7.7 mb in January to 76.2 mb, most of which is Iranian oil.

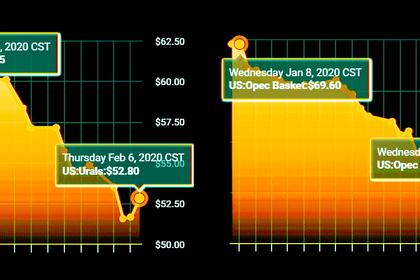

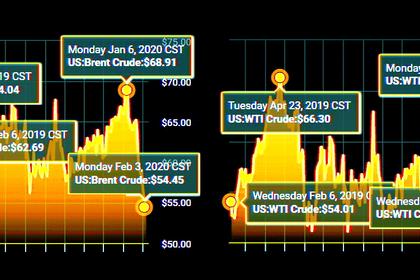

- Crude oil futures tumbled by $10/bbl during January in anticipation of a negative impact on demand from Covid-19. The price of grades from the Middle East, North Sea and West Africa, popular with Chinese refiners, fell while the Libyan outage was supportive for alternative crudes from Algeria and Azerbaijan. The coronavirus also weighed on product cracks, in particular jet/kerosene, although reports of Chinese run cuts provided support.

All eyes on China

The novel coronavirus (Covid-19) is a major global public health emergency that has brought tragedy to many lives. Its impact is still unfolding globally. There is already a major slowdown in oil consumption and the wider economy in China. While the SARS epidemic of 2003 is widely used as a reference point for analysis of Covid-19, China has changed enormously since then. Today, it is central to global supply chains and there has been an enormous increase in travel to and from the country, thus heightening the risk of the virus spreading. In 2003, China's oil demand was 5.7 mb/d and by 2019 it had more than doubled to 13.7 mb/d (14% of the global total). Moreover, last year China accounted for more than three-quarters of global oil demand growth.

The consequences of Covid-19 for global oil demand will be significant. Demand is now expected to contract by 435 kb/d in 1Q20, the first quarterly decrease in more than a decade. For 2020 as a whole, we have reduced our global growth forecast by 365 kb/d to 825 kb/d, the lowest since 2011. Growth in 2019 has been trimmed by 80 kb/d to 885 kb/d on lower-than-expected consumption in the OECD.

The impact of Covid-19 for oil prices have been sharp: Brent values fell by about $10/bbl, or 20%, to below $55/bbl. Before Covid-19 came along, the market was already nervous in anticipation of a supply overhang of 1 mb/d in the first half of 2020 due to continued expansion in the US, Brazil, Canada, and Norway. Even threats to security of supply, e.g. tension in Iraq, a 1 mb/d fall in Libyan oil production, and force majeure declared for some Nigerian cargoes, had little impact on prices. Now that the demand outlook has weakened, prices have moved significantly down.

From the point of view of the producers, before the Covid-19 crisis the market was expected to move towards balance in the second half of 2020 due to a combination of the production cuts implemented at the start of the year, stronger demand and a tailing off of non-OPEC supply growth. Now, the risk posed by the Covid-19 crisis has prompted the OPEC+ countries to consider an additional cut to oil production of 0.6 mb/d as an emergency measure on top of the 1.7 mb/d already pledged. Lower oil prices, if sustained, are also bad news for highly responsive US oil companies, but we are unlikely to see an impact on output growth until later in the year. The effect of the Covid-19 crisis on the wider economy means that it will be difficult for consumers to feel the benefit of lower oil prices.

The next edition of this Report on 9 March will be shorter and earlier than usual. It will be published on the same day as our annual five-year outlook: "Oil 2020 – Analysis and Forecast to 2025". We hope that by that time, the Covid-19 crisis will have abated.

-----

Earlier: