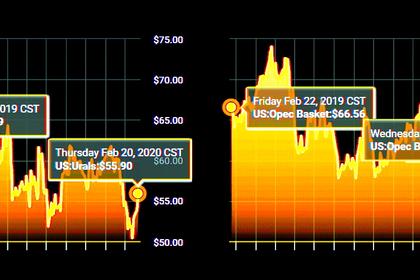

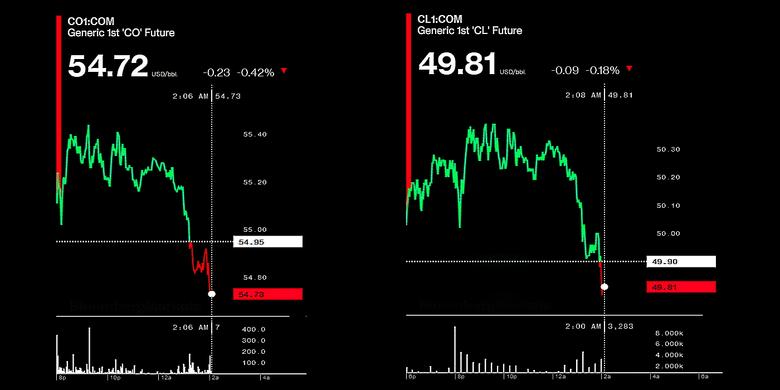

OIL PRICE: NEAR $55

REUTERS - FEBRUARY 26, 2020 - Crude prices inched higher on Wednesday as investors covered short positions after three sessions of losses and eyed potential supply cuts, even as fears of a coronavirus pandemic deepened.

Brent crude rose 33 cents, or 0.6%, to $55.28 a barrel by 0513 GMT, while U.S. West Texas Intermediate crude gained 41 cents, or 0.8%, to $50.31 a barrel. Still, prices are down nearly 7% since last Thursday's close.

Fears of a pandemic escalated as authorities around the world battled to prevent the spread of coronavirus, which has now been found in about 30 countries.

Asian shares fell on Wednesday as a U.S. warning to Americans to prepare for the possibility of a coronavirus pandemic drove another Wall Street tumble and pushed yields on safe-haven Treasuries to record lows.

"Investors unwound short positions after WTI dipped below a key support level of $50, as they have done a few times earlier this month," said Hideshi Matsunaga, analyst at Sunward Trading.

"The reduction in Libya's output and expectations for additional production cuts by the Organization of the Petroleum Exporting Countries (OPEC) and OPEC+ are also lending support," he said.

Oil output in Libya has fallen sharply since Jan. 18 because of a blockade of ports and oil fields by groups loyal to eastern-based commander Khalifa Haftar.

OPEC and its allies including Russia, a grouping known as OPEC+, are due to meet in Vienna over March 5-6.

"A weekly close below $55.00 a barrel on Brent crude will have the alarm bells ringing amongst the OPEC+ grouping," Jeffrey Halley, senior market analyst at OANDA said in a note.

"Some sort of price stabilization measures is inevitable should Brent crude prices continue falling," he added.

Saudi Arabia's energy minister said on Tuesday he was confident that OPEC and its partners would respond responsibly to the spread of the coronavirus.

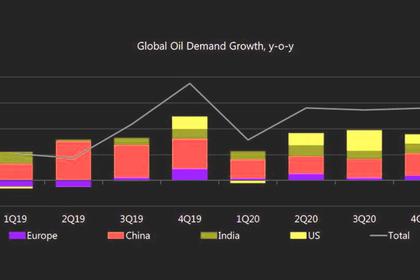

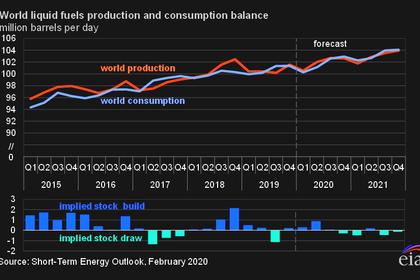

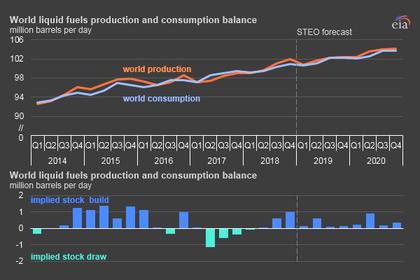

The International Energy Agency's (IEA) outlook on global oil demand growth has fallen to its lowest level in a decade, IEA Executive Director Fatih Birol said on Tuesday, adding it could be reduced further due to the coronavirus outbreak.

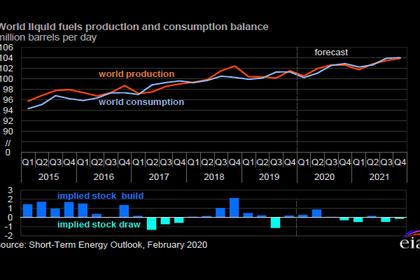

U.S. crude inventories are expected to rise for a fifth week running. The American Petroleum Institute (API) said late Tuesday that crude stockpiles rose 1.3 million barrels last week. Government data due at 10:30 a.m. EST (1530 GMT) on Wednesday was expected to show a 2 million-barrel rise, according to a Reuters poll.

-----

Earlier: