RUSSIA'S COAL FOR ASIA

PLATTS - 20 Feb 2020 - Asian markets are seeking Russian coals, Katerina Bosov, commercial director of Sibanthracite group said in an interview with S&P Global Platts on Wednesday, but limited railing capacity has hampered Russian coal exports to these markets.

To resolve this limitation, Russia's Sibanthracite group aims to boost the annual export capacity of Russian coals to 100 million mt with newly launched infrastructure project to build the second tunnel on Baikal Amur Mainline railway.

It will be the second tunnel on the 4,264 km-long Baikal-Amur Mainline, or BAM, railway, which stretches from Taishet in Eastern Siberia to Vanino in the Russian Far East, where it links to Asian markets.

"The infrastructure and logistics have limited our export capacity to meet growing demand in Asia, and we decided to tackle this problem by initiating the project in 2019, to build the second tunnel in cooperation with Russian Railway," Bosov said.

"It will be a collective benefit not only for us, but for other coal companies in Russia. Once completed, we will increase the country's export capacity from 16 million mt to 100 million mt," Bosov added.

Increase in PCI production to meet needs

Sibanthracite group's main products consists of anthracite, pulverized coal injection, or PCI, and a small amount of thermal coal, according to information on its website.

While the flagship product is their anthracite coal, Sibanthracite had entered the PCI market last year and found a steady demand for this metallurgical coal.

"We have plans to enter the PCI market, and this year we target 3 million mt of PCI production," Bosov said, adding that they will price their coal off Platts Low Vol PCI FOB Australia index.

Spot supply of PCI has been scarce in recent years with few new projects coming online, and much of the PCI volumes have been sold on long term contracts to users in Japan, South Korea, Taiwan and India. However, the slow down in European steel markets last year had resulted in Russian PCI flowing into the Asian market, putting pressure on Australian PCI prices.

Sibanthracite's ongoing mining projects is set to expand its production capacity, providing the group with "the opportunity to double total production in five years to 50 million mt," Bosov said.

Uncertainties ahead with the coronavirus outbreak

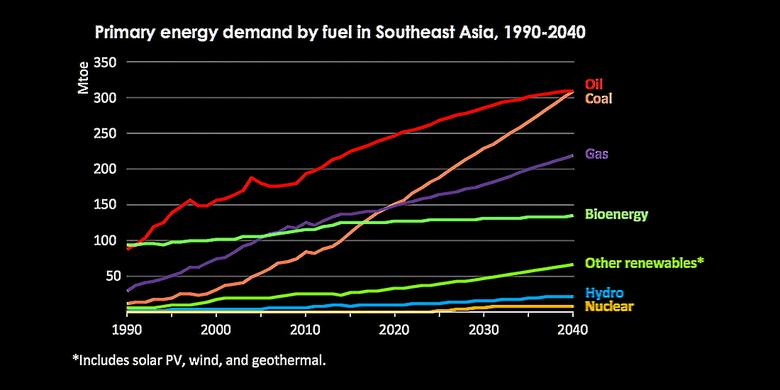

The coronavirus, or Covid-19, outbreak brings uncertainties to the Sibanthracite group as its main markets are in Asia, Bosov noted.

"The outbreak of the coronavirus has caused turbulence in the market. Our forecast on demand from our key markets, such as China and Southeast Asia has become uncertain," Bosov said, adding that the company may have a better understanding of end-users' production plans after first-quarter 2020.

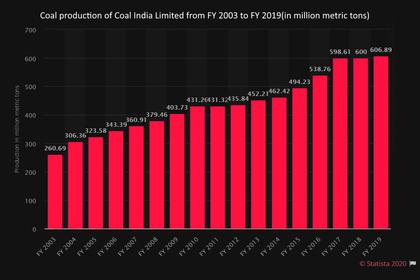

Bosov also expects demand from India to grow. "India has just announced that the country will increase its steel production, and given their interest in Russian coals, we will definitely increase our supply to India."

-----

Earlier: