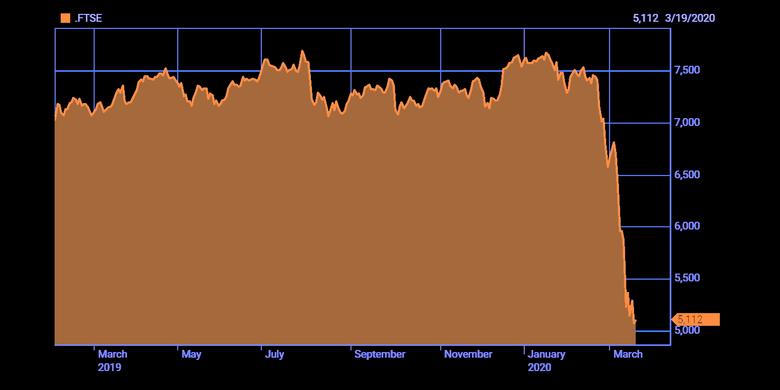

EURO BONDS DOWN

REUTERS - MARCH 19, 2020 - Government bond yields across the euro zone fell on Thursday after the European Central Bank stepped in with emergency stimulus measures to calm markets in the face of the coronavirus outbreak.

The ECB began new bond purchases worth 750 billion euros at an emergency meeting late on Wednesday, in a bid to stop a pandemic-induced financial rout from shredding the euro zone's economy.

The new purchases bring this year's planned purchases to 1.1 trillion euros. The new purchases alone are worth 6% of the euro area's GDP.

Italy, which has seen its borrowing costs jump in recent days, led the move in yields lower. Its two-year bond yields slumped as much as 100 basis points to 0.41%, set for its biggest one-day fall since 1996.

Ten-year Italian bonds yields slid as much as 90 bps to 1.40%. Fifty-year yields hit a record low at 2% .

The risk premium on Italian bonds - the gap over safer German 10-year Bund yields - tightened almost 100 bps from Wednesday's close to around 169 bps. It was last set for its biggest daily decline since June 2018.

"The market was obviously forcing the ECB hand," said Christoph Rieger, head of rates and credit research at Commerzbank.

On Wednesday, Italian yields had surged, with 10-year yields rising above 3%. Worries emerged regarding Italy's debt sustainability.

Spanish and Portuguese 10-year bond yields slid around 30 bps each. The premium they pay above German bonds also fell the most since 2018.

Benchmark 10-year German Bund yields, which rose on Wednesday, were down 12 bps at -0.35%.

Southern European bonds had been under growing pressure since ECB chief Christine Lagarde said after last week's policy decision that it's not the bank's job to "close" spreads. A series of clarifications followed but did not calm the markets.

"We don't know whether someone from the EuroTower made a phone call to Mario Draghi, but the beating around the bush should be over, at least for now," said ING chief economist Carsten Brzeski, referring to the former ECB chief.

The purchases will also include for the first time debt from Greece, which has been shut out of ECB buys because of its junk ratings. Now, around 12 billion euros in Greek government debt will be eligible for the purchases, according to Greece's finance minister.

Greek 10-year yields, which had shot up nearly 300 bps over the last two weeks, were the clear outperformer, sliding over 160 bps to 2.20%, according to Tradeweb pricing.

-----

Earlier: