РЫНОК НЕФТИ: НИЧЕГО СРОЧНОГО

ПРАЙМ - 20 Февраля 2020 - Россия находится в контакте с коллегами по ОПЕК+ по вопросу дальнейших действий в рамках сделки, ситуация на рынке неопределенная, быстро меняется, и анонсировать что-либо пока не стоит, сообщил журналистам глава Минэнерго Александр Новак.

"Мы находимся в контактах с нашими коллегами из других стран, обсуждаем ситуацию. Я вчера разговаривал с министром Саудовской Аравии, мы обсуждали текущую ситуацию на рынке, прогнозы, которые делают различные эксперты, аналитические агентства. Мы пока находимся в дискуссии", — сказал Новак, отвечая на вопрос о том, готова ли Россия поддержать коллег по ОПЕК+.

Он не стал говорить о тех предложениях, с которыми Россия может выйти на встречу.

"Мы обсуждаем. Давайте мы не будем вам анонсировать, у нас для этого еще есть две недели. Мы будем смотреть, как дальше будет развиваться ситуация, что будет на рынке происходить, какие прогнозы (будут — ред.) к этому времени. Ситуация достаточно неопределенная и очень быстро меняется... Все прогнозировали, что все будет падать, а цены — 59 (долларов за баррель — ред.) уже, видите. Они выросли почти на 10% от нижнего (уровня)", — подчеркнул министр.

"Если говорить о сроках встречи, то, наверное, общее сейчас понимание, что переносить на более ранние сроки уже нет целесообразности. То есть та встреча, которая была запланирована, 4 марта — JMMC (министерский мониторинговый комитет — ред.), 6 марта — встреча ОПЕК+. На мой взгляд, она в эти сроки и должна состояться. Но опять же — это мое мнение. Осталось две недели, ничего нет такого чрезвычайного, чтобы переносить сроки", — добавил Новак.

-----

OIL MARKET: NOTHING URGENT

PLATTS - 20 Feb 2020 - Russia is in no rush to announce its position on additional cuts proposed by OPEC, as nothing urgent is happening in the oil market and there are two more weeks until the scheduled OPEC, non-OPEC ministerial meeting, energy minister Alexander Novak said Thursday.

Plans for an earlier, mid-February meeting to mitigate a drop in oil prices caused by the coronavirus outbreak were formally canceled late Wednesday as Russia, among other countries, was not convinced of the need to deepen production cuts as proposed by an OPEC+ advisory committee.

"We are discussing, we still have two weeks to announce [our position]. We will see how the situation develops, what happens in the market, and what the forecasts are by this time," Novak was quoted by Prime news agency as telling reporters.

He noted that the situation with the spreading coronavirus and its impact on oil market remained "pretty uncertain" and was "changing rapidly," contradicting previous forecasts.

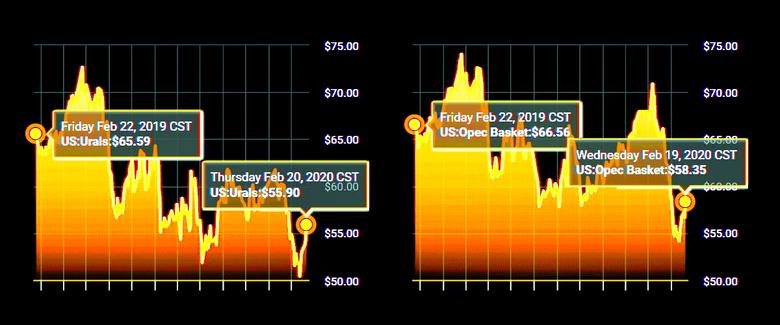

"Everyone predicted that prices would fall, but prices are at $59/b already, you see. They recovered by almost 10%," the minister added.

Despite the partial recovery, oil prices are still far below the level many OPEC members need for their budgets to balance.

Novak also argued that there was "nothing extraordinary to bring forward the date" of the OPEC, non-OPEC ministerial meeting in contrast to Saudi energy minister Prince Abdulaziz bin Salman's comment that "there is a fire in the house."

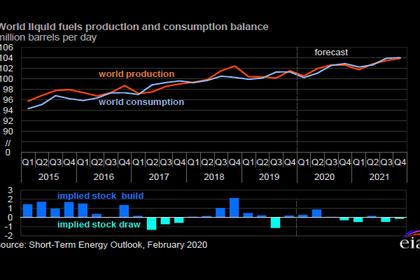

A technical committee of OPEC + delegates on February 7 recommended that the 23-country coalition deepen its existing 1.7 million b/d production cut accord by 600,000 b/d through the end of the second quarter to offset any demand impact from the infection.

OPEC and its allies are next scheduled to meet in Vienna on March 5-6 to decide on the future of their agreement on production cuts that expires in April.

-----

Earlier:

2020, February, 19, 12:00:00

OIL PRICE: ABOVE $58

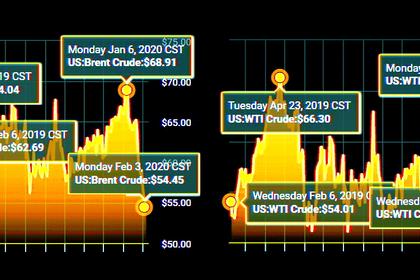

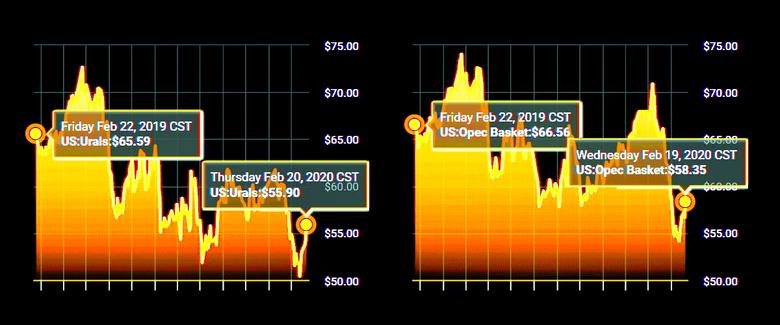

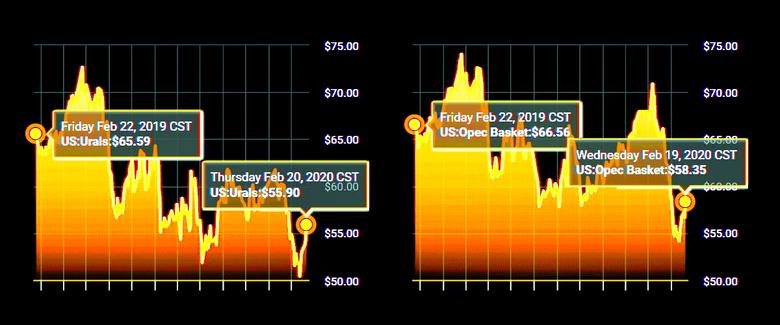

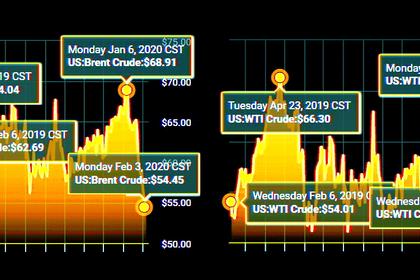

Brent was up by 51 cents, or 0.9%, at $58.26 a barrel, WTI was up 55 cents, or 1.1%, at $52.60 a barrel.

2020, February, 19, 11:55:00

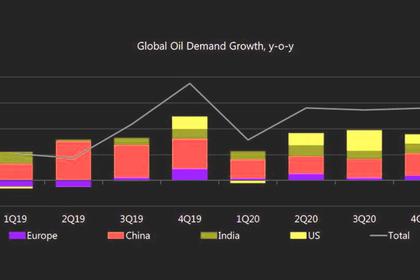

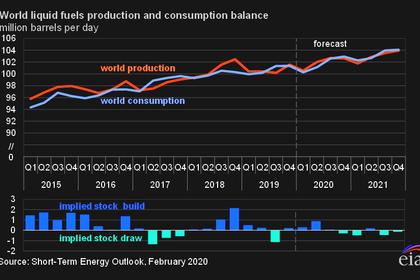

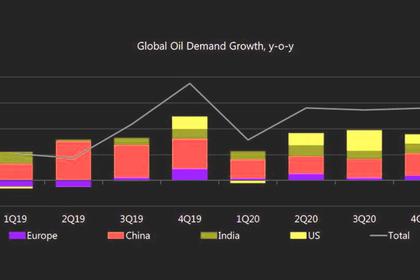

GLOBAL OIL DEMAND 2020: 100.73 MBD

Oil demand growth in 2020 is revised down by 0.23 mb/d from the previous month’s assessment. With this, global oil demand is now forecast to grow by 0.99 mb/d and average 100.73 mb/d for 2020,

2020, February, 19, 11:50:00

GLOBAL PETROLEUM DEMAND WILL UP BY 1.0 MBD

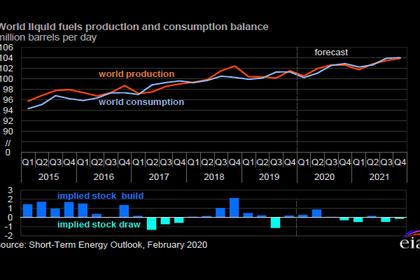

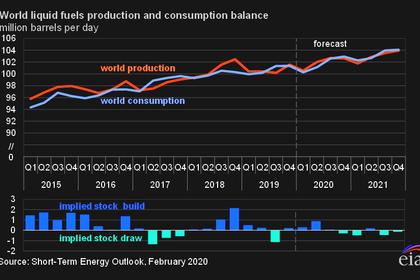

EIA now expects global petroleum and liquid fuels demand will rise by 1.0 million b/d in 2020, which is lower than the forecast increase in the January STEO of 1.3 million b/d in 2020, and by 1.5 million b/d in 2021.

2020, February, 14, 12:10:00

CHINA'S CORONAVIRUS: NO AFFECT

The coronavirus epidemic in China has had a marginal impact on energy markets and is unlikely to dramatically affect oil prices even if Chinese demand falls by 500,000 barrels per day, U.S. Energy Secretary Dan Brouillette told

2020, February, 12, 12:12:00

OIL PRICES 2020-21: $61-68

EIA forecasts Brent prices will average $61/b in 2020; with prices averaging $58/b during the first half of the year and $64/b during the second half of the year. EIA forecasts the average Brent prices will rise to an average of $68/b in 2021.

2020, February, 5, 11:25:00

OIL MARKET: WITHOUT A PANIC

"Any overreaction...is not in the interest of the general public, let alone the oil market. We have the consensus that we would not like to see this."

All Publications »

Tags:

OIL,

PRICE,

BRENT,

WTI,

OPEC,

RUSSIA