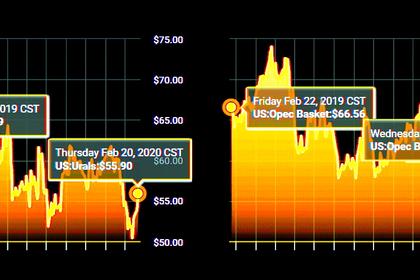

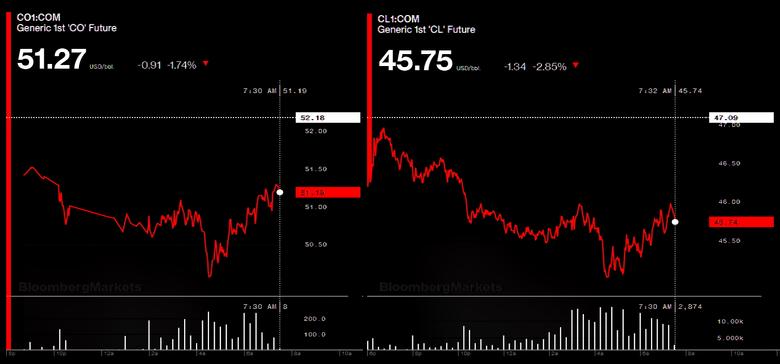

OIL PRICE: NEAR $51

REUTERS - FEBRUARY 28, 2020 - Oil prices slumped to their lowest in more than a year on Friday and were set for their steepest weekly fall in four years as the global spread of the coronavirus stokes demand fears.

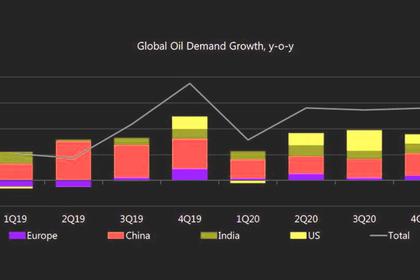

Investors are increasingly worried about an economic slowdown weighing on oil demand as the virus spreads beyond its epicentre in China to more than 40 other countries.

The most active Brent crude contract for May LCOc2 was down $1.74, or 3.3%, at $49.99 a barrel by 0959, its lowest since July 2017. The front-month contract, which fell to a session low of $50.05 and is headed for its biggest weekly fall since January 2016, expires later on Friday.

West Texas Intermediate (WTI) crude futures CLc1 fell $1.89, or about 4%, to $45.20. U.S. crude has fallen about 15% this week, representing the sharpest weekly decline since December 2008.

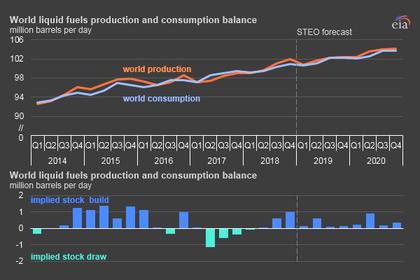

"While oil prices are expected to remain volatile in the near term, we expect Brent crude oil to recover to $64 a barrel (in the second half of 2020) as the economic recovery, slowing U.S. oil production growth and additional OPEC production cuts tighten the oil market," UBS analysts said in a note.

Oil was not the only market to slump. Coronavirus panic also sent global stock markets tumbling, compounding their worst week since the 2008 global financial crisis with losses amounting to $5 trillion.

Mainland China reported 327 new coronavirus cases, the lowest since Jan. 23, taking its total to more than 78,800 cases with almost 2,800 deaths. But as the outbreak eases in China it is surging elsewhere.

Four more countries reported their first cases, taking the number of affected countries and territories outside China to 55, with more than 4,200 cases and about 70 deaths.

Benchmark Brent crude's slump of about 13% this week is likely to focus minds when the Organization of the Petroleum Exporting Countries and allies including Russia, collectively known as OPEC+, meets next week to discuss output.

"Brent crude under $50 a barrel will be a nightmare scenario for OPEC and may well provoke a ... response of some kind from the core grouping," said Jeffrey Halley, senior market analyst at brokerage OANDA.

Oil markets have their eyes peeled for deeper supply cuts from the producer group.

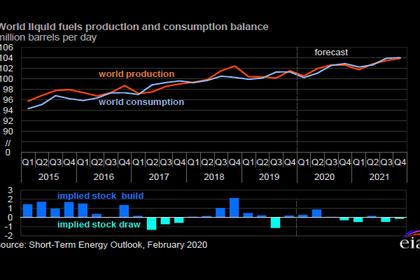

An OPEC+ committee this month recommended the group deepen its output cuts by an additional 600,000 barrels per day (bpd), but the coronavirus has spread more widely since then.

OPEC+, which is currently reducing output by roughly 1.7 million bpd to support prices, is due to meet in Vienna over March 5-6.

Saudi Arabia, which said it would continue to engage with Russia on oil policy, is reducing crude supplies to China in March by at least 500,000 bpd owing to slower refinery demand.

-----

Earlier: