2020-03-12 13:05:00

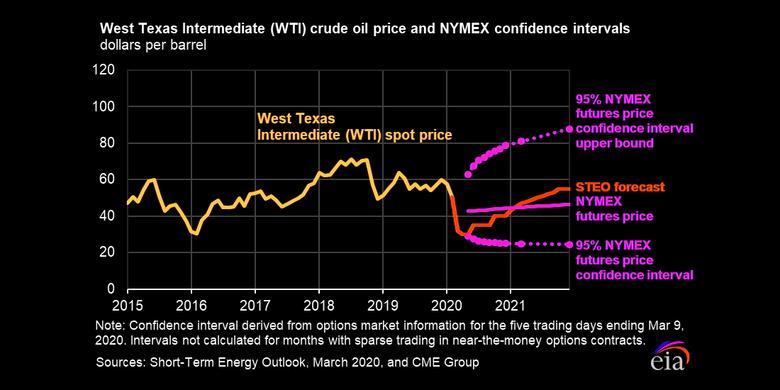

OIL PRICES 2020-21: $43-$55

U.S. EIA - March 11, 2020 - SHORT-TERM ENERGY OUTLOOK

Forecast Highlights

Global liquid fuels

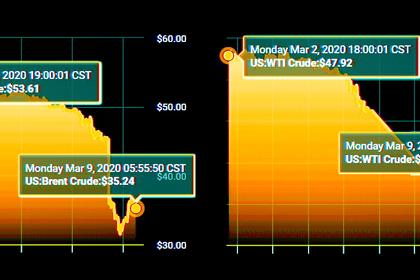

- EIA delayed the release of the March STEO update by one day to incorporate recent significant global oil market developments. On March 9, Brent crude oil front-month futures prices fell below $35/b, a 24% daily decline and the second largest daily price decline on record. Prices fell following the March 6 meeting between members of the Organization of the Petroleum Exporting Countries (OPEC) and its partner countries, which ended without an agreement on production levels amid market expectations for declining global oil demand growth in the coming months. In addition to the following highlights, EIA has provided a short summary of the March STEO forecast in the crude oil section of the Petroleum and Natural Gas Markets Review (PNGMR).

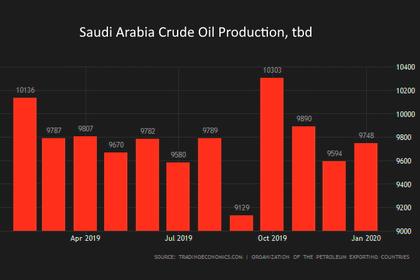

- As a result of the outcome of the March 6 OPEC meeting, EIA’s forecast assumes that OPEC will target market share instead of a balanced global oil market. EIA forecasts OPEC crude oil production will average 29.2 million barrels per day (b/d) from April through December 2020, up from an average of 28.7 million b/d in the first quarter of 2020. EIA forecasts OPEC crude oil production will rise to an average of 29.4 million b/d in 2021. The OPEC production data in the March STEO include Ecuador, which finalized its withdrawal from OPEC at the March 6 meeting. Beginning with the April 2020 STEO, EIA will include Ecuador’s production volumes in non-OPEC data.

- EIA expects global petroleum and liquid fuels consumption will average 99.1 million b/d in the first quarter of 2020, a decline of 0.9 million b/d from the same period in 2019. EIA expects global petroleum and liquid fuels demand will rise by less than 0.4 million b/d in 2020 and by 1.7 million b/d in 2021. Lower global oil demand growth for 2020 in the March STEO reflects a reduced assumption for global economic growth along with reduced expected travel globally because of the 2019 novel coronavirus disease (COVID-19).

- EIA expects that global liquid fuels inventories will grow by an average of 1.0 million b/d in 2020 after falling by about 0.1 million b/d in 2019. EIA expects inventory builds will be largest in the first half of 2020, rising at a rate of 1.7 million b/d because of slow oil demand growth. Firmer demand growth as the global economy strengthens and slower supply growth will contribute to balanced markets in the fourth quarter of 2020 and global oil inventory draws in 2021. EIA expects global liquid fuels inventories will decline by 0.4 million b/d in 2021.

- EIA forecasts Brent crude oil prices will average $43/b in 2020, down from an average of $64/b in 2019. For 2020, EIA expects prices will average $37/b during the second quarter and then rise to $42/b during the second half of the year. EIA forecasts that average Brent prices will rise to an average of $55/b in 2021, as declining global oil inventories put upward pressure on prices.

- EIA forecasts U.S. crude oil production will average 13.0 million b/d in 2020, up 0.8 million b/d from 2019, but then fall to 12.7 million b/d in 2021. The forecast decline in 2021 is in response to lower oil prices and would mark the first annual U.S. crude oil production decline since 2016. EIA models show oil prices affect production after about a six-month lag. Despite forecast annual average growth of 0.8 million b/d in 2020, EIA expects monthly U.S. crude oil production to begin declining around May, with production falling from 13.2 million b/d in May to 12.8 million b/d in December 2020.

- Based on the lower crude oil price forecast, EIA expects U.S. retail prices for regular grade gasoline to average $2.14 per gallon (gal) in 2020, down from $2.60/gal in 2019. EIA expects retail gasoline prices to fall to a monthly average of $1.97/gal in April before rising to an average of $2.13/gal from June through August.

Natural gas

- In February, the Henry Hub natural gas spot price averaged $1.91 per million British thermal units (MMBtu). Warmer-than-normal temperatures in February reduced demand for space heating and put downward pressure on prices. EIA forecasts that prices will begin to rise in the second quarter of 2020 as U.S. natural gas production declines and natural gas use for power generation increases the demand for natural gas. EIA expects prices to average $2.22/MMBtu in the third quarter of 2020. EIA forecasts that Henry Hub natural gas spot prices will average $2.11/MMBtu in 2020. EIA expects that natural gas prices will then increase in 2021, reaching an annual average of $2.51/MMBtu.

- U.S. dry natural gas production set a record in 2019, averaging 92.2 billion cubic feet per day (Bcf/d). Although EIA forecasts dry natural gas production will average 95.3 Bcf/d in 2020, a 3% increase from 2019, EIA expects monthly production to generally decline through 2020, falling from an estimated 96.5 Bcf/d in February to 92.3 Bcf/d in December. The falling production mostly occurs in the Appalachian and Permian regions. In the Appalachian region, low natural gas prices are discouraging producers from engaging in natural gas-directed drilling, and in the Permian region, low oil prices reduce associated gas output from oil-directed wells. In 2021, EIA forecasts dry natural gas production will rise from December 2020 levels in response to higher prices. Forecast dry natural gas production for 2021 averages 92.6 Bcf/d.

- EIA estimates that total U.S. working natural gas in storage ended February at 2.1 trillion cubic feet (Tcf), 9% more than the five-year (2015–19) average. EIA forecasts that total working inventories will end March at 1.9 Tcf, 12% more than the five-year average. In the forecast, inventories rise by almost 2.1 Tcf during the April through October injection season to reach almost 4.0 Tcf on October 31.

Electricity, coal, renewables, and emissions

- EIA expects the annual share of U.S. utility-scale electricity generation from natural gas-fired power plants will remain relatively steady through the forecast; it was 37% in 2019, and EIA forecasts it will average 39% in 2020 and 37% in 2021. Coal’s forecast share of electricity generation falls from 24% in 2019 to 21% in both 2020 and 2021. Electricity generation from renewable energy sources rises from a share of 17% last year to 19% in 2020 and to 21% in 2021. The increase in the renewables share is the result of additions to wind and solar generating capacity. The nuclear share of generation averaged 20% in 2019 and is expected to remain about the same in 2020 and 2021.

- EIA forecasts that U.S. coal production will total 573 million short tons (MMst) in 2020, down 117 MMst (17%) from 2019. Lower production reflects declining demand for coal in the electric power sector and lower demand for U.S. exports. EIA forecasts that electric power sector demand for coal will fall by 86 MMst (16%) in 2020. EIA expects that U.S. coal production will stabilize in 2021 as export demand rises and U.S. power sector demand for coal increases slightly because natural gas prices increase.

- After decreasing by 2.8% in 2019, EIA forecasts that energy-related carbon dioxide (CO2) emissions will decrease by 2.2% in 2020 and by 0.4% in 2021. Declining emissions in 2020 reflect forecast declines in total U.S. energy consumption because of energy efficiency and weather effects, particularly as a result of warmer-than-normal temperatures in January and February. A forecast return to normal temperatures in 2021 results in a slowing decline in emissions. Energy-related CO2 emissions are sensitive to changes in weather, economic growth, energy prices, and fuel mix.

-----

Earlier:

2020, March, 11, 12:25:00

СДЕЛКА ОПЕК + РОССИЯ

В 2019 году была подписана Хартия долгосрочного сотрудничества между государствами ОПЕК и не-ОПЕК.

2020, March, 11, 12:10:00

ARAMCO WILL PROVIDE 12.3 MBD

Saudi Aramco announces that it will provide its customers with 12.3 million barrels per day (MMBD) of crude oil in April

2020, March, 10, 13:50:00

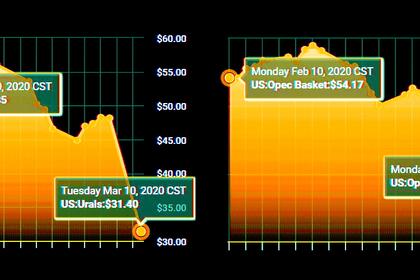

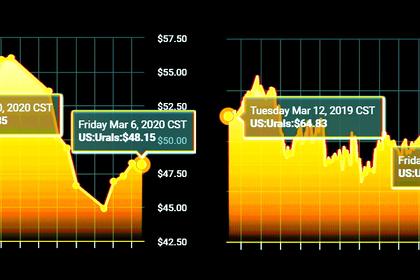

OIL PRICE: NEAR $37

Brent were up $1.44, or around 4%, to $35.80 a barrel, after hitting a session high of $37.38 a barrel. WTI gained $1.52, or around 5%, to $32.65 a barrel, after hitting a high of $33.73.

2020, March, 10, 13:45:00

НЕФТЬ РОССИИ КОНКУРЕНТОСПОСОБНА

«Российская нефтяная отрасль обладает качественной ресурсной базой и достаточным запасом финансовой прочности, чтобы оставаться конкурентоспособной при любом прогнозируемом уровне цен, а также сохранять свою долю на рынке. При этом Правительство будет уделять особое внимание стабильному снабжению отечественного рынка нефтепродуктами и сохранению инвестиционного потенциала в секторе», – сообщил Министр энергетики.

2020, March, 9, 15:00:00

OIL PRICE: ABOVE $35

Brent were down 22% at $37.05 a barrel, WTI fell by more than 24%, to $33.20 a barrel,