OIL PRICE: NEAR $27 YET

REUTERS - MARCH 26, 2020 - Oil prices fell on Thursday following three days of gains, with the prospect of rapidly dwindling demand due to coronavirus travel bans and lockdowns offsetting hopes a U.S. $2 trillion emergency stimulus will shore up economic activity.

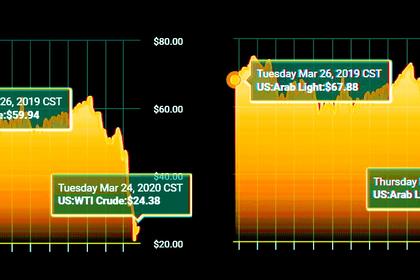

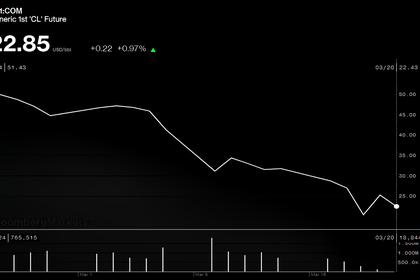

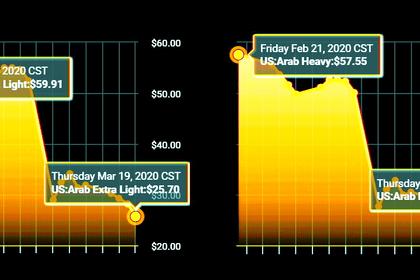

Brent crude LCOc1 futures fell 64 cents, or 2.3%, to $26.75 a barrel by 0732 GMT. West Texas Intermediate (WTI) crude CLc1 futures fell 78 cents, or 3.2%, to $23.71 a barrel. Both contracts are down about 60% this year.

"Oil markets received a lift from the U.S. stimulus chatter, but for the most part activity remains rudderless, awash in a sea of oil," said Stephen Innes, market strategist at AxiTrader.

The U.S. Senate on Wednesday overwhelmingly backed a $2 trillion bill aimed at helping unemployed workers and industries hurt by the coronavirus epidemic.

But with demand fast contracting and output rising, the outlook for oil remains dim.

IHS Markit estimated global oil demand will contract by more than 14 million barrels per day (bpd) in the second quarter, leading to unprecedented inventory builds.

"Expect fundamental pressure concentrated over March and April, an eight-week blitz period over which stocks currently stand to build north of 1 billion barrels cumulatively," said Roger Diwan, vice president of financial services at IHS Markit.

At the same time, the collapse of a supply-cut pact between the Organization of the Petroleum Exporting Countries and other producers led by Russia, known as OPEC+, is set to boost oil supply, with Saudi Arabia planning to ship more than 10 million bpd from May.

Oil stocks are already rising with tanks around the world filling fast despite a 50%-100% jump in lease costs, as oil companies and traders scramble to park unwanted crude and refined products.

"At that tipping point, the producer surplus will become a massive logistical headache for oil storage consideration, which then opens up the trap door for oil prices to plummet below cash costs," said Innes.

Vienna-based JBC Energy said it expected world oil demand to fall by an even larger 15.3 million bpd in the second quarter, likely pushing benchmark prices, at least temporarily, to around $10 per barrel.

"OPEC+ as an organization is of pretty limited relevance in this context, as they are neither likely to be willing nor able to stem the current demand shock," said Johannes Benigni, chairman at JBC Energy in a note on Wednesday.

U.S. crude inventories rose by 1.6 million barrels in the most recent week, the U.S. Energy Information Administration said on Wednesday, marking the ninth straight week of increases.

Products supplied, a proxy for U.S. demand, dropped nearly 10% to 19.4 million bpd, EIA data showed.

-----

Earlier: