RUSSIA, SAUDI ARABIA READINESS

PLATTS - 03 Feb 2020 - Saudi Arabia and Russia are ready for "further coordination of actions" to ensure the stability of the global oil markets as oil prices have plunged amid concerns that the coronavirus will sap oil demand in the world's largest crude oil importer China.

Russian President Vladimir Putin and Saudi King Salman bin Abdulaziz "thoroughly discussed" the current oil market conditions as prices have fallen by more than 20% in the past three weeks amid global oil demand concerns, a Kremlin statement said late Monday.

"Both sides confirmed their readiness for further coordination of actions in the OPEC plus format to ensure stability of the global oil market," the statement added. "It was agreed to continue contacts at various levels."

OPEC+ is the middle of a deal cutting 1.7 million b/d from combined output, up from 1.2 million b/d last year, which runs until the end of March. The group is expected to slash output a further 500,000-1 million b/d, but any upward price movement is likely to be muted until there are signs that the corona virus outbreak is under control.

The crude from OPEC+ is very exposed to the coronavirus outbreak in China China buys more than 70% of its crude from OPEC and its allies, making demand destruction caused by the spread of the virus critical for the cartel.

TECHNICAL MEETING

This statement comes ahead of a technical committee of the 23-member OPEC+ coalition which is set to meet Tuesday and Wednesday in Vienna to assess the impact of the epidemic on oil demand.They are expected to discuss whether to bring forward a ministerial meeting currently scheduled for March 5-6, according to OPEC sources.

One OPEC source said the meeting will try to assess the expected impact of the coronavirus on oil demand and decide on what action to take.

The Joint Technical Committee is co-chaired by delegates from Saudi Arabia and non-OPEC Russia. It is typically tasked with reviewing compliance with the coalition's production quotas and analyzing market conditions.

The OPEC+ coalition deepened its production cuts to 1.7 million b/d starting January 1, up from a 1.2 million cut last year, as part of a deal reached in December. The new deal runs to the end of March.

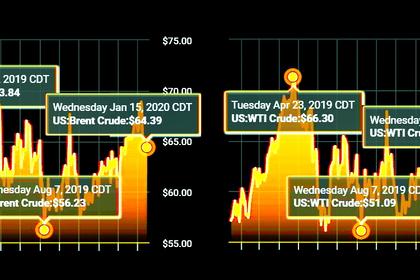

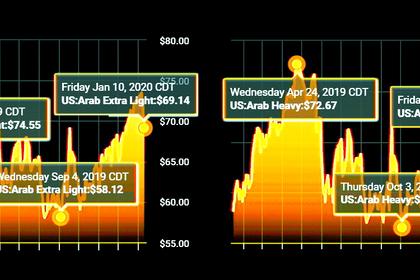

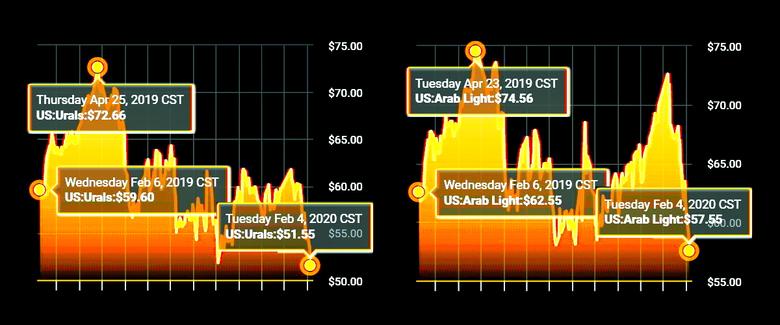

Oil prices slumped sharply on Monday as the coronavirus is expected to significantly weigh on China's economic outlook.

ICE April Brent slid to a one year low of $54.27/b while NYMEX March WTI briefly fell below $50/b.

The outbreak is expected to blunt global oil demand by at least 900,000 b/d in February and 650,000 b/d in March, according to S&P Global Platts Analytics. In a worst-case scenario involving travel curtailments, demand could drop by up 2.6 million b/d in February and 2 million b/d in March.

-----

Earlier: