GLOBAL OIL DEMAND 2020: 99.73 MBD

OPEC - 11 March 2020 - Monthly Oil Market Report

Oil Market Highlights

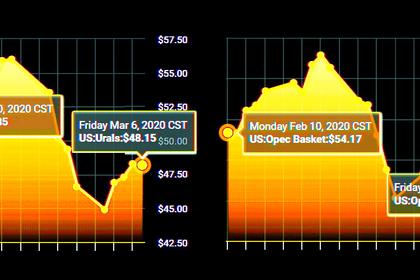

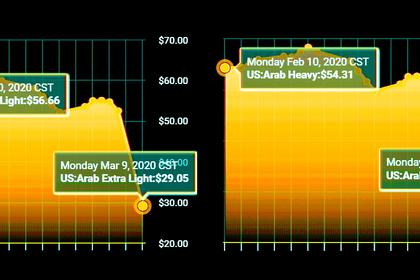

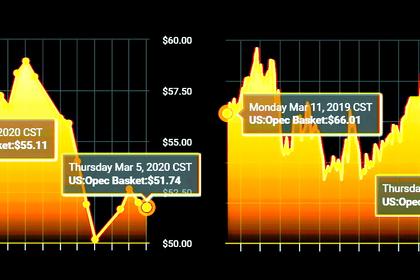

Crude Oil Price Movements

The OPEC Reference Basket (ORB) value fell sharply in February, tumbling by about $10, or 15%, month-on-month (m-o-m), to settle at an average of $55.49/b, its lowest since September 2017. The ORB dropped further in March, to close at $34.71/b on 9 March. Similarly, ICE Brent fell in February by $8.20, or 12.9%, to average $55.48/b, while NYMEX WTI declined by $6.99, or 12.1%, to average $50.54/b. In March, futures prices tumbled about 25% in one trading session on 9 March, recording their biggest daily decline in nearly 30 years, with ICE Brent and NYMEX WTI settling respectively at $34.36/b and $31.13/b. Year-to-date (y-t-d), ICE Brent price was down $2.47, or 4.0%, at $59.77/b, while NYMEX WTI was higher by $1.03, or 1.9%, at $54.21/b, compared to a year earlier. The backwardation market structure of both ICE Brent and DME Oman flattened in February, before the M1/M3 spread flipped on 9 March to a deep contango of $1.42/b and $1.48/b, respectively. Meanwhile, NYMEX WTI moved deeper into contango, to stand at 81¢/b on 9 March. Hedge funds and other money managers continued to reduce their net long positions in February in response to the significant decline of more than 12% in crude oil prices over the month.

World Economy

Following a considerably weaker economic growth for 2H19 in Japan, Euro-zone and in India, the Covid-19 related developments necessitated a further downward revision of the 2020 GDP growth forecast to 2.4% from 3.0% forecast in the previous month. This compares to a 2019 GDP growth estimate of 2.9%. US growth remains at 2.3% for 2019 but is revised down to 1.6% for 2020 due to an anticipated slowdown in consumption amid rising uncertainties, triggered by declining asset markets. Euro-zone growth remains at 1.2% for 2019, but is lowered to 0.6% for 2020, mainly due to the expectation of reduced exports, slowing consumption in select Euro-zone economies and the drastic development seen in Italy. Japan's 2019 GDP growth is revised down to 0.7% on the back of much lower-than-estimated 4Q19 growth, which, in combination with Covid-19 related effects also led to a downward revision for 2020 GDP growth to -0.2%. Following growth of 6.1% in 2019, the 2020 economic growth forecast for China is revised down to 5.0%, considering the latest Covid-19 impacts. India's 2019 growth is revised up to 5.3%, based on India's latest actual GDP growth numbers, but is revised down to 5.2% for 2020, mainly due to ongoing domestic challenges, as well as a deteriorating external environment. Brazil's growth remains unchanged at 1.0% for 2019, but is revised down to 1.6% for 2020, impacted by slowing external trade. Russia's growth remains unchanged at 1.1% for 2019 and is revised down to 0.8% for 2020, impacted by the decline in commodity export markets. Further downside risks to the world economy remains given the uncertainty regarding the magnitude of Covid-19 related impacts.

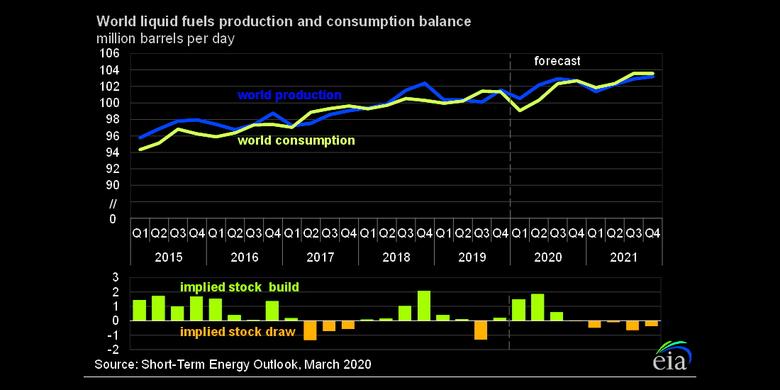

World Oil Demand

World oil demand growth in 2019 is revised down by 0.08 mb/d to 0.83 mb/d from the previous month's assessment. The downward adjustment mainly reflects weaker-than-expected data from OECD Americas. World oil demand growth in 2020 is also adjusted lower by 0.92 mb/d to 0.06 mb/d, reflecting slower global economic growth associated with a wider spread of Covid-19 beyond China. The impact of the Covid-19 outbreak in China and its adverse impacts on transportation and industrial fuels were the main causes of this downward revision. In addition, the outbreak is also assumed to severely affect oil demand growth in various other countries and regions outside China, such as Japan, South Korea, OECD Europe and the Middle East, which has led to a downward revision in those regions as well. Total global oil demand is now assumed at 99.73 mb/d in 2020, with 2H20 forecast to see higher consumption than 1H20. Considering the latest developments, downward risks currently outweigh any positive indicators and suggest further likely downward revisions in oil demand growth, should the current status persist.

World Oil Supply

Non-OPEC oil supply growth for 2019 is revised up by 0.09 mb/d to 1.99 mb/d from the previous month's assessment. It should be noted that Ecuador is included in this group as of this month's MOMR issue. For 2020, the non-OPEC oil supply growth forecast is revised down by 0.49 mb/d to 1.76 mb/d. Production is revised up mainly for Russia, Thailand, Indonesia and Oman, while the US, China, Mexico, Colombia, Norway, Azerbaijan and Malaysia are revised lower. US liquids production growth in 2020 is revised down by 0.36 mb/d to 0.90 mb/d, y-o-y. However, the US is forecast to drive growth throughout the year, along with Brazil, Norway, Canada, Guyana and Australia, while Mexico, Colombia, Egypt and China are forecast to see the largest declines. OPEC NGL production in 2019 is estimated to have grown by 0.04 mb/d to average 4.80 mb/d and for 2020 will grow by 0.03 mb/d to average 4.83 mb/d. In February, OPEC crude oil production dropped by 546 tb/d m-o-m to average 27.77 mb/d, according to secondary sources.

Product Markets and Refining Operations

Product markets in February lost ground in the Atlantic Basin. In the US and in Europe, the middle of the barrel weakened, in particular the jet fuel segment, caused by aviation transportation disruptions as Covid-19 spread beyond China. In Asia, hefty refinery intake cuts and robust product exports provided support, offsetting demand-side pressure as Covid-19 strongly affected fuel consumption. High sulphur fuel oil crack spreads jumped in Europe and Asia, and increased to reach positive levels in the US, after remaining in negative territory in the previous four consecutive months.

Tanker Market

Dirty tanker spot freight rates were negatively impacted by the unexpected developments in February, undermining the optimist outlook that began the year. Disruptions caused by measures to stem the outbreak of Covid-19 in China led to a sharp drop in economic activities, including refinery runs, which weighed on crude import demand and freight rates. At the same time, tanker availability was further increased by the unexpected lifting of sanctions on a subsidiary of China's Cosco at the end of January, which dampened dirty tanker spot rates, particularly for VLCCs. The market appeared to be looking for a bottom by the end of February, but considerable uncertainties remain for March, given the widening disruptions brought about by the ongoing spread of Covid-19.

Stock Movements

Preliminary data for January showed that total OECD commercial oil stocks rose by 37.8 mb m-o-m to stand at 2,940 mb. This was 56.9 mb higher than the same time one year ago and 12.9 mb above the latest five-year average. Within the components, crude stocks fell slightly by 0.8 mb, while products stocks rose by 38.6 mb m-o-m. OECD crude stocks stood at 9.1 mb below the latest five-year average, while product stocks exhibited a surplus of 21.9 mb. In terms of days of forward cover, OECD commercial stocks rose m-o-m by 0.8 days to stand at 62.2 days, which was 1.6 days above the same month in 2018, and 0.4 days above the latest five-year average. Given the expected growing imbalance in the coming months, oil stocks, including floating storage, are likely to increase.

Balance of Supply and Demand

Demand for OPEC crude in 2019 stood at 29.9 mb/d, 1.2 mb/d lower than the 2018 level. Demand for OPEC crude in 2020 is expected at 28.2 mb/d, around 1.7 mb/d lower than the 2019 level.

-----

Earlier: