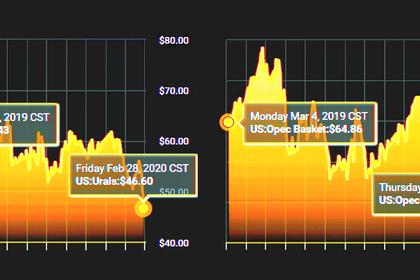

OIL PRICE: ABOVE $35

REUTERS - MARCH 9, 2020 - Oil prices lost as much as a third of their value on Monday in their biggest daily rout since the 1991 Gulf War after Saudi Arabia signalled it would hike output to win market share when the coronavirus has already left the market oversupplied.

Saudi Arabia slashed its official selling prices and made plans to ramp up crude output next month after Russia balked at making a further steep output cut proposed by the Organisation of Petroleum Exporting Countries to stabilise oil markets.

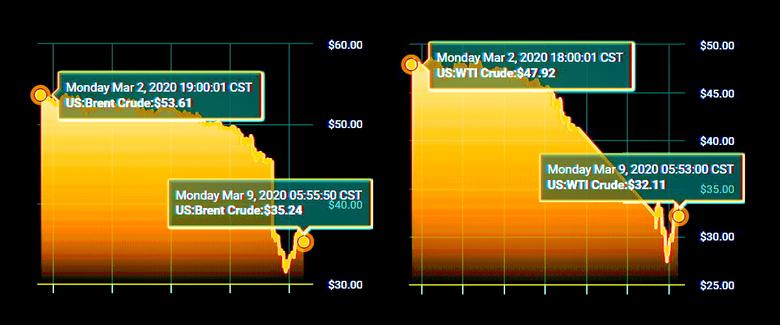

Brent LCOc1 crude futures were down 22% at $37.05 a barrel by 1000 GMT, after early dropping by as much as 31% to $31.02, their lowest since Feb. 12, 2016.

U.S. West Texas Intermediate (WTI) crude CLc1 fell by more than 24%, to $33.20 a barrel, after initially falling 33% to $27.34, also the lowest since Feb. 12, 2016.

The U.S. benchmark's biggest decline on record was in 1991 when it also fell by a third.

"The timing of this lower price environment should be limited to a few months unless this whole virus impact on global market and consumer confidence triggers the next recession," said Keith Barnett, senior vice president strategic analysis at ARM Energy in Houston.

The disintegration of the grouping called OPEC+ - made up of OPEC plus Russia and other producers - ends more than three years of cooperation to support the market.

Saudi Arabia plans to boost its crude output above 10 million barrels per day (bpd) in April after the current deal to curb production expires at the end of March, two sources told Reuters on Sunday.

The kingdom has been producing around 9.7 million bpd in recent months.

Saudi Arabia, Russia and other major producers last battled for market share in 2014 as they tried to put a squeeze on production from the United States, which is not participating in any oil limiting pacts and has grown to become the world's biggest producer of crude.

"The deal was always destined to fail," said Matt Stanley, senior broker at Starfuels in Dubai, adding that the main result of the OPEC+ pact "has been that U.S. shale producers have gained market share."

Saudi Arabia over the weekend cut its official selling prices for April for all crude grades to all destinations by between $6 and $8 a barrel.

"The prognosis for the oil market is even more dire than in November 2014, when such a price war last started, as it comes to a head with the significant collapse in oil demand due to the coronavirus," Goldman Sachs said.

VIRUS IMPACTS DEMAND

China's efforts to curtail the coronavirus outbreak has disrupted the world's second-largest economy and curtailed shipments to the biggest oil importer. The virus has also spread to other major economies such as Italy and South Korea.

The International Energy Agency said on Monday oil demand was set to contract in 2020 for the first time since 2009. It cut its annual forecast by almost 1 million bpd, signalling a contraction of 90,000 bpd.

Major banks have cut their demand growth forecasts. Morgan Stanley predicted China would have zero demand growth in 2020, while Goldman Sachs sees a contraction of 150,000 bpd in global demand.

Goldman Sachs also cut its forecast for Brent to $30 for the second and third quarters of 2020.

In other markets, the dollar was down sharply against the yen, Asian stock markets sharply lower, and gold rose to its highest since 2013 as investors fled to safe havens.

-----

Earlier: