2020-02-12 12:12:00

OIL PRICES 2020-21: $61-68

U.S. EIA - February 11, 2020 - SHORT-TERM ENERGY OUTLOOK

Forecast Highlights

Global liquid fuels

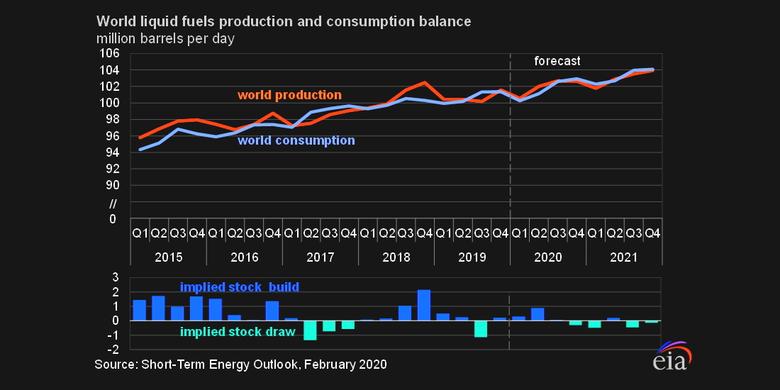

- EIA expects global petroleum and liquid fuels demand will average 100.3 million barrels per day (b/d) in the first quarter of 2020. This demand level is 0.9 million b/d less than forecast in the January STEO and reflects both the effects of the coronavirus and warmer-than-normal January temperatures across much of the northern hemisphere. EIA now expects global petroleum and liquid fuels demand will rise by 1.0 million b/d in 2020, which is lower than the forecast increase in the January STEO of 1.3 million b/d in 2020, and by 1.5 million b/d in 2021.

- EIA’s global petroleum and liquid fuels supply forecast assumes that the Organization of the Petroleum Exporting Countries (OPEC) will reduce crude oil production by 0.5 million b/d from March through May because of lower expected global oil demand in early 2020. This OPEC reduction is in addition to the cuts announced at the group’s December 2019 meeting. EIA now forecasts OPEC crude oil production will average 28.9 million b/d in 2020, which is 0.3 million less than forecast in the January STEO. In addition to these production cuts, EIA’s lower forecast OPEC production reflects ongoing crude oil production outages in Libya during the first quarter. In general, EIA assumes that OPEC will limit production through all of 2020 and 2021 to target relatively balanced global oil markets.

- Global liquid fuels inventories fell by roughly 0.1 million b/d in 2019, and EIA expects they will grow by 0.2 million b/d in 2020. Although EIA expects inventories to rise overall in 2020, EIA forecasts inventories will build by 0.6 million b/d in the first half of the year because of slow oil demand growth and strong non-OPEC oil supply growth. Firmer demand growth as the global economy strengthens and slower supply growth later in the year contribute to forecast inventory draws of 0.1 million b/d in the second half of 2020. EIA expects global liquid fuels inventories will decline by 0.2 million b/d in 2021.

- Brent crude oil spot prices averaged $64 per barrel (b) in January, down $4/b from December. Brent prices fell steadily through January and into the first week of February, closing at less than $54/b on February 4, the lowest price since December 2018, reflecting market concerns about oil demand. EIA forecasts Brent prices will average $61/b in 2020; with prices averaging $58/b during the first half of the year and $64/b during the second half of the year. EIA forecasts the average Brent prices will rise to an average of $68/b in 2021.

Natural gas

- In January, the Henry Hub natural gas spot price averaged $2.02 per million British thermal units (MMBtu), as warm weather contributed to below-average inventory withdrawals and put downward pressure on natural gas prices. As of February 6, the Henry Hub spot price had fallen to $1.86/MMBtu, and EIA expects prices will remain below $2.00/MMBtu in February and March. EIA forecasts that prices will rise in the second quarter of 2020, as U.S. natural gas production declines and natural gas use for power generation increases the demand for gas. EIA expects prices to average $2.36/MMBtu in the third quarter of 2020. EIA forecasts that Henry Hub natural gas spot prices will average $2.21/MMBtu in 2020. EIA expects that natural gas prices will then increase in 2021, reaching an annual average of $2.53/MMBtu.

- U.S. dry natural gas production set a record in 2019, averaging 92.1 billion cubic feet per day (Bcf/d). Although EIA forecasts dry natural gas production will average 94.2 Bcf/d in 2020, a 2% increase from 2019, EIA expects monthly production to generally decline through 2020, falling from an estimated 95.4 Bcf/d in January to 92.5 Bcf/d in December. The falling production mostly occurs in the Appalachian and Permian regions. In the Appalachia region, low natural gas prices are discouraging natural gas-directed drilling, and in the Permian, low oil prices are expected to reduce associated gas output from oil-directed wells. In 2021, EIA forecasts dry natural gas production to stabilize near December 2020 levels at an annual average of 92.6 Bcf/d, a 2% decline from 2020, which would be the first decline in annual average natural gas production since 2016.

- EIA estimates that U.S. working natural gas inventories ended January at more than 2.6 trillion cubic feet (Tcf), 9% higher than the five-year (2015–19) average. EIA forecasts that total working inventories will end March at almost 2.0 Tcf, 14% higher than the five-year average. In the forecast, inventories rise by a total of 2.1 Tcf during the April through October injection season to reach almost 4.1 Tcf on October 31, which would be the highest end-of-October inventory level on record.

Electricity, coal, renewables, and emissions

- EIA expects the share of U.S. utility-scale electricity generation from natural gas-fired power plants will remain relatively steady; it was 37% in 2019, and EIA forecasts it will be 38% in 2020 and 37% in 2021. Electricity generation from renewable energy sources will rise from a share of 17% last year to 20% in 2020 and 21% in 2021. The increase in the renewables share is the result of expected use of additions to wind and solar generating capacity. Coal’s forecast share of electricity generation will fall from 24% in 2019 to 21% in both 2020 and 2021. The nuclear share of generation, which averaged slightly more than 20% in 2019 will be slightly lower than 20% by 2021, consistent with upcoming reactor retirements.

- EIA forecasts that U.S. coal production will total 595 million short tons (MMst) in 2020, down 95 MMst (14%) from 2019. Lower production reflects declining demand for coal in the electric power sector and lower demand for U.S. exports. EIA forecasts that electric power sector demand for coal will fall by 81 MMst (15%) in 2020. EIA expects that coal production will stabilize in 2021 as export demand stabilizes and U.S. power sector demand for coal increases because of rising natural gas prices.

- After decreasing by 2.3% in 2019, EIA forecasts that energy-related carbon dioxide (CO2) emissions will decrease by 2.7% in 2020 and by 0.5% in 2021. Declining emissions in 2020 reflect forecast declines in total U.S. energy consumption because of increases in energy efficiency and weather effects, particularly as a result of warmer-than-normal January temperatures. A forecast return to normal temperatures in 2021 results in a slowing decline in emissions. Energy-related CO2 emissions are sensitive to changes in weather, economic growth, energy prices, and fuel mix.

-----

Earlier:

2020, February, 10, 10:50:00

OIL PRICE: ABOVE $54

Brent crude futures gave up losses to be up 17 cents at $54.64 a barrel while U.S. crude futures added 8 cents to $50.4 a barrel.

2020, February, 7, 11:05:00

OPEC+ : 600 TBD

The Russian delay is sure to frustrate OPEC kingpin Saudi Arabia, which had called for the collective to immediately implement deeper cuts of 500,000 b/d or more amid the sell-off in crude prices.

2020, February, 5, 11:30:00

OIL PRICE: ABOVE $54

Brent were up 31 cents, or 0.6%, to $54.27 a barrel, WTI were up 21 cents or 0.4% to $49.82 a barrel

2020, February, 5, 11:25:00

OIL MARKET: WITHOUT A PANIC

"Any overreaction...is not in the interest of the general public, let alone the oil market. We have the consensus that we would not like to see this."