U.S. LNG COMPANIES DOWN

REUTERS - FEBRUARY 7, 2020 - Shares of U.S. liquefied natural gas companies tumbled on Thursday as China's biggest importer of the fuel suspended some purchases amid weaker demand and a global glut that has driven prices to record lows.

China is the world's second-largest LNG importer but its spot purchases have nearly ground to a halt as the economic effects of business closings due to the spread of the coronavirus, as well as lower heating demand from a relatively warm winter.

Shares of Cheniere Energy Inc, the largest U.S. exporter of LNG, dropped to their lowest in over a year before finishing down 3.4% at $57.65, while Tellurian Inc fell 7.4% to $7.07, and NextDecade Corp lost 5.6% at $4.70.

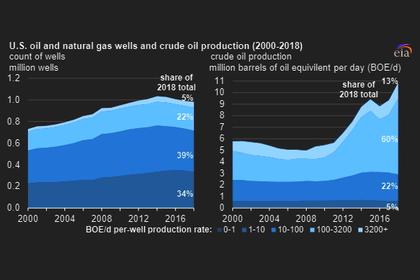

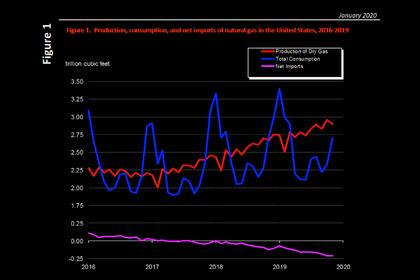

U.S. gas producers are counting on LNG exports to absorb record production from the shale boom. Those exports jumped 68% to a record 5.0 billion cubic feet per day in 2019 after soaring 53% in 2018.

China National Offshore Oil Corp (CNOOC) had declared force majeure, which allows companies to suspend contracts after unexpected events like natural disasters.

LNG traders said they were scrambling to divert shipments or find new outlets for cargoes destined for China, driving Asian LNG prices for April to record lows. The price fell to $2.99 per million British thermal units on Thursday, about the cost of chilling the fuel.

Goldman Sachs analysts lowered their growth forecast for Chinese LNG imports for the first quarter by 8.4 million tonnes per annum to nearly zero year-on-year due to the combination of the virus and reduced demand.

French oil major Total SA rejected a force majeure notice from a Chinese LNG buyer, Philippe Sauquet, head of Total's gas, renewables and power segment, said on Thursday.

CNOOC has been offering to resell LNG amid high levels of stocks and weak demand due to a slowing economy and a mild winter.

Cheniere this week said that unless market conditions improve, it could reduce LNG production this summer if customers refuse cargoes, Bloomberg reported.

"It would not be surprising to see (U.S.) LNG terminals curtail production for strategic maintenance this spring regardless, as they wait for the global supply glut to ease," Daniel Myers, market analyst at Gelber & Associates in Houston, said in a report.

Tellurian and NextDecade did not immediately respond to requests for comment.

-----

Earlier: